![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)

General Requirements for CPE in North Carolina

CPE is a requirement for licensees of the AICPA. Primarily because it helps ensure their skills and knowledge are on par with industry standards. However, individual Boards of Accountancy regulate each state, different locations can have different requirements and limitations. So, CPE in North Carolina might look different from other places. And because of this, it’s important for individuals to know the state requirements for their location. Otherwise, their Board could penalize their license renewal efforts.

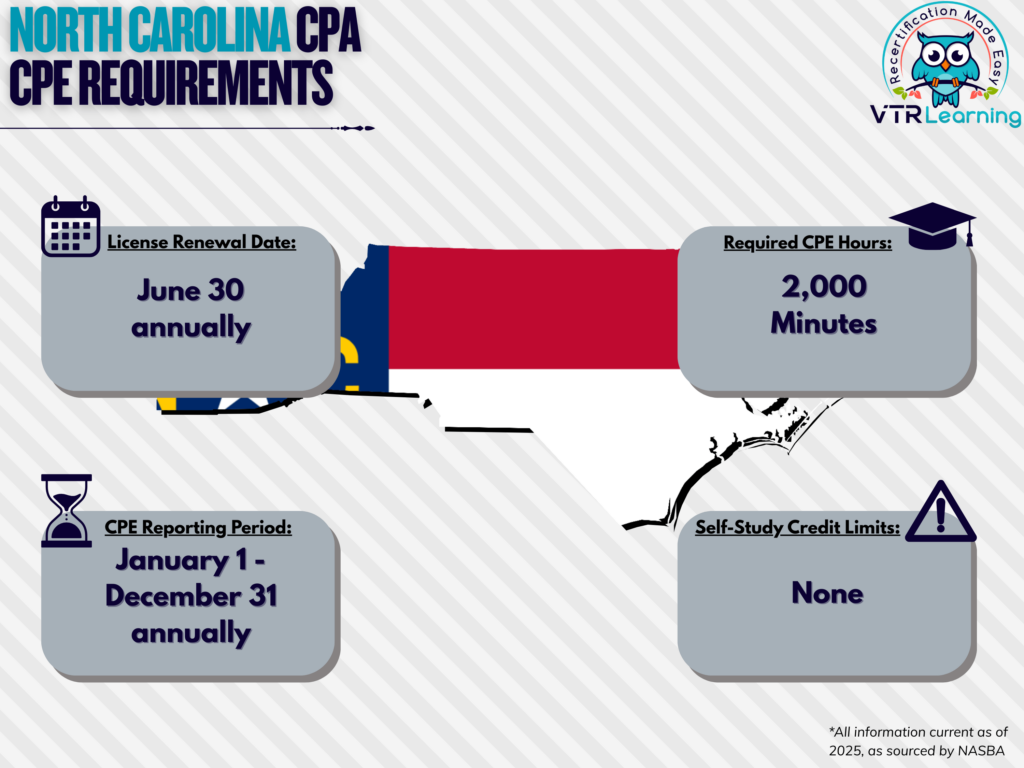

Licensed CPAs in North Carolina have to renew their license each year. And during that time, they must complete 2,000 minutes of CPE. The table below provides the main recertification limitations and deadlines for members who live in North Carolina.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 annually | January 1 – December 31 annually | 2,000 minutes | None |

Subject Area Requirements

Every year, licensees must take at least 50 minutes of CPE dealing with Professional Ethics from a registered NASBA sponsor. These minutes also count toward the 2,000-minutes requirement for the year. However, there are no further subject area requirements.

Credit Limitations and Calculation

In North Carolina, CPAs who give formal lectures can obtain up to 50% of their required minutes for the year. This method also covers instruction of college or university courses. However, licensees only receive credit if the material is above the level of basic accounting principles. For general lectures, credit is equal to the presentation and preparation times combined. But CPE for college instruction is based on the number of credit hours given to students for completing the course. CPAs will not receive credit for repeated instances of instruction as long as the material remains the same.

CPAs taking a college or university course can also claim CPE credit. Here, credit calculates to 750 CPE minutes per semester hour and 500 CPE minutes per quarter hour. However, audited courses will receive no credit.

Authorship is also an acceptable method for earning CPE. But the material in question must be published, instructional or educational content. Furthermore, no more than 25% of the total required minutes per recertification period can be obtained this way.

Self-study CPE credit calculates based on the overall length the course. And ultimately, the providing sponsor is responsible for determining this amount.

The Board also accepts partial credits in any amounts.

Other Policies and Exemptions

A maximum of 1,000 minutes may carry over from one reporting period to the subsequent renewal period. However, CPAs may not use carried minutes to meet the ethics requirement.

A non-resident licensee may satisfy the annual CPE requirements in the jurisdiction where they are licensed and currently reside or work. However, that must have an annual CPE requirement. Otherwise, the licensee must meet North Carolina’s requirements.

A non-resident licensee whose primary office is located in North Carolina must meet the North Carolina ethics requirement. All other non-resident licensees may meet the ethics requirement by completing the ethics requirement in the jurisdiction in which they are licensed as a CPA and work or reside. But if there is no ethics CPE requirement in that jurisdiction, they must comply with the North Carolina ethics requirement.

CPAs in the following categories do not have to complete CPE to renew their license:

- Retirees who do not offer services to any third parties

- Unemployed individuals who offer no services to third parties

- Those who have temporarily left the workforce and do not offer services to third parties

- Members who have formally listed their status as “inactive” and do not offer services to any third parties

Furthermore, waivers are available by request for CPAs on the following bases:

- Health complications

- Active-duty military service

- Extreme natural disasters (according to North Carolina Board policies)

- Other similar circumstances which could prevent members from completing CPE requirements

Additional Resources for CPE in North Carolina

Last Updated:

![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)

![Delaware CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Delaware-CPA-CPE-Requirements.png)