![Texas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Texas-CPA-CPE-Requirements.png)

Overview of Texas CPA CPE Requirements

As a CPA, CPE is one of the main parts of the license renewal process. But individual Boards of Accountancy are in charge of setting the state requirements. So, the specifics typically change from one place to another. For example, the Texas CPA CPE Requirements are different from those in other states. Consequently, CPAs need to stay up on the license renewal requirements for their state. Because this will help make the process as simple as possible.

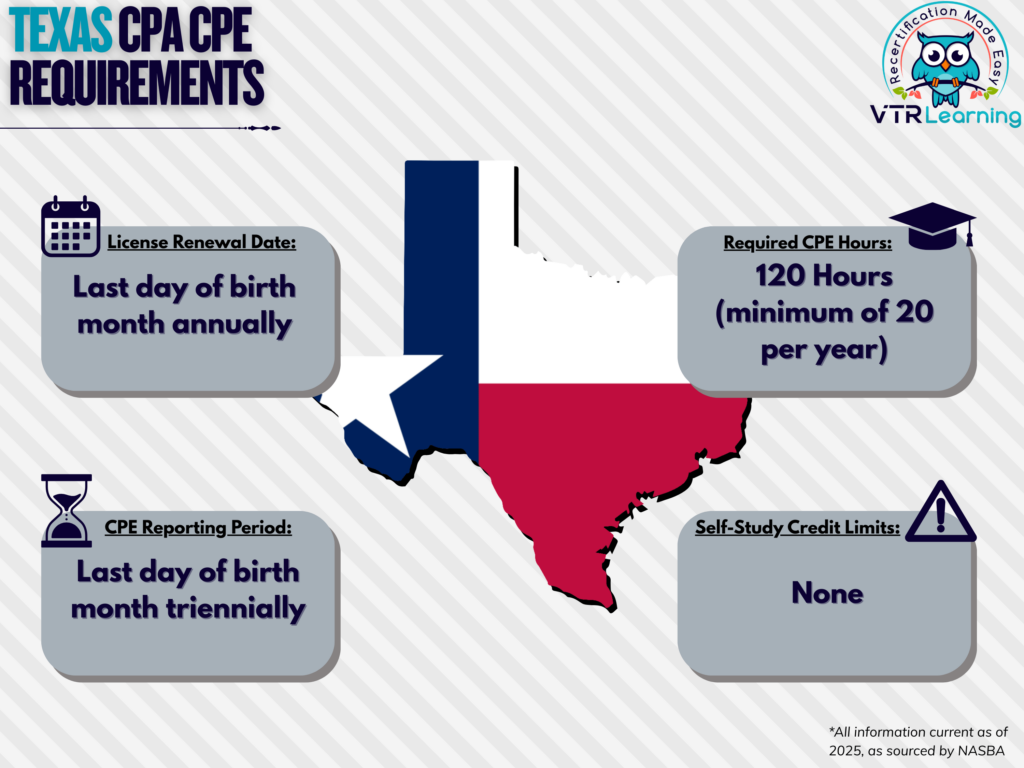

In Texas, CPAs renew their licenses ever three years, completing 20 CPE hours each year. Overall, they must obtain 120 hours during the renewal period. The table below highlights some of the primary limitations and requirements for CPAs in Texas.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| Last day of birth month, annually | Ends on last day of birth month, over a three-year period | 120 hours | None |

Subject Area Requirements

During each licensing period, CPAs must complete 4 Professional Ethics CPE hours. Furthermore, the licensee must obtain these hours from a provider registered with the Board and certified to provide them. However, there are no other CPE subject area requirements.

Credit Limitations and Calculation

Individuals who are instructors in a formal setting can receive up to 20 hours per year of CPE credit. However, the Board will not accept instruction of an introductory level college course as a method. Qualifying opportunities earn credit equal to three times the presentation length. But this is only the case if the material has been altered or changed. Overall, multiple instances of instruction shall receive proportionate CPE credit.

CPAs enrolled in a college or university course have the right to claim CPE credit hours equal to 15 CPE hours per semester hour or 10 CPE hours per quarter hour of that course.

Authoring instructional material related to subjects in Accounting is another method for earning CPA CPE. However, the licensee must have published the material in order to receive credit. There is a 10-hour maximum per year limit for those who choose to utilize this method. This stipulation includes reviewers of published books and articles.

It is possible for Texas CPAs to earn CPE by completing other certificate programs. However, there is a 50% maximum during any given three-year reporting period. This includes certifications or designations such as Certified Financial Planner, Certified Internal Auditor, Certified Fraud Examiner, other financial certifications and/or financial securities licenses.

Nano-Learning and Self-Study

Nano-learning opportunities can earn 50% of the required hours for a reporting period. But for this method, a passing grade must be 100%. Furthermore, one-fifth credit hour increments are the only permissible amounts for these opportunities.

The limit on non-technical courses is 50% of the maximum hours required.

For live and blended learning programs, a maximum of one full credit must be awarded initially. But after obtaining the first full credit hour, credits may be earned in one-fifth or one half increments. And for self-study, a minimum of one-half credit must be awarded initially. However, after obtaining the first full credit hour, individuals can earn credits in one-fifth or one-half credit hour amounts.

Other Policies and Exemptions

A non-resident licensee may fulfill Texas CPA CPE requirements by meeting the CPE requirements of their main place of business. But, if the place of business has no CPE requirements, the licensee must meet Texas’ CPE requirements.

Credit hours earned from sources other than registered sponsors should be submitted on the appropriate form. There, licensees must justify the reason for claiming CPE credit hours. And this includes listing the benefit to the licensee or their employer. Furthermore, individuals may not claim more than 50% of their hours from non-registered sponsors in any recertification period.

Some CPAs are automatically exempt from their license renewal requirements. But this is only so long as they don’t offer services to other parties.

- Retirees

- Unemployed licensees

- Those who have temporarily left the workforce

- Inactive members

Furthermore, active members of the AICPA have the option to request a waiver for CPE requirements. The reasons include:

- Health issues

- Military duty

- Large natural disasters

- Other like circumstances

Additional Resources for Texas CPA CPE Requirements

Last Updated:

![Georgia CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2021/03/Georgia-CPE-Requirements.png)

![Puerto Rico CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/Puerto-Rico-CPA-CPE-Requirements.jpg)