![Minnesota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Minnesota-CPA-CPE-Requirements.png)

Minnesota CPE Requirements for CPAs

CPE is the bedrock upon which members of the AICPA ensure their knowledge and skills remain up-to-date. Because it all goes toward making their services top-notch. However, as most CPAs are well-aware, the actual requirements for obtaining CPE differ from one location to another. Because state Boards of Accountancy are responsible for determining and regulating the stipulations and limitations for individual states. So, the Minnesota CPA CPE requirements differ from those of other locations. Ultimately, CPAs need to be well-aware of the regulations to avoid confusion and frustration during the license recertification cycle.

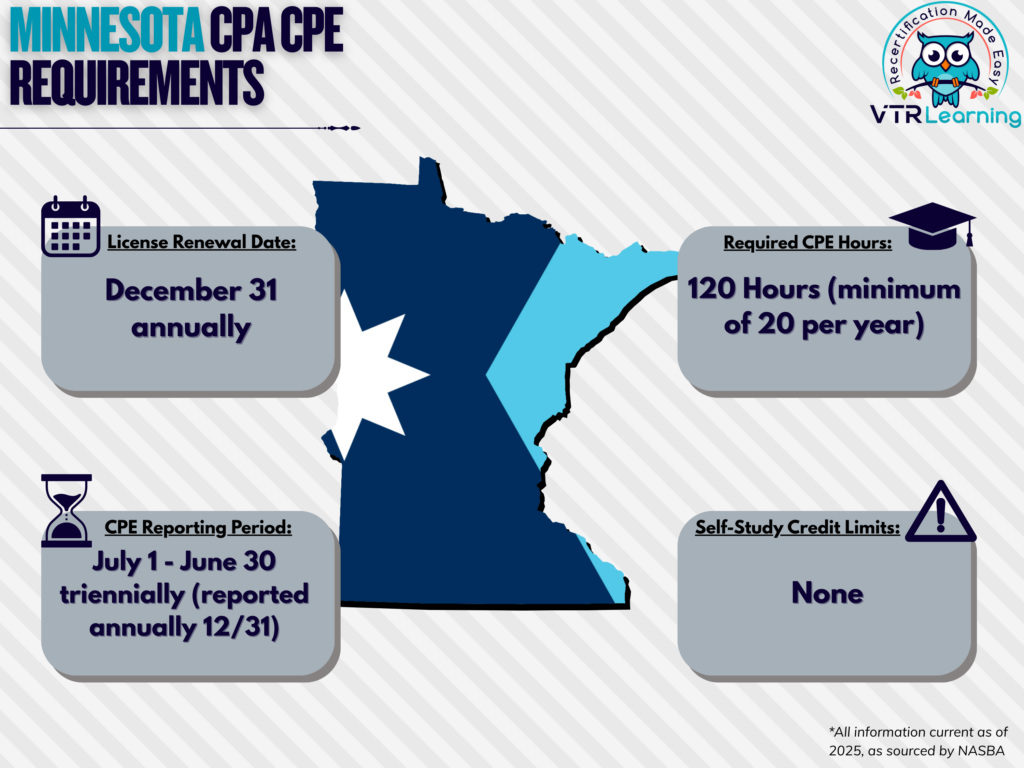

Overall, Minnesota licensees must recertify every three years. Also, they must complete 20 CPE hours each year, with a total 120 hours every recertification period. The table below further expands on the primary requirements as set by the Minnesota Board of Accountancy.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 annually | July 1 – June 30 triennially-rolling | 120 hours | None |

Subject Area Requirements

Within each recertification cycle, CPAs must also take 8 CPE hours in regulatory (technical) or behavioral (non-technical) ethics.

For technical subjects, CPAs must obtain a minimum of 60 hours from relevant learning activities. The NASBA Fields of Study, July 2016 Revision further defines these activities.

CPAs must obtain at least 24 hours per recertification cycle by attending group or blended learning programs. Furthermore, NASBA must recognize providers of blended learning programs on the NASBA National Registry of CPE Sponsors.

Credit Limitations and Calculation

Licensees can earn up to 60 CPEs for instruction or presentation of formal educational material. This type of learning activity also resets every recertification cycle.

CPAs can also earn credit for authoring and subsequently publishing instructional or educational material. This category includes articles, curriculum and books, and it also caps at 60 hours.

Providers of Nano-Learning programs must also certify with the NASBA National Registry of CPE Sponsors.

However, there are no provided limits for self-study credit.

Other Minnesota CPA CPE Requirements

A minimum of 72 hours per recertification period must be from approved providers, further defined as:

- Providers that are on the NASBA Registry of CPE Sponsors.

- The Office of the Legislative Auditor or State Auditor, so long as a peer review has been completed within the last three years. Furthermore, an unmodified report on such a review must have been filed with the Board. Also, this peer review must be similar in scope to a system review level peer review conducted on a CPA firm.

- CPA firms who have had a system review level peer review completed within the last three years. But only if an unmodified report on such a review has been filed with the Board.

- Colleges and universities where academic programs qualify an applicant to sit for the CPA examination.

- Professional organizations recognized by the Board as Report Acceptance Bodies.

- CPE programs sponsored by professional organizations which are recognized by another state’s Board of Accountancy.

Exemption from Minnesota CPA CPE Requirements

A non-resident licensee in Minnesota also meets Minnesota’s requirements by meeting those where the licensee’s principal office is located. But if the principal office state has no CPE requirement, Minnesota’s requirements apply. Further, this exemption from CPE reporting must be requested by December 31 of the year a license is set for renewal.

Also worth noting, CPAs not offering services to third parties are exempt from license recertification and CPE requirements. But only so long as they fall into one of the following four categories:

- Retired individuals

- Currently unemployed individuals

- Individuals who have temporarily and willingly left the workforce for an unspecified period of time

- Individuals who are formally listed as inactive members of the AICPA

Exemption waivers can be requested by active members of the AICPA for the following reasons:

- Health issues or complications

- Military service (generally active duty)

- Extreme natural disasters which prevent members from being able to complete CPE requirements (further determined by Board)

- Other similar circumstances which could also prevent a member from completing their CPE requirements

Additional CPE Resources for CPAs

Last Updated:

![How to Earn CPEs [5 Quick Tips]](/wp-content/uploads/2022/06/5-Quick-Tips-for-Obtaining-CPEs.png)