![Oregon CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/Oregon-CPA-CPE-Requirements.png)

Overview of the Oregon CPA CPE Requirements

As with most things, the business world is anything but static. In fact, it changes and shifts, and the accounting profession is no exception. Because the field advances quickly, it’s important for CPAs to stay on top of changes. And part of that also means completing CPE. Essentially, AICPA members must complete a certain amount of CPE every few years in order to maintain their licensed status. But since each state Board of Accountancy has its own requirements, the rules differ from one location to another. So, Oregon CPA CPE requirements aren’t the same as those in other places. And that’s why it’s important for licensees to stay aware of their state requirements.

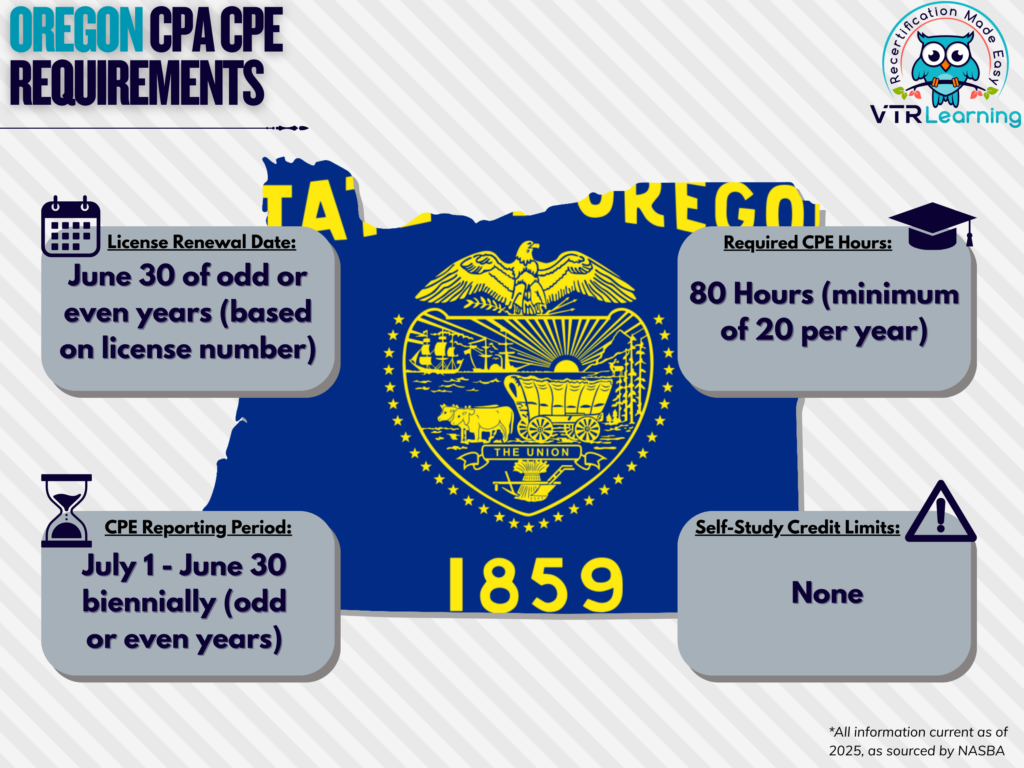

Overall, Oregon CPAs must renew their license every two years. Furthermore, they must complete at least 20 hours of CPE each year. However, the overall requirement states that licensees must have completed 80 hours per license renewal period. The table below also offers more details about the licensing requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 (odd numbered license = odd year; even numbered license = even year) | July 1 – June 30 biennially (odd-numbered license = odd year; even-numbered license = even year) | 80 hours | None |

Subject Area Requirements

During each renewal cycle, 4 of the 80 hours must be in the areas of Professional Conduct and Ethics. Programs in ethics qualify for CPE credit if offered by sponsors registered with the Board. They also must include information pertaining to each of the following topics:

- Oregon Administrative Rules and Oregon Revised Statutes pertaining to the practice of public accountancy

- Examples of issues or situations that also require a licensee to understand relevant statutes, rules and case law

- The Code of Professional Conduct adopted by the Board and set forth in OAR chapter 801, division 030

- Review of recent case law pertaining to ethics and professional responsibilities for the accounting profession

If the licensee’s principal place of business is not in Oregon, they may meet the ethics requirement by completing that of the principal place of business. However, if the principal place of business does not have an ethics requirement, the licensee must meet Oregon’s ethics requirement.

Licensees admitted to the municipal roster must complete 24 hours of CPE in subjects related to governmental environment and auditing. A minimum of 16 hours must be completed within the following subjects:

- State and local governmental unit audits

- Governmental Accounting and Financial Reporting Standards and relevant updates

- Generally Accepted Governmental Auditing Standards and relevant updates

- The Single Audit Act and related Office of Management and Budget circulars and supplements

- Oregon Local Budget Law

- Minimum standards of audits and revisions of Oregon municipal corporations

Overall, no more than 8 of the 24 hours may be from courses on Generally Accepted Auditing Standards and Procedures.

Credit Limitations and Calculation

Formal presentations are a valid method, as per the Oregon CPA CPE requirements. So are authorship and subsequent publication of written materials. Though CPAs can only earn 50% of the maximum required credits each renewal period through instruction and authorship combined. However, instructors may not obtain credit for repetitive instances of instruction unless they’ve significantly changed the material. And furthermore, authorship credit applies only to the first instance of publication of a work. For calculation, instructors will receive CPE credit for prep time up to twice the length of presentation. They also receive credit for presentation time itself.

Licensees enrolled in relevant higher education courses can claim credit hours. 15 hours are allotted to each semester hour, and 10 hours for every quarter hour taken. Non-credit university courses afford 50 minutes of credit per qualifying hour of classroom time.

Non-technical subjects may not exceed 16 credits per recertification period. And the hours do not carry forward to meet requirements of the next renewal cycle.

Practice review credit is limited to 2 hours per instance. Furthermore, only 16 total hours per renewal period count as valid credit.

Self-study credit must be approved by NASBA’s Quality Assurance Service (QAS) in order to qualify as an acceptable CPE method.

Credits may be obtained in half-hour (25-minute) increments.

Other Policies and Exemptions

CPAs are considered exempt from the continuing professional education requirements in Oregon if they are:

- Retired

- Currently unemployed

- Temporarily apart from the workforce

- Formally listed as “inactive” with the AICPA

However, to qualifying for exemption, members in the above categories must not offer their services to third parties.

It is also possible for individual members to request waivers for the continuing professional education requirements for reasons including:

- Declining health

- Some instances of military service

- Natural disasters (determined by Board approval)

- Other, similar circumstances

Additional Resources for Oregon CPA CPE Requirements

Last Updated:

![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)

![CNMI CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/12/CNMI-CPA-CPE-Requirements.png)

![Maryland CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Maryland-CPA-CPE-Requirements.png)