![Ohio CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/05/Ohio-CPA-CPE-Requirements.png)

CPE Requirements for Ohio CPAs

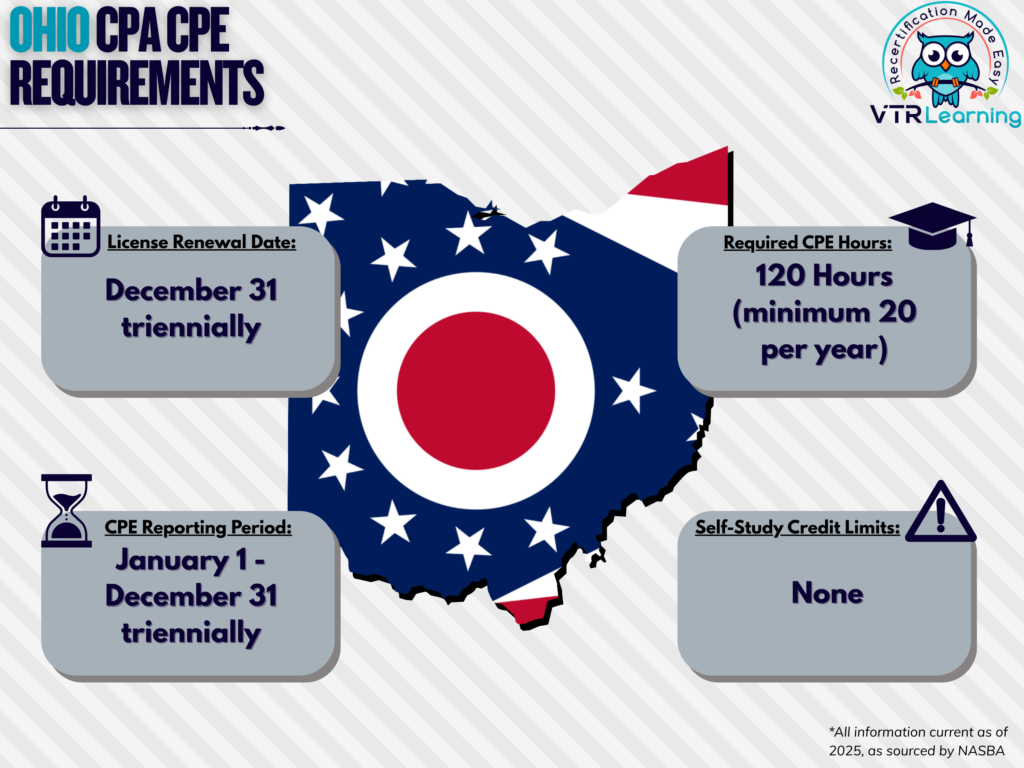

Business pros often benefit from licensure as members of various accrediting organizations. Because having a designation proves their trustworthiness and ability to achieve quality results. Generally, members must complete a set amount of CPE hours during a renewal period. Because doing so demonstrates their willingness to keep up with key industry issues. However, the specific requirements vary widely according to a member’s location. So, the Ohio CPA CPE requirements are unique to the state. AICPA members who live in Ohio answer to the state’s Board of Accountancy. And according to the rules, must complete 20 CPE hours per year and 120 hours every renewal period.

Because Ohio’s requirements differ from those of other states, CPAs there must be aware of the specifics. Otherwise, confusion and frustration complicate the renewal process. The table below further highlights the primary limitations and deadlines for the Ohio CPA CPE requirement.

Share this Image On Your Site

Ohio CPA CPE Requirements and Recertification Deadlines

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 triennially | January 1 – December 31 triennially | 120 hours | None |

Subject Area Requirements

During each renewal cycle, CPAs must obtain 3 of the required 120 CPEs from a Professional Ethics course. Furthermore, the Executive Director of the Accountancy Board of Ohio must specifically approve the course. If the licensee works on financial reporting engagements or performs financial reporting work outside public accounting while using the CPA designation, 24 hours per renewal period must also be in Accounting or Auditing. If the licensee works on tax engagements, provides tax advice to clients or performs tax work outside public accounting while using the CPA designation, 24 hours per renewal period must also be in Tax.

Credit Limitations and Calculation

For Ohio-based CPAs, up to 90 credits per recertification period can be obtained by providing formal instruction or presenting lectures. Here, credit equals three times the presentation length. However, no credit will be granted for preparation or repeat presentations of the same material during a single cycle.

CPAs taking college or university students can also earn up to 15 CPE credits per semester hour. Furthermore, students can obtain up to 10 CPE credits for quarter hour courses. However, in both cases, courses must relate to the accounting profession.

Licensees who author and publish instructional material can claim CPE credit for the work. But this is subject to examination and approval by the Executive Director of the Board. Ohio permit holders may also to submit appropriate documentation to support the credit claimed for authorship.

Ohio CPAs can obtain up to 8 credits for live group daily during one day. In order to count for CPE, the session must last at least 400 minutes in length, excluding breaks.

Credit are also awarded for passing major professional examinations which are approved by the Executive Director of the Board. Though, like other methods, this is subject to individual approval. This method is generally 10 credits per hour if the total session lasts at least three continuous hours. And CPAs can earn up to a maximum of 40 credits per session.

For live group study, CPE can be earned in 10-minute increments after the first full hour has been obtained. For self-study, CPE credit may be earned in 10-minute increments prior to earning the first full hour.

Exemptions

A non-resident Ohio permit holder can fulfill the Ohio CPA CPE requirements also by meeting the CPE requirements of the state where the permit holder’s principal office is located. However, if that state does not have a CPE requirement, the non-resident Ohio permit holder must comply with the Ohio reporting requirements.

Licensed CPAs in any of the following categories will be considered exempt from completing continuing education requirements. But they cannot offer professional services to any third parties.

- Retirees

- Members who are currently unemployed

- Members who have temporarily and willingly left the workforce

- Formally-listed inactive members of AICPA

For licensees not in any of the above categories, waivers can be requested for the following reasons:

- Health complications

- Active-duty military service

- Extreme natural disasters (in accordance with Ohio Board policies)

- Other similar circumstances which might prevent a member from completing their CPE requirements

Additional CPE Resources for CPAs

Last Updated:

![New York CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/04/New-York-CPA-CPE-Requirements.png)

![Indiana CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Indiana-CPA-CPE-Requirements.png)