![Hawaii CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Hawaii-CPA-CPE-Requirements.png)

General Hawaii CPA CPE Requirements

The AICPA is one of many organizations that certifies business professionals. Essentially, it offers prestigious titles and designations which further serve to enhance licensees’ standing in their career field. A vital part of maintaining that designation, though, is the requirement to complete CPE each recertification period. And overall, this can become confusing for CPAs who aren’t familiar with the stipulations for license renewal. Further complicating the issue is the fact that each state or territory has its own set of requirements. So, in essence, the Hawaii CPA CPE requirements differ from those of other states.

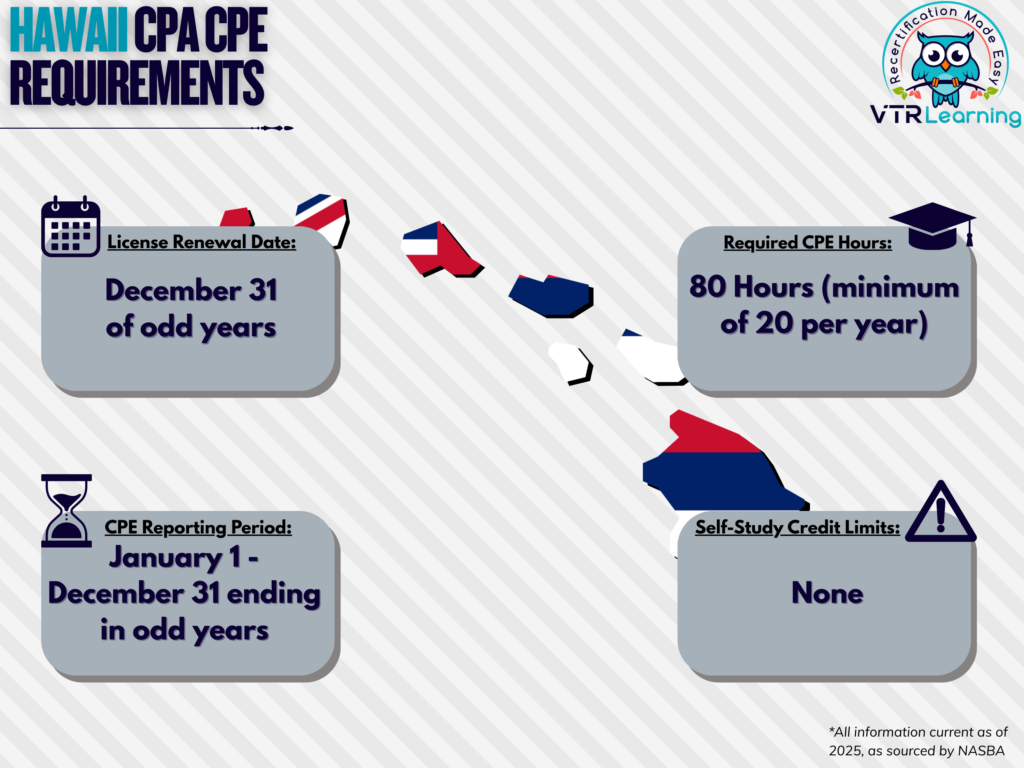

Overall, members in Hawaii must renew their license every two years and complete 80 CPE hours during that time. They must also complete at least 20 hours each year. The table below further showcases several important deadlines and limitations.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 of odd years | January 1 – December 31 biennially, ending in odd-numbered years | 80 hours | None |

Subject Area Requirements

For Hawaii CPAs, the sole subject requirement is to complete 4 hours of professional ethics training during each recertification period.

Credit Limitations and Calculation

Instruction is a valid CPE method in Hawaii, though it carries a 40 hour limit. However, credit for teaching the same course in the same recertification period is awarded only once. And furthermore, credit is given for presentation time only.

Active participation in college or university courses is also a Board-approved method of CPE. Overall, it calculates as 15 CPE credits per semester hour and 10 CPE credits per quarter hour. However, non-credit university courses are also worth 1 CPE hour for each hour of class participation.

Further credit is available for authorship, though this must not exceed 20 CPE hours. Also, in order to qualify, the CPA must have published the educational or instructional material.

The Board ultimately has provisions to allow CPE credit hours for a reviewer at a formally-sponsored interoffice or interfirm quality review program, with 50% of each hour and not to exceed 20 hours per recertification period.

Self-study course credit has no stated limitations further regulated by the Board.

Other Policies and Exemptions

Course providers must be one of the following:

- A non-profit, nationally recognized accounting and auditing association

- An accredited university or college

- Approved by either the Hawaii Board of Accountancy or another state board of accountancy

- Approved by NASBA’s National Registry of CPE Sponsors

Up to 40 hours earned in excess of the reporting period requirements may be earned over the next reporting period.

AICPA members who fall into the following categories are considered exempt from continuing professional education requirements:

- Retirees who do not offer their services to other parties

- Unemployed members who do not offer their services to other parties

- Members who have temporarily and willingly left the workforce who do not offer services to other parties

- Formally listed, “inactive” members who do not offer their services to other parties

Waivers can be requested for exemption by CPAs for the following reasons:

- Complications with health

- Issues related to military service

- Instances of natural disaster (further decided by the Board)

- Other circumstances which prevent timely accrual of continuing professional education credit (also subject to Board determination)

Additional Resources for Hawaii CPA CPE Requirements

Last Updated:

![Washington State CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2022/02/Washington-State-CPE-Requirements.png)

![Alaska CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/Alaska-CPA-CPE-Requirements.png)

![Maryland CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Maryland-CPA-CPE-Requirements.png)