![Kentucky CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/03/KY-CPE-Requirements.png)

Kentucky CPA Requirements for Continuing Education

As most CPAs know, continuing professional education is a requirement for license recertification with the AICPA. Primarily, because it is the means by which the organization ensures its licensees are up-to-date on industry standards. In turn, this helps provide the best service to clients. However, each state has its own set of requirements, as set by the state Board of Accountancy. So, CPAs in one place likely won’t have the same requirements as CPAs in another. Essentially, Kentucky CPA Requirements are different from other states. And because of this, it’s vital for licensees to become familiar with their specific state regulations. Otherwise, they might become confused and frustrated during the license renewal process.

CPAs who live in Kentucky must to renew their license every two years. And they must complete 60-80 CPE hours during that time, depending on the following factors:

- 80 hours if the CPA worked 3,000 hours or more in a public accounting firm

- 60 hours if the CPA worked less than 3,000 hours in a public accounting firm

- 60 hours if the CPA works in industry, education or government

- 40 hours of technical credit for CPAs who worked 3,000+ hours in public accounting firms, beginning in 2021

- 30 hours of technical credit for CPAs who worked less than 3,000 hours in public accounting firms, beginning in 2021

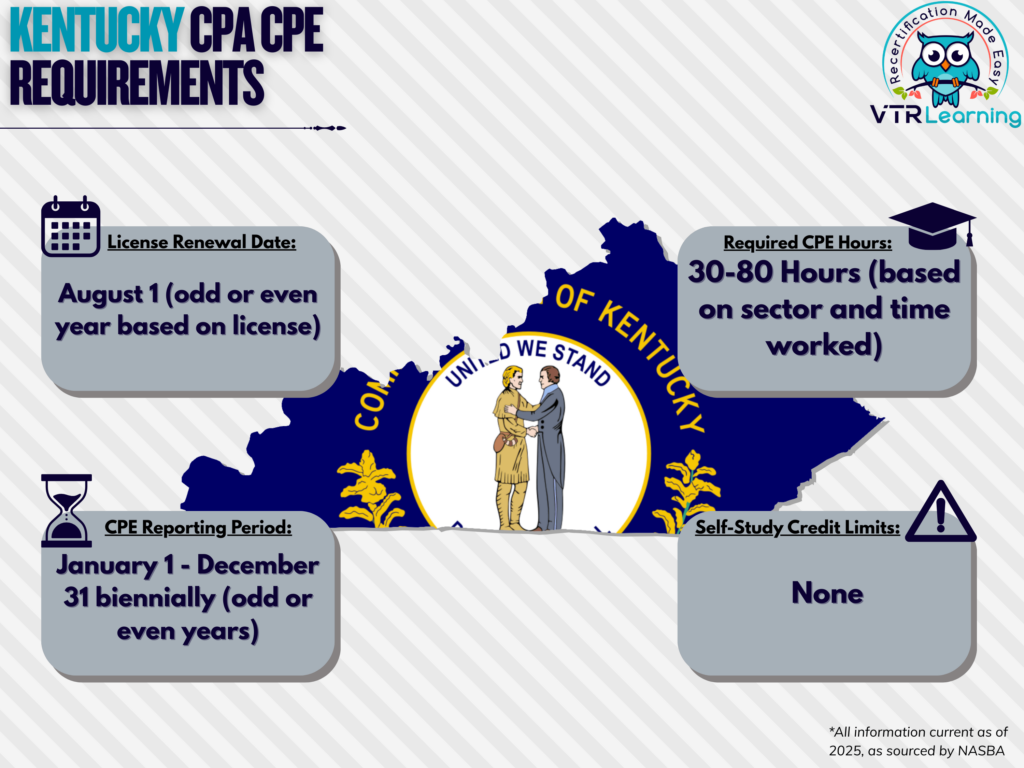

The table below shows several of the main Kentucky CPA requirements for CPE.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| August 1 (even license number = even years; odd license number = odd years) | January 1 – December 31 biennially (even license number = even years; odd license number = odd years) | 30-80 hours (depending on above factors) | None |

Subject Area Requirements

The Kentucky Board of Accountancy requires 2 of the recertification hours to be in Professional Ethics. Licensees must complete a further 8 hours in attest or compilation services. But only if they release or authorize release of attest, compilation, or financial prep services, starting in 2021. There are also certain impermissible subject areas for CPE credit. These include Behavioral Ethics, Personnel/HR, Production and Social Environment of Business.

Personal development credit cannot exceed 8 hours for CPAs with an 80 hour requirement, or 12 hours for those with 60.

Credit Limitations and Calculation

In Kentucky, CPAs can obtain up to 60% of their required CPE hours through formal instruction or presentation. However, repeated presentations of the same material will not receive credit. Instructors obtain 1 hour for each contact hour and up to twice the class time for preparation.

Authoring and publishing educational material is another source of CPE credit for CPAs in Kentucky. However, 25% of the required amount is the limit for authoring and publishing articles or books.

Other Policies and Exemptions

Providers are not required to be members of the NASBA Registry. Nor do they have to register with the Kentucky State Board of Accountancy.

If a licensee’s main place of business is located in another state, they may satisfy the CPE requirements in Kentucky by indicating that they met the requirements of the state in which their place of business is located. If the state in which their office is located has no CPE requirement, they must comply with all CPE requirements for license renewal in Kansas.

CPAs in the following categories are exempt from CPE requirements. However, they must not offer any of their services to any parties.

- Retirees

- Unemployed members

- Those who have temporarily left the workforce

- Members who have formally listed their status as “inactive”

Individuals can also request waivers for the CPE requirements during any given recertification period for reasons related to:

- Health

- Military service

- Natural disaster

- Other extenuating circumstances

Additional Resources for Kentucky CPA Requirements

Last Updated:

![Minnesota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Minnesota-CPA-CPE-Requirements.png)

![Delaware CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Delaware-CPA-CPE-Requirements.png)

![New Mexico CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/New-Mexico-CPA-CPE-Requirements.png)