![North Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/North-Dakota-CPA-CPE-Requirements.png)

General North Dakota CPA CPE Requirements

Generally, certifying organizations like the AICPA require CPE for members who want to renew their licenses. Because it is a method for ensuring they stay up-to-date with important industry trends and developments. In the overall picture, it helps licensees offer premium, quality services to whichever industries they serve. However, licensees in each state report to a different Board of Accountancy which sets its own requirements. So, the North Dakota CPA CPE requirements are different from the rules in other places. Consequently, it is important for licensees to know the specific requirements for their location.

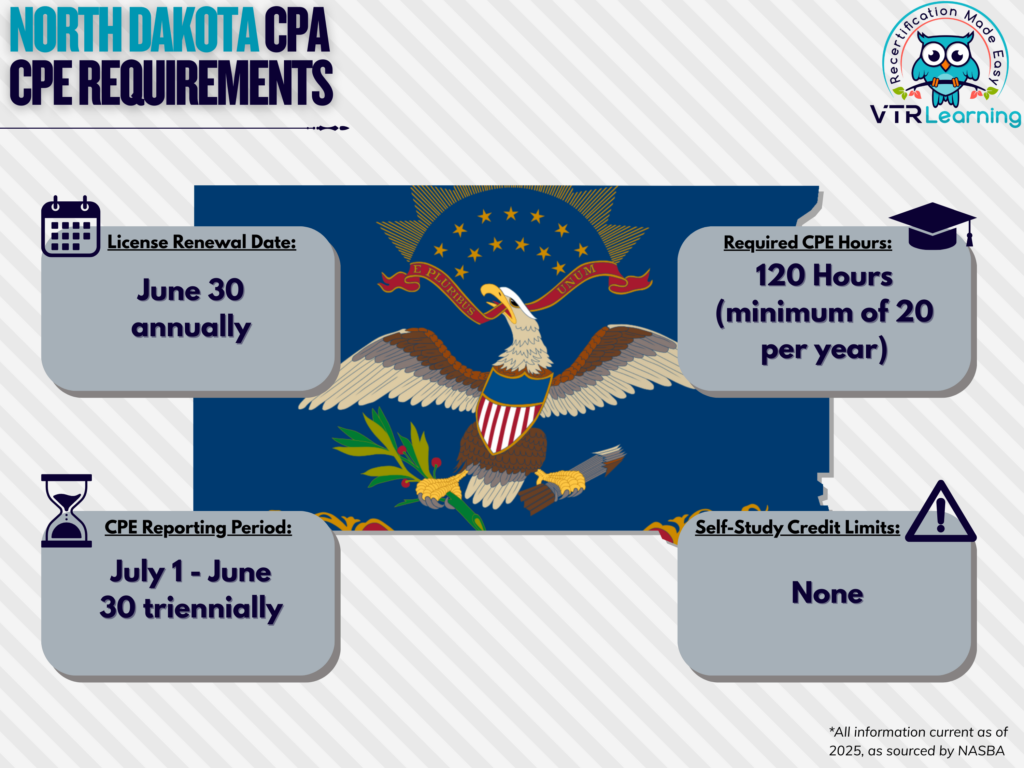

In North Dakota, licensees must earn 20 CPE hours per year over a period of three years. Though, by the end of that period they must have obtained a total of 120 CPE hours. Some of the most important dates and requirements are also listed in the table below.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 annually | July 1 – June 30 triennially | 120 hours | None |

Subject Area Requirements

During each licensing period, CPAs must take at least 6 hours in Professional Ethics. Of course, these hours count toward the full 120 hours requirement. However, there are no further subject area requirements for North Dakotan CPAs.

Credit Limitations and Calculation

CPAs who instruct groups through formal presentations can obtain CPE credit for doing so. Though, repetitious presentations of the same educational material do not qualify for further credit. Credit for teaching in such a setting caps at two times the credit amount available for actually taking the course. And for university instruction, credit also cannot exceed twice the CPE course credit available for those taking the course.

CPAs in college or university courses can claim 15 CPE hours per semester hour of institutional credit. Or alternatively, 10 CPE hours per quarter hour.

Group live, group internet-based, self-study or blended learning is accepted in 0.2 or 0.5 hour increments. Nano-Learning methods can earn partial credit only in 0.2 hour increments.

Other Policies and Exemptions

Non-resident accountants are exempt from the North Dakota CPA CPE requirements. But only if they verify meeting the CPE requirements of their state of residence. Furthermore, the state of residence rules must compare to the North Dakota CPA CPE requirements. This exemption is not applicable for CPA residents of Wisconsin, New York and the Virgin Islands.

CPAs in any of the following categories shall automatically acquire exemption from the general AICPA license renewal requirements. Though they must not offer their services to any third parties:

- Retirees

- Currently unemployed members

- Members who have chosen to temporarily leave the workforce

- Members who have willingly listed their organizational status as “inactive”

Active members can also request individual waivers for license recertification requirement exemption for reasons such as:

- Health complications

- Active military service

- Natural disasters

- Other similar circumstances that prevent completion of CPE requirements

Additional Resources for North Dakota CPA CPE Requirements

Last Updated:

![Oklahoma CPA CPE Requirements to Recertify [Updated 2025]](/wp-content/uploads/2021/06/Oklahoma-CPA-CPE-Requirements.png)

![Massachusetts CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Massachusetts-CPA-CPE-Requirements.png)

![Missouri CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/04/Missouri-CPA-CPE-Requirements.png)