![Vermont CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2022/02/Vermont-CPA-CPE-Requirements.png)

Overview of Vermont CPA CPE Requirements

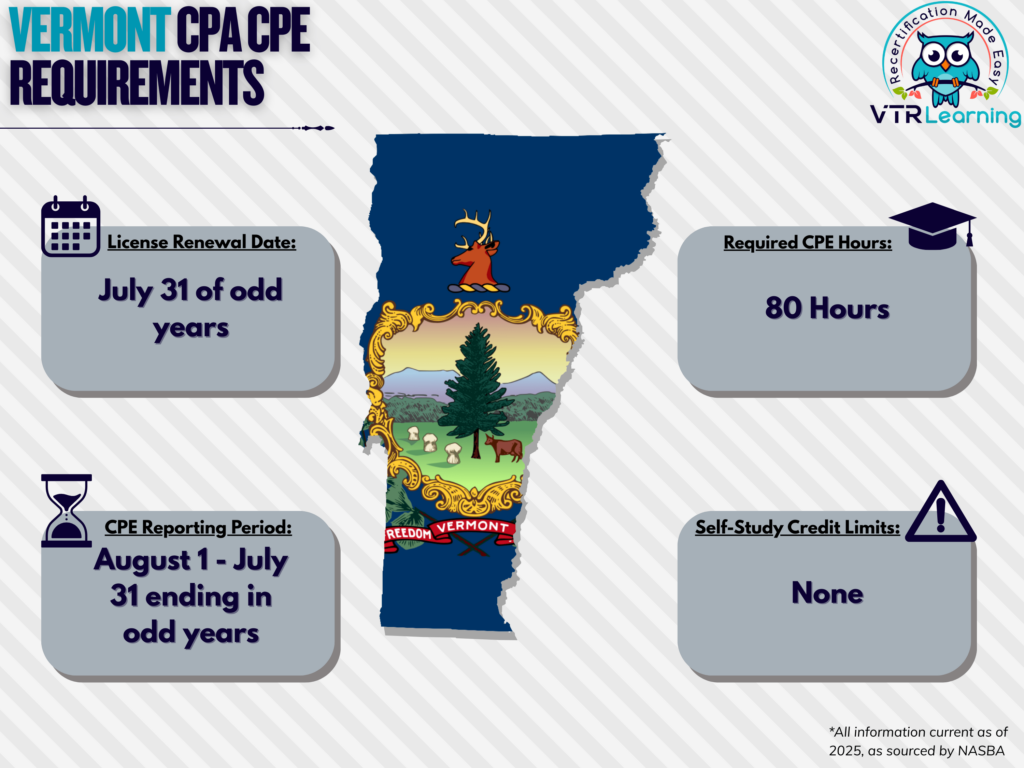

Generally, business professionals know the importance of continuing education. Because CPE is how different certifying organizations ensure their members’ professionality. After all, changing practices demand continuous learning. And without a doubt, CPAs are right in the middle of it all. But because different boards of accountancy set various rules and limitations, CPAs have to know their own state requirements well. Otherwise, they might find themselves lost in the process of license renewal. Overall, the Vermont CPA CPE requirements dictate members must recertify every two years. And furthermore, during that time, they have to complete 80 CPE hours. But there are many other stipulations to keep up with. The table below lists further information about the general requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| July 31 on odd years | August 1 – July 31 biennially, ending on odd years | 80 hours | None |

Subject Area Requirements

Ultimately, Vermont CPA CPE requirements dictate that licensees have to complete 80 CPE hours every two years. However, they must also earn at least 4 hours of ethics credit. And furthermore, they must dedicate 8 CPE hours to subjects dealing with accounting and auditing specifically.

Credit Limitations and Calculation

Overall, there are many ways CPAs in Vermont can earn CPE credit. For example, they might provide instruction or presentations in a formal setting. Individuals who choose to do so can ultimately earn up to 50% of their required CPE through this method. And generally, credit equals the presentation time added to preparation. However, the time for prep cannot exceed twice the length of presentation. And furthermore, credit will not be granted for repeated instruction of the same material in a single renewal period. Though if the material changes substantially, further credit can be earned.

CPAs can also earn credit for active participation in college or university courses. So, licensees can obtain 15 CPE hours for a full semester hour or 10 CPEs per quarter hour completed.

Another, less familiar method, is authorship and publication. Here, CPAs can earn CPE credit by writing and publishing educational information related to the profession. However, this method cannot exceed 20% of the required credit each renewal period.

There are no stated limitations on the number of CPE hours CPAs can get from self-study courses.

CPAs should also note they can earn credit in partial increments after completing the first full CPE hour.

Other Policies and Exemptions

At the end of each reporting period, a maximum of 10 excess CPEs may carry forward into the next cycle. However, these hours must not be used to satisfy the accounting, auditing, or ethics requirement for license renewal.

Additionally, some CPAs are automatically exempt from the CPE requirements. However, they must not offer their services to third parties in order to keep this status:

- Retired individuals

- Any individuals currently unemployed

- Those who have temporarily left the workforce for various reasons

- Members who have formally listed their status as “inactive”

Furthermore, active CPAs can request CPE exemption waivers for reasons such as:

- Health problems

- Military service and deployment

- Extreme natural disaster (subject to Board discernment)

- Other similar circumstances (also determined by the Board)

Additional Resources for Vermont CPA CPE Requirements

Last Updated:

![Tennessee CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Tennessee-CPA-CPE-Requirements.png)

![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)