![New Jersey CPA Requirements [Updated 2025]](/wp-content/uploads/2020/11/NJ-CPA-CPE-Requirements.png)

Overview of NJ CPA CPE Requirements

CPE is one method which the AICPA uses to ensure its members stay up with important changes in the industry. However, the process is easily confusing to individual CPAs who don’t understand their state regulations. Since local Boards are responsible for determining the specific state requirements for licensure, no two have exactly the same conditions. So, the NJ CPA CPE requirements might differ greatly from another state’s.

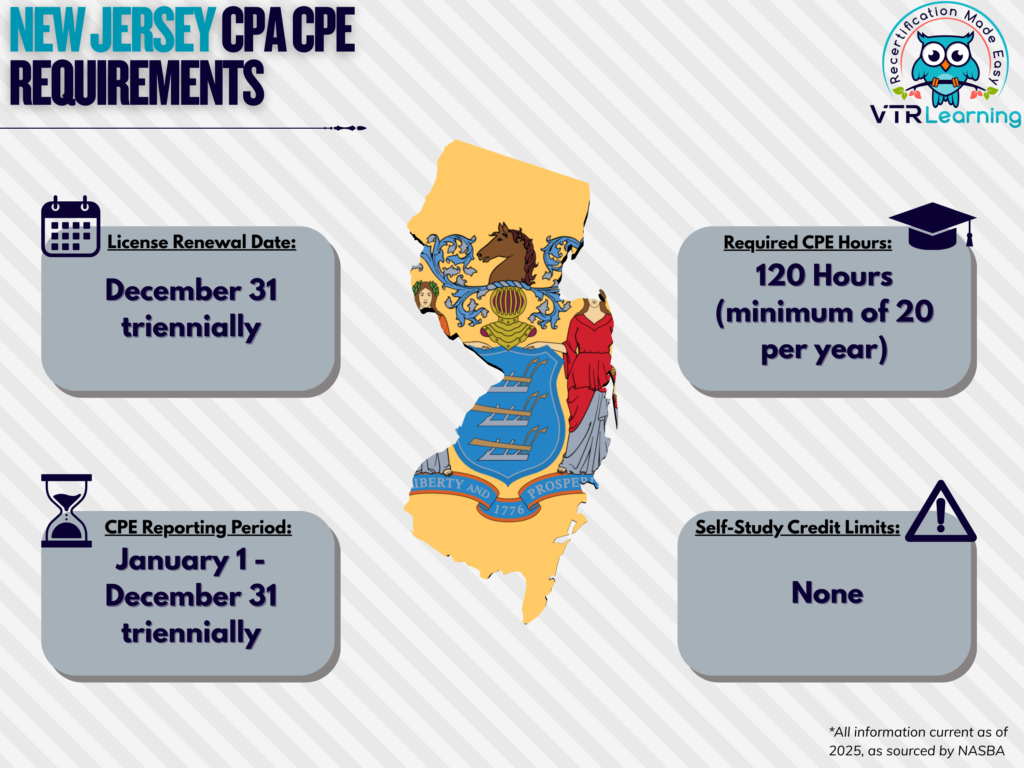

In effect, New Jersey CPAs must renew their licenses every three years. They also must complete 20 hours of CPE per year. However, by the end of the license renewal process, they must have completed 120 hours total. The table below further highlights information on NJ CPA CPE requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 triennially ($135 fee) | January 1 – December 31 triennially | 120 hours | None |

Subject Area Requirements

During each renewal period, CPAs should take 4 hours of subjects dealing with New Jersey law and ethics. The Board must also have approved the courses or methods, which count toward the total 120 credits required. Individuals must also complete 60 hours of CPE in technical subjects. Acceptable topics include Accounting, Auditing, Business Law, Computer Science, Economics, Finance, Management Advisory Services, Mathematics, Statistics, SEC Practice, Taxation and Professional Ethics. Also note that any of these subjects may be in specialized industries. Finally, licensees must also complete 24 hours in Auditing, Review and Compilation each recertification period. However, this requirement only applies if the licensee engages in public accountancy or attestation functions.

Credit Limitations and Calculation

CPAs who give formal presentations or instruct educational sessions can obtain up to 60 hours of CPE. However, anyone employed as an instructor or discussion leader on a full-time basis cannot obtaining credit through these methods. Here, credit equals presentation time plus preparation, where preparation is twice the length of presentation. But repeated instruction of the same material within the same year is not acceptable. Although, repeat instruction after one year may be applicable for obtaining further credit. Also, this only applies if the presenter substantially alters the subject material.

CPAs participating in college or university courses also have the option of claiming CPE credit. But the courses in question must be in technical subject areas. For acceptable courses, credit equals 15 CPEs per semester hour. Likewise, quarter hour courses are worth 10 CPEs. And minimally, 1 CPE hour is provided per non-credit classroom hour.

It is also possible for authors of instructional or educational material to obtain CPE credit. However, this only applies for published material. And credits for this method may not exceed 30 each renewal period.

Courses related to the development of a licensee’s practice or the marketing of services are not applicable. So, licensees will not receive credit for such instances.

Licensees can obtain up to 60 hours of CPE credit for technical or peer review program committee participation.

Self-Study, Blended Learning, and Nano-Learning Limitations

Self-study, blended learning and nano-learning sponsors must be registered with NASBA. Otherwise, completed courses will give no CPE to licensees. Self-study credit opportunities can provide 0.5 credits prior to the completion of the first full credit. But after the first full hour has been earned, in increments of 0.2 or 0.5. Blended learning credits are also acceptable in 0.2 or 0.5 increments after the first full hour has been obtained. However, nano-learning credits are obtainable in 0.2 credit amounts at any point.

For all other methods, CPE is obtainable in half-credit amounts, but only after completing the first full hour.

Other Policies and Exemptions

The following program sponsors are exempt from registering with the New Jersey Board of Accountancy:

- Accredited universities or colleges

- National and state professional organizations

- Federal and state governmental agencies

- Sponsors registered with NASBA

Some CPAs are also automatically exempt from AICPA license renewal requirements. But to meet this criteria, they must not offer their services to any third parties.

- Retirees

- Any unemployed individual

- Those who have temporarily left the workforce

- Members formally listed as “inactive”

However, it is also possible for members to request exemption waivers for reasons such as but not limited to:

- Health

- Military active-duty

- Extreme natural disaster, though subject to Board determination

- Other similar circumstances also determined by the Board

Additional Resources for NJ CPA CPE Requirements

Last Updated:

![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)

![PA CPE Requirements for CPA License Renewal [Updated 2025]](/wp-content/uploads/2021/05/PA-CPE-Requirements.png)

![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)