![Utah CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Utah-CPA-CPE-Requirements.png)

Overview of Utah CPA CPE Requirements

Many professional organizations, like the AICPA, require their members to complete a specific amount of CPE within a given period. Primarily to make sure licensees offer quality services. However, each state has its own regulatory Board of Accountancy. And consequently, the actual CPE requirements vary widely from one location to another. Consequently, the Utah CPA CPE requirements aren’t the same as in other places. So, it is up to each individual accountant to know the state requirements they must meet.

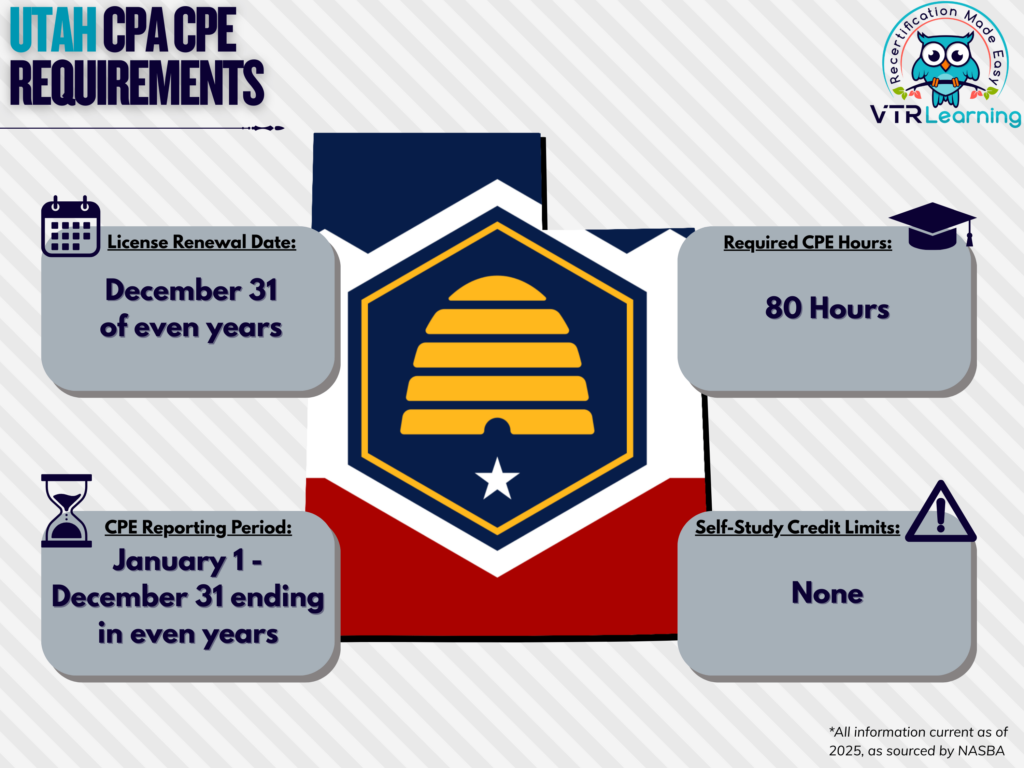

In Utah, AICPA members must renew their license every two years. And during that time, they have to complete at least 80 hours of CPE. The following table also provides more insight into the CPA CPE requirements for Utah.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 on even-numbered years | January 1 – December 31 biennially, ending on even-numbered years | 80 hours | None |

Subject Area Requirements

During every renewal period, CPAs in Utah must complete at least 4 CPE hours in subjects related to Professional Ethics. Furthermore, one hour has to cover Utah CPA Licensing Act and CPE Licensing Act Rules. Another three hours must also cover at least one of the following areas.

AICPA Professional Code of Conduct, case-based instruction focusing on real-life situational learning, ethical dilemmas faced by accounting professionals, or business ethics. The four hours of Professional Ethics training also count toward the total 80 required for license renewal.

Credit Limitations and Calculation

In Utah, CPAs who provide formal instruction experiences can obtain up to 50% of their required credit hours. Instructors, discussion leaders or speakers who present a learning activity for the first time receive credit for prep time. So, CPE equals twice the number of credits to which participants would be entitled, in addition to prep time.

Some AICPA members actively participate in college or university courses related to the Accounting profession. And in such instances, are entitled to CPE credit hours. This method calculates to 15 CPE hours per semester hour or 10 CPE hours per quarter hour. CPAs can submit courses not worth credit but still related to Accounting. However, only at a rate of one CPE credit hour per actual hour of qualified class time.

Furthermore, CPAs can obtain credit for authoring and publishing instructional or educational material related to the Accounting profession. Though, an independent party must formally review each published work. Ultimately, credit may only be claimed once publication has occurred. The maximum amount of credit earned cannot exceed 25% of the CPE requirement for any given recertification period.

Committee and firm meetings only afford CPE credit so long as portions are designed as programs of learning. Furthermore, they must comply with NASBA/AICPA CPE standards.

Blended learning credit is also a Board-approved method for earning CPE credit. Though only so long as the credit amount is within the rounding rules.

Overall, CPE credit can be obtained in half-hour increments after the first full hour has been completed. However, group-live, internet-based, blended learning, and interactive self-study can accrue in 0.2 or 0.5 increments after the first hour. Nano learning is only accepted in 0.2 increments.

Other Policies and Exemptions

CPAs in any of the following categories have automatic exemption from the general CPE requirements. However, they must not offer their services to third parties..

- Retired members

- Any currently unemployed members

- Members who have willfully left the workforce for a temporary period

- Those who have willfully listed their organizational status as “inactive”

Furthermore, it is possible for individual members to request exemption waivers for the following reasons:

- Health complications

- Active-duty military services

- Extreme natural disasters (as determined by the Board)

- Any other similar circumstances which might reasonably prevent a member from completing CPE requirements

Additional Resources for Utah CPA CPE Requirements

Last Updated:

![North Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/North-Dakota-CPA-CPE-Requirements.png)

![Oregon CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/Oregon-CPA-CPE-Requirements.png)

![Minnesota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Minnesota-CPA-CPE-Requirements.png)