![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)

Overview of Arizona CPA CPE Requirements

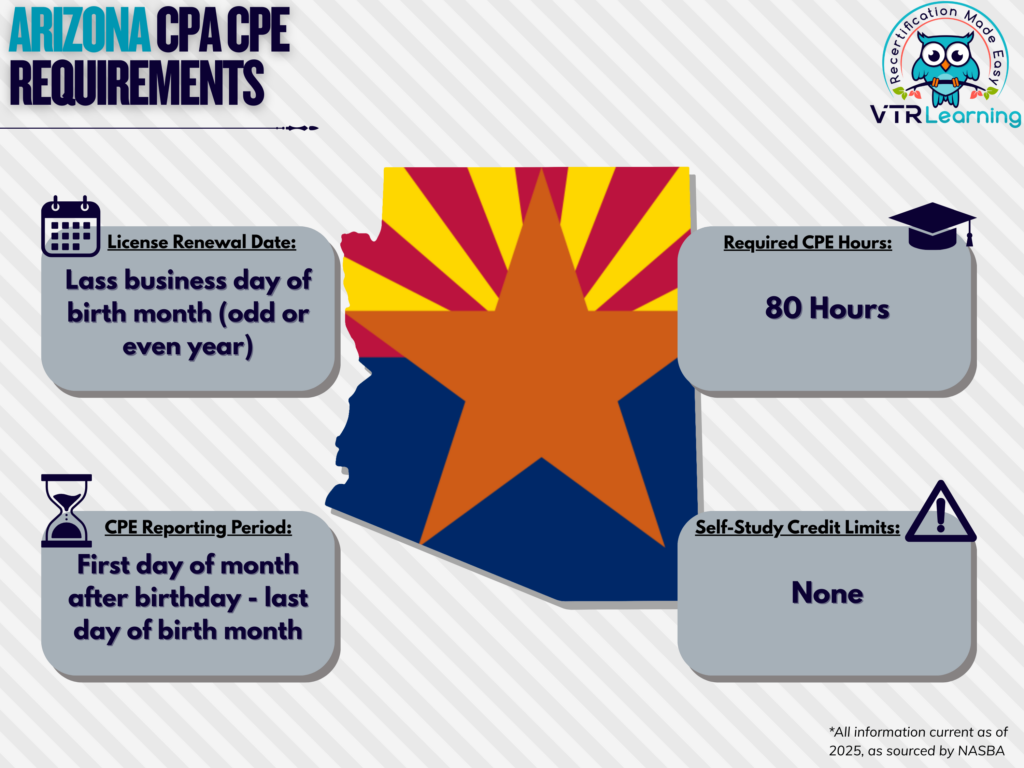

For businesspersons holding professional titles or designations, CPE is a common requirement. Because ideally, it helps maintain their standing as a licensed member of their accrediting organization. However, it’s important to recognize that the organizational requirements for licensure can vary by state or territory. Overall, the Arizona CPA CPE requirements instruct individuals to renew licenses every two years. Furthermore, during that time, they must complete 80 hours of CPE.

Of course, the Arizona Board of Accountancy is responsible for determining the requirements of CPAs within it’s jurisdiction. So, it is important for Arizona licensees to stay aware of the specific state stipulations for license renewal. The table below further highlights the primary recertification limitations and deadlines for Arizona.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| Last business day of birth month, biennially (odd or even year based on birth year) | First day of month following birth month to last business day of birth month, biennially (odd or even year based on license) | 80 hours | None |

Subject Area Requirements

One major subject area requirement for Arizona CPAs is completing 4 hours of professional ethics. Furthermore, this must happen during each license renewal period. However, employers or coworkers cannot teach these hours. And they must include a minimum of one hour of each of the following subject:

- Ethics related to the practice of accounting. This includes the Code of Professional Conduct of the American Institute of Certified Public Accountants

- Board statutes and administrative rules

CPAs must also obtain 40 hours of CPE credit in accounting, auditing, taxation, business law or management advisory services. Additionally, 16 of those 40 hours must be related to accounting, auditing or taxation. And 16 must also be in a classroom or interactive webinar setting.

Credit Limitations and Calculation

In Arizona, CPAs who instruct or present material in a professional capacity can earn up to 50% of their CPE hours. Though instructor credits, combined with authorship credits, must not exceed 40 hours per recertification period. Overall, credit equals presentation time plus preparation, where preparation does not exceed the length of presentation. However, repeat instructions of the same material will not earn credit.

Authorship and publication of instructional material is also a Board-approved method for obtaining CPE credits in Arizona. So, CPAs who choose to utilize this route can earn up to 25% of their maximum required hours. Published materials must be a minimum of 3,000 words. For each 3,000 words of written material, the author may earn two credit hours.

CPAs active in university or college courses can obtain up to 15 CPE hours per semester hour. Or alternatively, 10 CPE hours per quarter hour through class attendance and participation. Non-credit university courses also count for CPE credit, where each classroom hour equals one qualifying hour.

Only portions of blended learning programs in a live classroom or interactive webinar setting count toward the 16 hours classroom and interactive webinar requirement. Arizona requires proof for any portion of a blended learning program claimed toward this requirement. Group Live, Group Internet Based, Blended Learning, Interactive Self-Study, Author Published Material, QAS Self-Study and Non-Interactive Self-Study learning programs must offer a minimum of one credit hour. However, credit can accrue in one-fifth or one-half credit hour increments after the first full hour is earned.

Nano-learning credits cannot surpass 5% of hours per reporting period, and accrue in one-fifth credit hour increments.

Introductory-level computer courses are limited to 25% of the total hours per recertification period.

Other Policies and Exemptions

A non-resident licensee can meet the Arizona CPE requirement by instead meeting those of the state where their office is located. If that state has no CPE requirements, the licensee must comply with all the Arizona CPE requirements.

Members of the AICPA are automatically exempt from CPE requirements if they fall into any of the categories described below:

- Retired members who do not offer their services to third parties

- Unemployed licensees who do not offer services to other third parties

- Members who have temporarily opted to remove themselves from the workforce and do not offer their services to third parties

- Members who willfully list their status as “inactive” and offer no services to third parties

Further waivers for CPE exemption for any given recertification can be requested for the following reasons:

- Issues with health

- Military service

- Occurrences of natural disasters (as dictated by the Board)

- Any other circumstances which might prevent a licensed CPA from completing continuing professional education requirements

Additional Resources for Arizona CPA CPE Requirements

Last Updated:

![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)

![Florida CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/05/Florida-CPA-CPE-Requirements.png)