![Maine CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Maine-CPA-CPE-Requirements.png)

Overarching Maine CPA CPE Requirements

Many accrediting organizations which license business professionals also require their members to participate in CPE. Because doing so helps individuals stay knowledgeable about their craft and keep fresh on any changes in their given industry. One such organization, the AICPA, generally requires its members to complete 120 hours of CPE every three years. However, the specifics of accomplishing that goal differ from state to state. Because a Board of Accountancy sets the actual regulations for each state or territory local to that jurisdiction. As such, the Maine CPA CPE requirements differ from those in other places. So, if CPAs aren’t familiar with their state requirements, the recertification process can become quite frustrating.

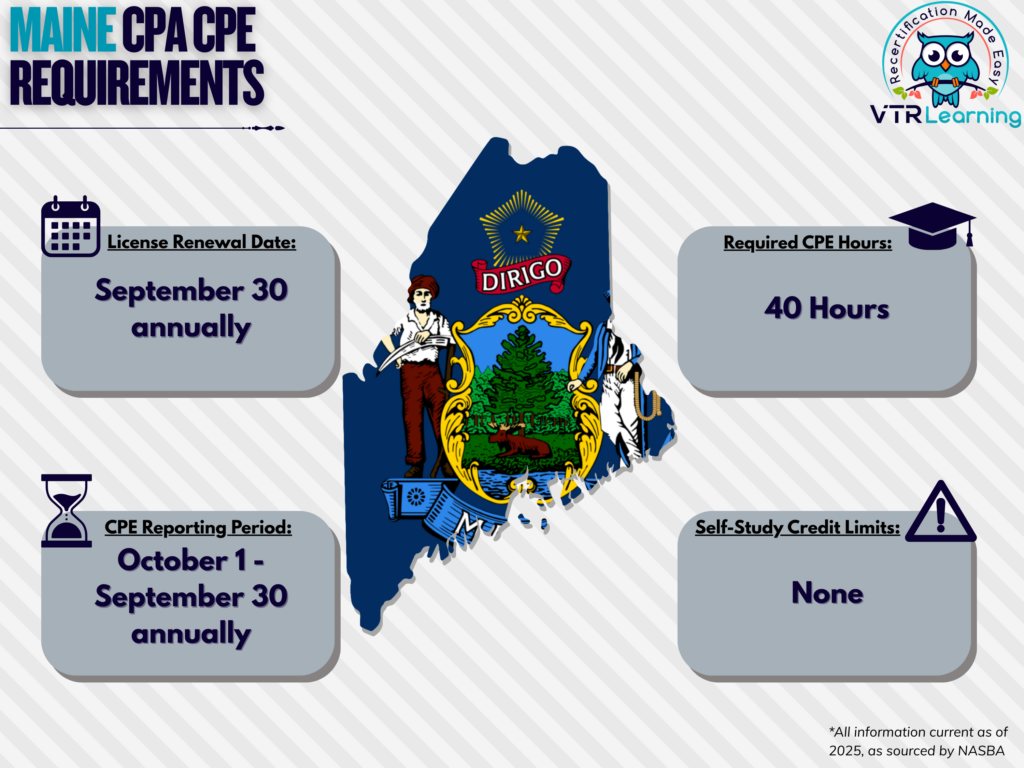

The Maine Board of Accountancy requires CPAs to renew their license every year. And in that period, they must complete 40 CPE hours. The table below further describes the primary details of license recertification for CPAs in Maine.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| September 30 annually | October 1 – September 30 annually | 40 hours | None |

Subject Area Requirements

Every three years, Maine licensees must complete 4 hours of continuing professional education in Professional Ethics. There are no further subject area requirements.

Credit Limitations and Calculation

Licensees can earn up to 50% of the required credit each recertification cycle through formal instruction or presentation. Overall, credit for this method equals three times presentation length. However, CPAs receive no credit for preparation. And furthermore, repeat instruction of the same course will only count if the material has been substantially altered.

For non-technical subjects, courses in some subject areas cannot exceed 50% of the total required hours, including: communication arts, mathematics, statistics, probability and quantitative applications in business, economics, business securities and administrative law, human resources policies, and computer software applications.

Authorship and publishing CPE credit counts, so long as the material is instructional or educational. However, this type must not surpass 50% of the total required hours per recertification period.

CPAs can obtain credits in half-hour increments so long as they’ve already earned the first full hour.

Overall, there are no stated requirements or limitations for self-study course credit.

Other Policies and Exemptions

Licensees can carry a maximum of 20 credit hours from one reporting period to the subsequent reporting period. But carried hours cannot satisfy the ethics requirement.

Exemption from CPE requirements are allowed for CPAs in the following categories, but the licensees must not offer their services:

- Retired Licensees

- Currently unemployed licensees

- Licensees who have temporarily left the workforce

- Licensees who have officially listed their CPA status as “inactive”

Further exemptions can be requested upon the following bases:

- Health issues

- Military duty or active service

- Extreme natural disaster (overall up to Board discretion)

- Similar circumstances which warrant exemption (further approved by the Board)

Additional Resources for Maine CPA CPE Requirements

Last Updated:

![Ohio CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/05/Ohio-CPA-CPE-Requirements.png)

![Hawaii CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Hawaii-CPA-CPE-Requirements.png)