![South Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/South-Dakota-CPA-CPE-Requirements.png)

General South Dakota CPA CPE Requirements

CPE might not be at the forefront of a CPA’s priorities. But if they hope to keep their license with the AICPA, it’s a strict requirement. Because if individuals want to great services, they must be aware of changes to their industry and practices. But because state requirements differ by location, it can be confusing to know which regulations apply and which don’t. For example, the South Dakota CPA CPE requirements aren’t the same as those in other places. So, licensees need to understand which rules apply to them.

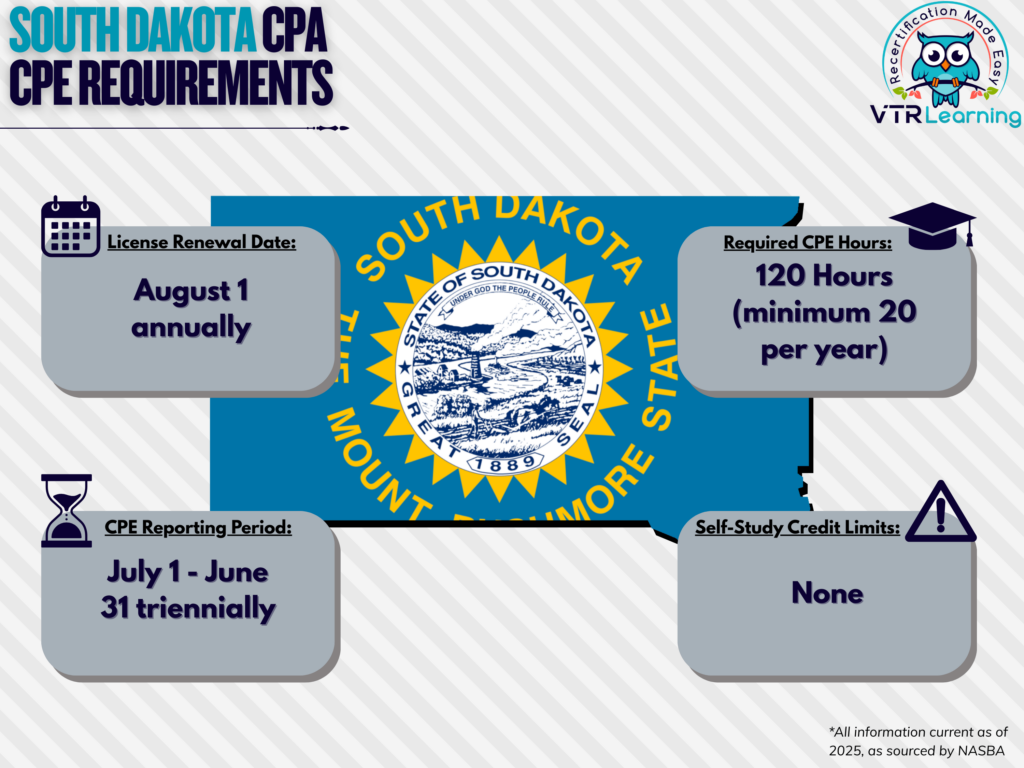

South Dakota CPAs must complete 120 CPE hours over a three-year period. Furthermore, during that timespan, CPAs must obtain at least 20 hours each year. The table below further details some of the other requirements for licensees in South Dakota.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| August 1, annually | July 1 – June 30 over a three-year rolling period | 120 hours | None |

Credit Limitation and Calculation

In South Dakota, CPAs can complete 60 CPE hours per recertification cycle by presenting in a formal setting. Or alternatively, by instructing a university course. It is also possible for the licensee to claim less than 60 hours for the course taught. If so, they can instead claim the remaining balance in a subsequent year. But only as long as the course falls at least partially within each year.

For instruction, CPAs may receive credit for preparation and presentation times. Although, preparation credit cannot exceed twice the available credit for class participants. Repeated presentations only qualify if adequately demonstrated that the learning activity further developed or changed. And more so, in a way requiring significant additional research or study on the part of the instructor.

Participation in college or university courses warrants CPE credit up to 15 hours per semester hour completed. Licensees can also obtain 10 CPEs per quarter hour, or 1 CPE per hour of classroom time for non-credit courses.

Licensees can earn 50% of their required hours through authorship and publication of instructional or educational materials. Overall, this includes articles, books or CPE programs. Also, both research and writing time apply in the calculation of total credit. Furthermore, an independent third party must review the published material in order to qualify.

The Board permits no more than 24 hours of behavioral or motivational courses for any licensees engaged in public accounting practices.

Self-Study and Other Credit Types

As a general rule, the Board accepts partial credit in increments of 0.2 and 0.5 hours. Additionally, licensees can earn self-study in half-hour increments prior to the completion of the first full hour. But afterward, it may be earned in 0.2 or 0.5 increments. Group program credit also accrues in 0.2 or 0.5 hour increments only following completion of a full hour. And overall, nano-learning credit is only accepted in 0.2 hour increments.

Ultimately, personal development credits are only valid if they maintain or improve a CPA’s professional competency.

Other Policies and Exemptions

Licensees are also compliant with South Dakota’s CPE requirements if they meet the requirement in the state where their principal place of business is located. The individual’s principal place of business is the location registered as their office on the Board records. If the principal place of business has no CPE requirements, the non-resident must comply with all requirements for South Dakota.

CPAs who receive automatic exemption from the CPE requirements include:

- Those who are retired

- Members who are currently unemployed

- Those who have left the workforce temporarily

- Anyone whose organizational status is listed as “inactive”

In order to apply for exemption status, the individual must not offer their services to third parties. However, it is possible for practicing licensees to apply for a waiver on bases such as:

- Health

- Military service

- Natural disaster

- Other similar circumstances

Additional Resources for South Dakota CPA CPE Requirements

- VTR Learning Self-Study CPA Courses

- Submitting Your Application & Fees for Renewal

- NASBA Approved Fields of Study

Last Updated:

![Wyoming CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Wyoming-CPA-CPE-Requirements.png)

![Wisconsin CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Wisconsin-CPA-CPE-Requirements.png)

![How to Become a CPA [State Exam Requirements]](https://assets.vtrlearning.com/wp-uploads/2024/09/Understanding-How-to-Become-a-CPA.png)