![Washington State CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2022/02/Washington-State-CPE-Requirements.png)

Overview of Washington State CPE Requirements

Generally, business professionals are well familiar with the process of continuing education. After all, CPE is an intrinsic part of the licensing process – especially for CPAs. Because continued learning makes it possible to stay up-to-date with key industry changes and advances. So, while it might be time-consuming, it’s essential to continued licensure with the AICPA. However, since different Boards of Accountancy oversee each state, the specific requirements might differ from one place to another. As such, the Washington state CPE requirements are unique in their own right. And CPAs there would do well to understand the regulations and rules for recertification.

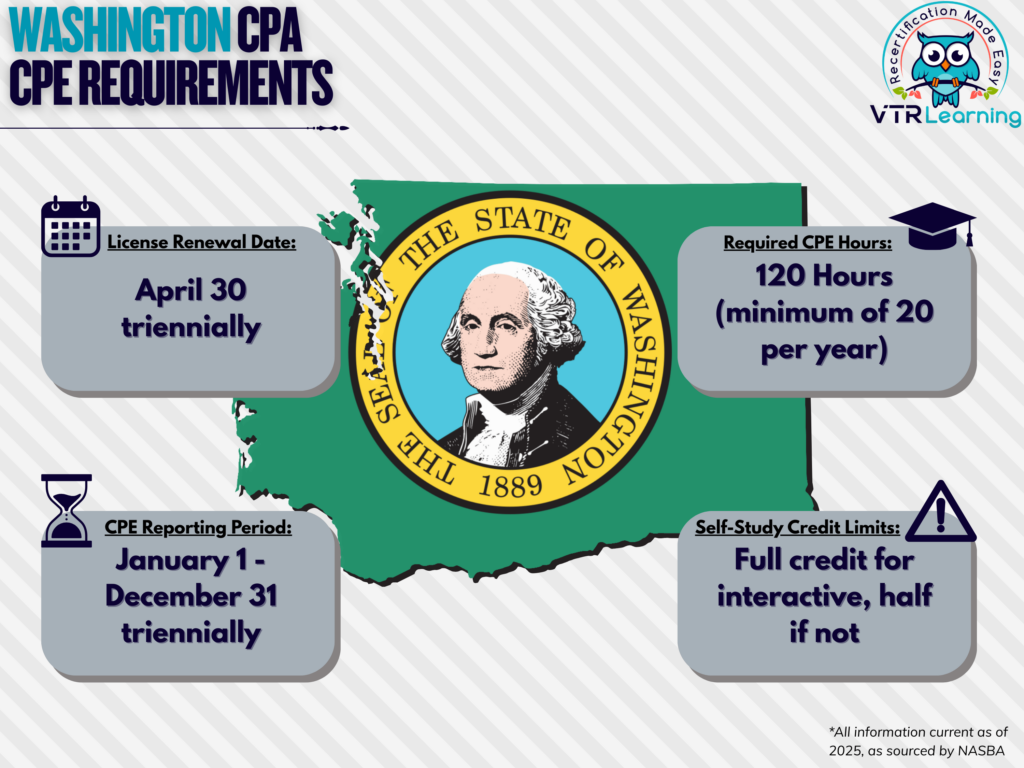

Ultimately, CPAs in Washington must earn at least 20 CPE hours every calendar year and 120 per recertification period – a three-year cycle. The chart below details a few of the most important dates and requirements for the license renewal process.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| April 30 triennially ($230) | January 1 – December 31 triennially | 120 hours | Full credit if interactive, half credit if non-interactive |

Subject Area Requirements

Every recertification period, CPAs must take at least 4 hours of Board-approved ethics and regulations CPE. However, courses not Board-certified or approved can count toward the technical or total hour requirement instead.

Credit Limitations and Calculation

As per Washington state CPE requirements, non-technical CPE credit cannot exceed 60 hours during each three year recertification period. Generally, this includes subjects like communication, interpersonal management, leadership and personal development, motivational and behavioral topics, and speed reading or memory building.

Furthermore, credit for the following types of programs must not surpass 60 hours per recertification period. Additionally, this credit may not apply toward the 20 CPE minimum per year requirement.:

- Service on the Washington State Board of Accountancy or the Board’s committees or, similarly, volunteer service on one of the Board-approved peer review committees

- First-time instructor or developer of a college or university course

- Instructing or developing a CPE course for the first time

- Authoring published articles, books or other material relevant for enhancing professional competence

CPAs enrolled and participating in college courses can claim CPE credit. Here, CPE credit hours equal 15 credits for a semester hour and 10 CPE credits for a quarter hour.

Nano-learning credit is admissible but is limited to 12 hours each recertification period. Instances of self-study are also permitted, but they must come from interactive methods for full credit. However, if the method is non-interactive, CPAs can still claim half credit.

CPAs can earn credit in half-hour amounts once they’ve completed the first full CPE hour. However, Nano-learning credit only accrues in 0.2 hour increments.

Other Policies and Exemptions

Non-resident licensees may meet Washington’s CPE requirements by meeting the stipulations for the principal place of business state. However, if that state has no CPE requirements, the licensee must instead meet Washington’s CPE requirements.

Some licensed CPAs are automatically exempt from the continuing education requirements. However, in order to apply, they must not offer services to third parties. These include:

- Retirees

- Currently unemployed members

- Willfully unemployed members who intent to return to the workforce

- Any member formally listed as “inactive” with AICPA

Furthermore, exemption waivers are available upon request for CPAs for certain approved reasons, including:

- Health issues

- Military service and deployment

- Extreme natural disaster

- Other extenuating circumstances (pending Board approval)

Additional Resources for Washington State CPE Requirements

Last Updated:

![DC CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/02/DC-CPA-CPE-Requirements.png)

![Missouri CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/04/Missouri-CPA-CPE-Requirements.png)