![Georgia CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2021/03/Georgia-CPE-Requirements.png)

Georgia CPE Requirements for CPAs

CPE is an important part of keeping knowledge and skills on par with industry standards. Especially in an uncertain business climate. So, it’s clear why organizations like the AICPA require it. However, since a Board of Accountancy oversees each state, rules typically vary from one place to another. As such, the Georgia CPE requirements differ from those of other places. Of course, this can also make the license renewal process more difficult than it needs to be. So, it’s important for CPAs to stay up-to-date with their state requirements.

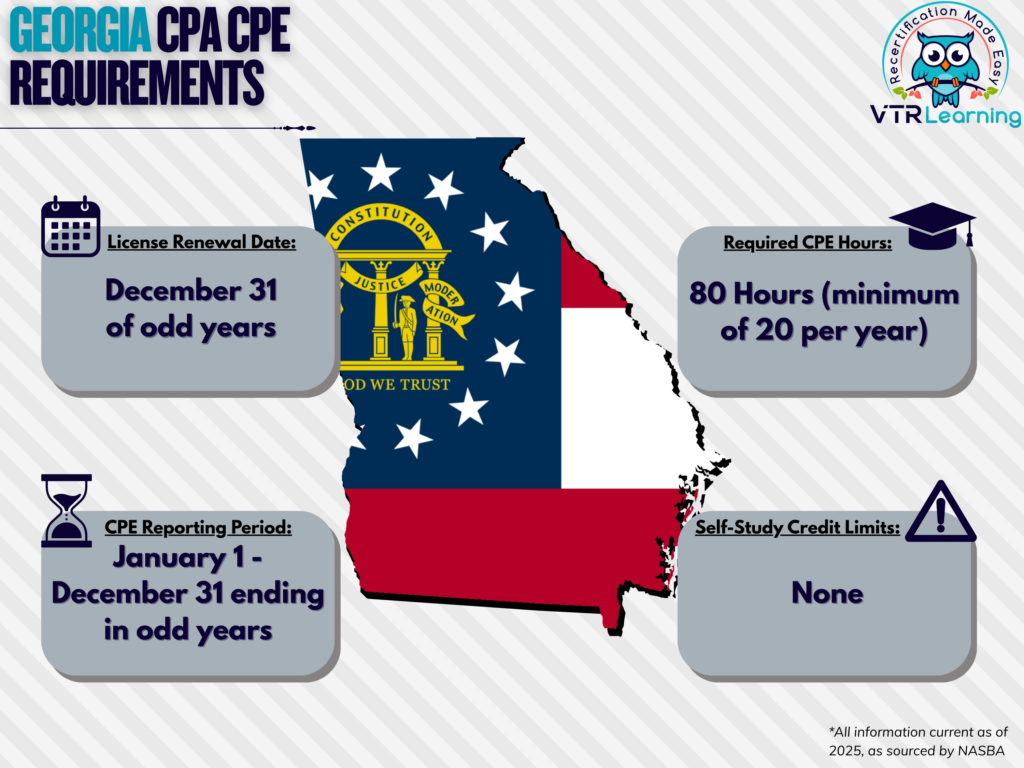

Georgia AICPA members should renew their license every two years. And during that time, they must complete at least 80 hours of CPE. They also have to earn a minimum of 20 hours each year. The table below further shows the primary deadlines and limitations for CPAs in Georgia.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 biennially in odd years | January 1 – December 31 biennially in odd years | 80 hours | None |

Subject Area Requirements

Each renewal period, CPAs must earn at least 40 credits in technical areas, 4 credits in ethics, and 1 credit in Georgia-specific ethics.

Credit Limitations and Calculation

It is possible for CPAs to earn credit through formal instruction or presentation. Here, credit equals presentation plus prep time. However, prep time must not exceed twice the length of presentation. And furthermore, the Board will not award credit for repeat instruction of the same material during one renewal period.

Up to 15 CPE hours per semester hour can be earned through college or university courses. And CPAs can also earn 10 CPE hours for participating in a quarter hour university course. Furthermore, CPE credit can be earned with non-credit university courses, equaling one CPE credit per hour of classroom time.

CPE credits are also available for authoring and publishing instructional material. However, this method is limited to 50% of the required hours.

Generally, committee meetings do not represent a method of continuing education acceptable to the Georgia Board. However, if a meeting was part of work led by a technical committee, CPAs could earn up to 25% of their total hours.

Technical review for courses is acceptable for up to 50% of the maximum required credits during a reporting period.

CPE blended learning credits are acceptable if the program is measurable as per Board policies.

Credits can be obtained in half-hour increments as long as the first full hour has already been earned.

There are no limitations or requirements for self-study CPE credit methods.

Other Policies and Exemptions

CPAs who earn their license during the second year of any reporting period become exempt for the requirements of that reporting period. Those who earn their license during the first year of the reporting period must meet a 40-hour requirement, with 20 credits during the second year minimum and at least 20 technical credits.

Furthermore, CPAs may carry a maximum of 15 credit hours from one renewal period to the next period. Carried hours cannot be used to meet the yearly minimums or accounting and auditing requirements.

Any licensee who has turned 70 years old is exempt from the CPE requirements for license renewal. CPAs in any of the following categories will also be exempt from license renewal requirements. Though they may not offer professional services to any parties.

- Retirees

- Currently unemployed licensees

- Those who have temporarily left the workforce

- Members who have formally listed their status as “inactive”

Individuals can also request waivers for exemption for the following reasons, though they are subject to Board approval:

- Health issues

- Military service

- Extreme natural disasters (further up to Board discretion)

- Other similar situations (also subject to Board determination)

Additional Resources for Georgia CPE Requirements

Last Updated:

![Alaska CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/Alaska-CPA-CPE-Requirements.png)