![Missouri CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/04/Missouri-CPA-CPE-Requirements.png)

Missouri CPA CPE Requirements for License Renewal

Members of the AICPA must complete a certain amount of CPE each license recertification period in order to renew their membership with the organization. However, the specific requirements actually vary from one place to another. Because a Board of Accountancy regulates each state and sets the stipulations for their jurisdiction. So, the Missouri CPA CPE requirements might be different from those in other states. Because of this, CPAs need to be aware of the state requirements to ensure they obtain CPE in a Board-approved method. Otherwise, license recertification could be jeopardized.

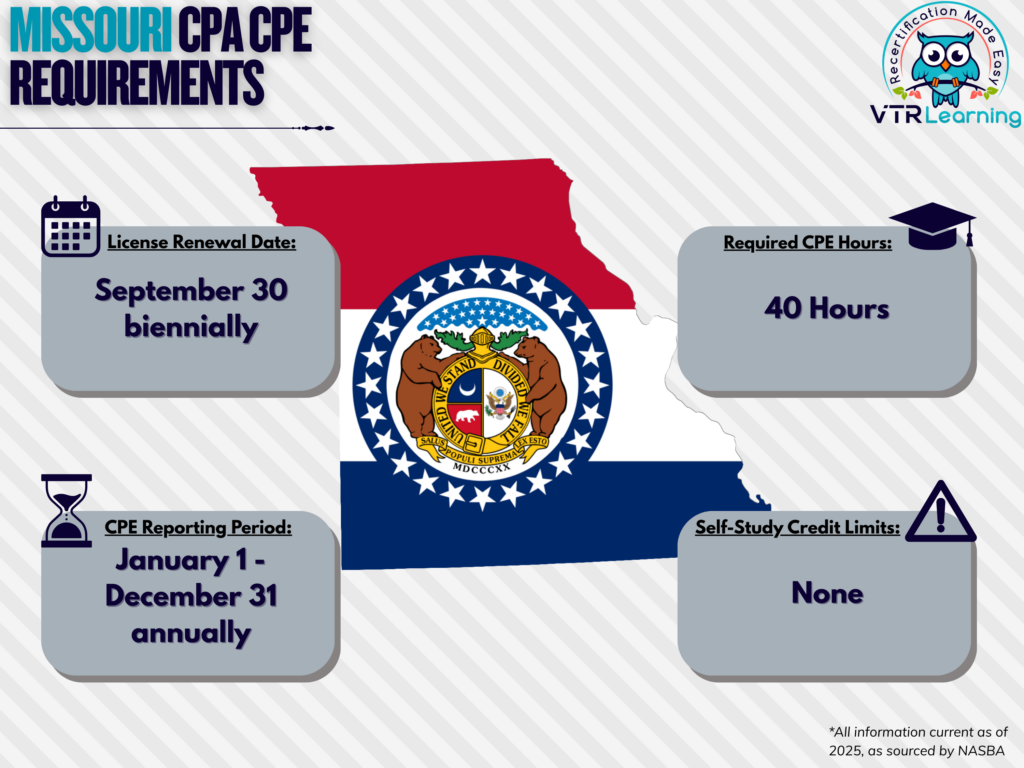

Specifically, CPAs in Missouri have to renew their license every two years. And they must complete 40 hours of CPE during that time. The table below also highlights some of the primary recertification deadlines and stipulations for CPAs in Missouri.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| September 30, biennially | January 1 – December 31 annually | 40 hours | None |

Subject Area Requirements

For every recertification period, 2 of the required 40 CPE credits must include Professional Ethics. However, there are no further subject area requirements.

Credit Limitations and Calculation

CPAs can obtain credit through formal instruction of educational material, where credit is equal to presentation time plus preparation. However, preparation credit cannot exceed twice the length of presentation. And repeat instruction of the same course will only be accepted so long as the curriculum has been substantially altered or changed.

Active enrollment in a college or university course is also a Board-approved method for obtaining CPE hours. Here, one semester hour is equal to 15 CPE hours and one quarter hour equals 10 CPE hours. Non-credit university courses can also be submitted, but grant credit at a rate of 1 CPE hour per classroom hour. All university credit hours must be related to the accounting profession.

CPAs can obtain credit for authoring published material. However, they can earn no more than 2 credits per reporting period.

Group programs and blended learning programs must least a minimum of one hour, but credit is obtainable in one-fifth or one-half hour increments once the first full hour is complete.

Nano-Learning always accrues in one-fifth hour increments.

There are no stated limitations for self-study credit hours. However, they must last at least one-half hour initially. Afterward, they can accrue in one-fifth hours.

Other Policies and Exemptions

A non-resident licensee seeking renewal of a license in this state shall also be determined to have met the CPE requirement of this rule by meeting the CPE requirements for renewal of a license in the state in which the licensee’s principal office is located. However, if a non-resident licensee’s principal office state has no CPE requirements for renewal of a license, the non-resident licensee must comply with all CPE requirements for license renewal in Missouri.

Any licensee remaining in good standing can obtain a grace period from January 1st through March 1st in case of CPE shortage from the preceding year. This period requires written submission to the board for approval.

Automatic exemption from CPE requirements is granted on the following bases, so long as the individual provides no services to third parties:

- Retired members

- Currently unemployed members

- Members who have temporarily left the workforce

- Members who are formally inactive with the AICPA

Waivers are available to active CPAs for the following reasons (subject to Board approval):

- Health issues

- Military service

- Extreme natural disasters

- Other similar circumstances

Additional Resources for Missouri CPA CPE Requirements

Last Updated:

![Find Your Required CPA CPE Hours [State Chart]](https://assets.vtrlearning.com/wp-uploads/2025/03/Find-Your-CPE-Hours.png)

![South Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/South-Dakota-CPA-CPE-Requirements.png)