![Delaware CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Delaware-CPA-CPE-Requirements.png)

Overall Delaware CPA CPE Requirements

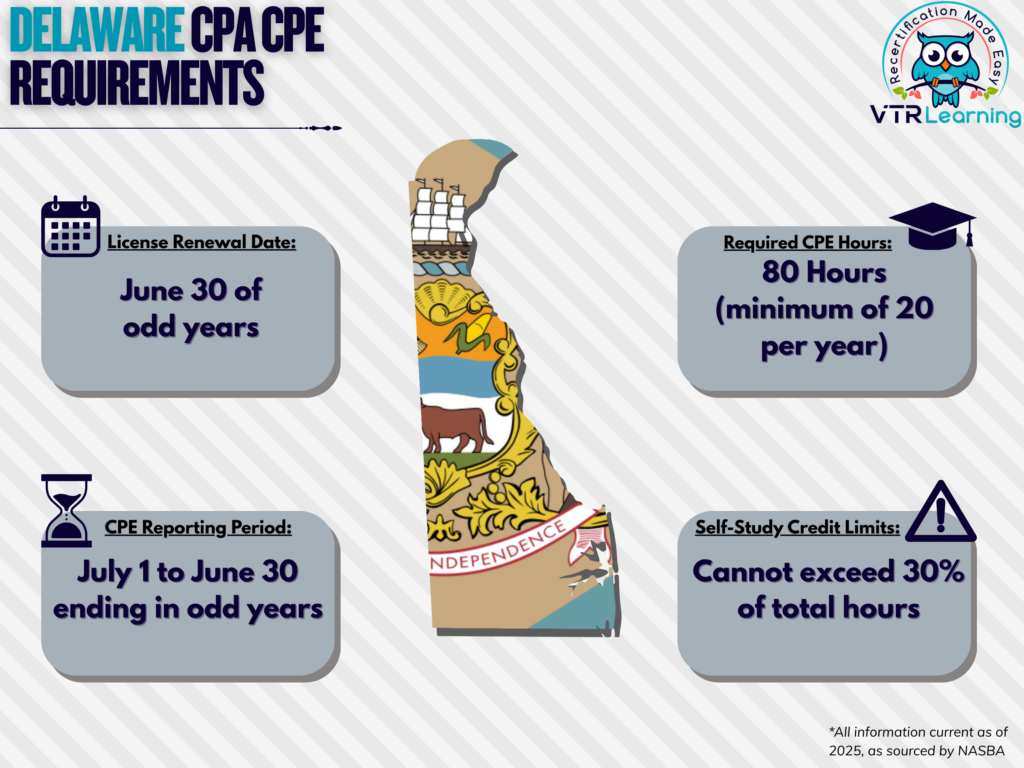

Many professional licensing organizations use CPE as a way of keeping members up-to-date on important topics while also developing their skills. However, the requirements for recertification often vary by location, as with the AICPA. Because each state is governed by a state Board of Accountancy, the rules differ from one place to another. For example, the Delaware CPA CPE requirements aren’t necessarily the same as those in other states. So, it’s important for CPAs to recognize the state requirements they must meet for license renewal.

Overall, licensees residing in Delaware must renew their license every two years. And they must also complete at least 20 CPE hours of each year, with 80 hours every recertification period. The table below further details the recertification limitations and deadlines for Delaware.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 of odd years | July 1 – June 30 biennially on odd years | 80 hours | Maximum of 30% of total required hours |

Subject Area Requirements

Every recertification period, Delaware CPAs must complete 8 hours in Accounting and Auditing and a further 8 hours in Tax. Additionally, they must obtain 20 credit hours in either Accounting, Auditing or Taxation.

Credit Limitations and Calculation

In Delaware, CPAs who instruct over accounting or auditing topics can obtain up to 50% of the total hours required. Overall, individuals can earn 1 CPE credit for each hour as an instructor. And additionally, 2 hours of credit for each classroom hour for research and presentation. No credit accrues for repeat instruction unless the material has been substantially altered or changed.

CPAs actively enrolled in college or university courses can also claim 15 CPE hours per semester hour. Furthermore, they can obtain 10 CPE hours per quarter hour course. However, no credit will be awarded for non-credit courses.

Overall, the maximum credit allowed for authorship and subsequent publication is 25% of total required hours. However, for calculation, 1 hour of credit is granted for each 50 minutes of participation time on a self-declaration basis.

Generally, the maximum credit allowed for self-study is 30% of the total required hours. Furthermore, the Board determines the amount of credit and will not approve any program without sufficient evidence of completion.

Specialized group learning apart from qualified sponsors must not exceed 25% of total required hours.

The board will accept half credits after the first full hour of CPE. However, nano learning only accrues in 0.2-hour increments.

Other Policies and Exemptions

Licensed members in any of the following categories are automatically exempt. As such, they have no requirement to meet CPE stipulations, given that they offer no services to any parties.

- Retirees

- Members who are currently unemployed

- Licensees who have temporarily left the workforce

- Individuals who have formally listed their AICPA status as “inactive”

Additional Resources for Delaware CPA CPE Requirements

Last Updated:

![South Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/South-Dakota-CPA-CPE-Requirements.png)