![DC CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/02/DC-CPA-CPE-Requirements.png)

The General DC CPA CPE Requirements

CPE is an important aspect of many professional careers, including business. Because it goes a long way toward ensuring full capability and quality in the services an individual performs. Of course, CPE types and requirements differ greatly between career fields. But it should also be noted that it can vary with location, even for members of the same organizations. For example, the AICPA is regulated by state Boards of Accountancy. So, the state requirements and stipulations vary from one state or territory to another. And consequently, the DC CPA CPE requirements differ from those in other locations around the country.

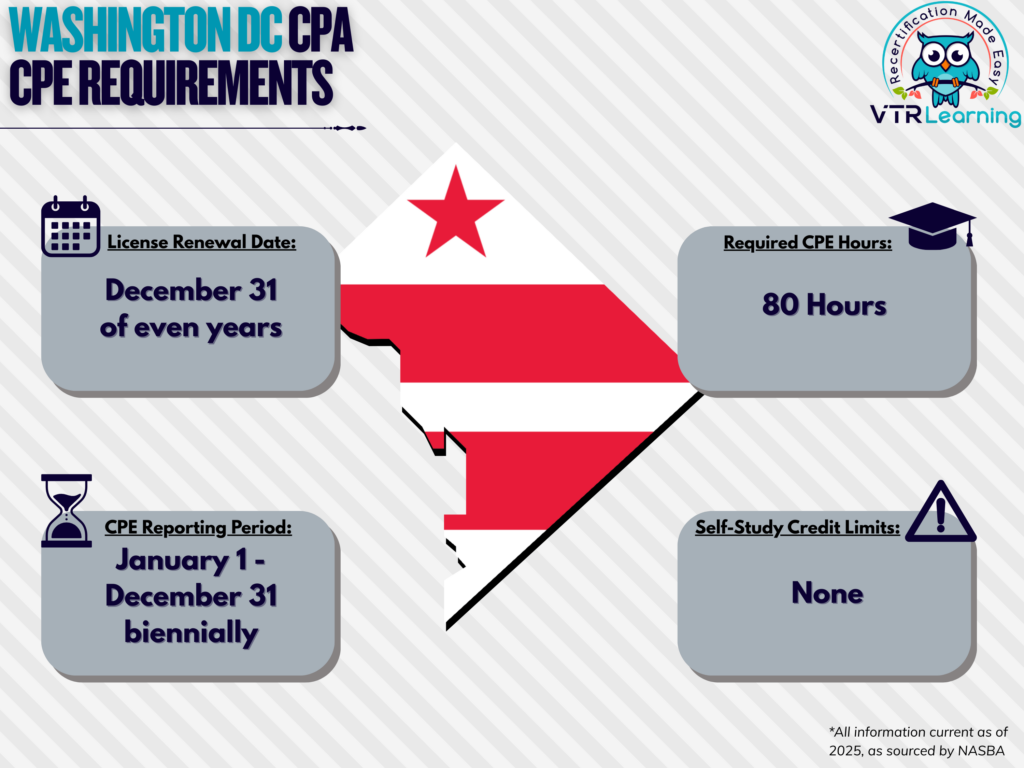

Overall, DC AICPA members have to renew their license every two years. And furthermore, they must complete 80 CPE hours per recertification period. The table below further details the primary DC CPA CPE requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 of even years | January 1 – December 31 biennially | 80 hours | None |

Subject Area Requirements

Each recertification period (two years), licensees in Washington D.C. must take at least 4 hours of professional ethics. There are no further subject area requirements as mandated by the District of Columbia.

Credit Limitations and Calculation

DC licensees can earn up to 50% of their CPE per recertification period through formal instruction. Additionally, for calculation, individuals can claim credit preparation time up to twice the class contact hours.

Active participants in college or university courses can also earn credit, as per Board rules. Overall, credit accrues at a rate of 15 CPEs per hour of a semester course. And additionally, 10 CPE credits per quarter hour.

Furthermore, credit for the authorship and publication of instructional or educational materials cannot surpass 25% of the total required credits. However, in exceptional circumstances, an applicant may request additional credit by submitting the publication to the Board with an explanation of the circumstances which justify a greater credit amount. Furthermore, the Board is fully responsible for determining the amount of credit awarded for a given publication.

Licensees can also obtain credit for attending committee and firm meetings. But this method may not exceed 25% of the total required credits per recertification period.

Overall, there is no set limitation or requirement for self-study credit.

At any point, credit may be obtained in half-hour increments.

Credit for subjects not specified in the regulations do not apply unless licensees demonstrate how they contribute to professional competence. Furthermore, these credits can only count toward 25% of the total requirement.

The Board shall only approve programs from organizations that are also exempt or courses from providers that are members of NASBA’s National Registry of CPE Sponsors or that are QAS-approved. Generally, such organizations include:

- AICPA

- NASBA

- State Accountancy Boards

- Professional Firms

- Colleges and Universities

- Greater Washington Society of CPAs

- Other State societies

Other Policies and Exemptions

Of course, some AICPA members do not have to complete the DC CPA CPE requirements. These exempt individuals also must not offer services to other parties. They generally include:

- Retired members

- Currently unemployed individuals

- Those who have temporarily left the workforce (who may return in the future)

- Licensees who have formally listed their status as “inactive”

It is also possible to request waivers for continuing professional education requirements on the following bases:

- Health complications

- Military service

- Extreme natural disasters (further determined by the Board)

- Other situations which warrant exception (also subject to Board approval)

Additional Resources for DC CPA CPE Requirements

Last Updated:

![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)