![Oklahoma CPA CPE Requirements to Recertify [Updated 2025]](/wp-content/uploads/2021/06/Oklahoma-CPA-CPE-Requirements.png)

Primary Oklahoma CPA CPE Requirements

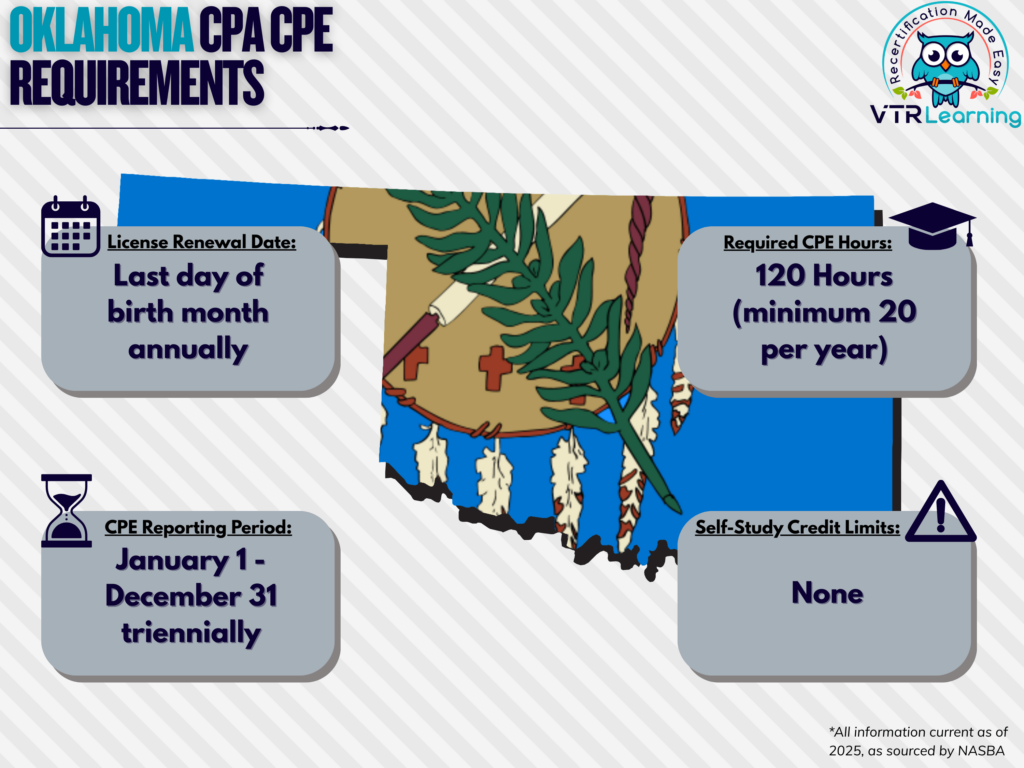

CPE is typically the way certifying organizations like the AICPA require their members to renew their licenses. So, individuals have to complete a certain amount of CPE during a license renewal period to keep their status. But because the requirements actually vary by location, licensees need to know the state regulations for their area specifically. Essentially, the Oklahoma CPA CPE requirements are different from those of other states. Here, licensees must renew their licenses every three years. And furthermore, they must complete at least 20 hours of CPE each year. Overall, they must complete 120 hours of credit during the three year renewal period.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| Last day of birth month, annually | January 1 – December 31, triennially-rolling | 120 hours | None |

Subject Area Requirements

Licensees in Oklahoma must complete at least 4 hours of Professional Ethics CPE per license renewal period. This credit also counts toward the 120-hour requirement. If a CPA works in industry, they must complete 72 hours minimum in subject areas related to the practice of public accounting, taxation or assurance. CPAs must also complete a minimum of 4 hours per year in compilation engagements (not compilation and review). This requirement holds only if the licensee actively supervises or reviews compilation engagements for third-party reliance. However, this only applies if the licensee or their firm enrolls in an approved peer review program.

Credit Limitations and Calculation

Formal instruction, presenting on relevant topics, is a valid method for obtaining CPE credit in Oklahoma. However, repeated presentations of the same course material will not be accepted unless the subject material has been changed drastically. Instructors, discussion leaders, or speakers will receive CPE credit for the actual preparation time. However, prep credit cannot exceed twice the length of the actual presentation.

CPAs currently enrolled in college/university courses can claim CPE credit. This calculates as 15 CPE credits per semester hours or 10 CPE credit hours per quarter hour of university credit. However, non-credit university courses are worth 1 CPE hour per qualifying classroom hour at a 1:1 ratio. University course instructors can also claim up to 15 CPE credits per college credit hour taught. But only if the preparation for instruction required the individual to maintain or improve their professional competence.

Licensees can also obtain credit for authorship. So long as the individual publishes material related to instructional or educational topics. However, this method must not exceed 10 hours per calendar year each renewal cycle.

Structured learning programs that maintain or increase the professional competence of a CPA qualify as credit opportunities. But only if they also increase their ability to deliver public accounting services.

The Oklahoma Board accepts blended learning credit as long as the amount is within the current rounding rules. The current acceptable amount is 0.5 credits after obtaining the first full hour of credit.

Self-study credit opportunities must be interactive. And the provider must also be approved by NASBA, the AICPA or the Oklahoma Board.

Nano Learning credits are not an approved form of continuing professional education credit for Oklahoma CPAs.

For all approved methods, credits can be obtained in half-hour increments once the first full hour has been earned.

Other Policies and Exemptions

CPAs can be considered exempt from the continuing professional education requirements if they:

- Have retired and are not offering their services to any third parties

- Are currently unemployed and are not offering their professional services to third parties

- Have left the workforce (temporarily or permanently) and are not offering their services to third parties

- Have formally listed their AICPA status as “inactive” and do not offer services to third parties

It is also possible for individual members to request waivers for the CPE requirements upon bases similar to the following:

- Complications with health

- Military service

- Extreme natural disaster of a sort which prevents continuing education opportunities (determined by the Board)

- Similar circumstances to those listed above which could keep members from completing their continuing professional education

Additional Resources for Oklahoma CPA CPE Requirements

- VTR Learning CPA Courses

- How to Submit Your Application & Fees for Renewal

- Approved Fields of Study

- OSCPA – What It Is and Why It Matters

Last Updated:

![South Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/South-Dakota-CPA-CPE-Requirements.png)

![Kentucky CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/03/KY-CPE-Requirements.png)

![Vermont CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2022/02/Vermont-CPA-CPE-Requirements.png)