![PA CPE Requirements for CPA License Renewal [Updated 2025]](/wp-content/uploads/2021/05/PA-CPE-Requirements.png)

The Basic PA CPE Requirements for CPAs

Most CPAs are aware that the AICPA tasks state Boards with setting CPE requirements. And since each location has its own stipulations, it’s important for individuals to know what they are. In effect, licensees in Pennsylvania need to understand the PA CPE requirements specifically. Otherwise, the license renewal process could become unduly complicated.

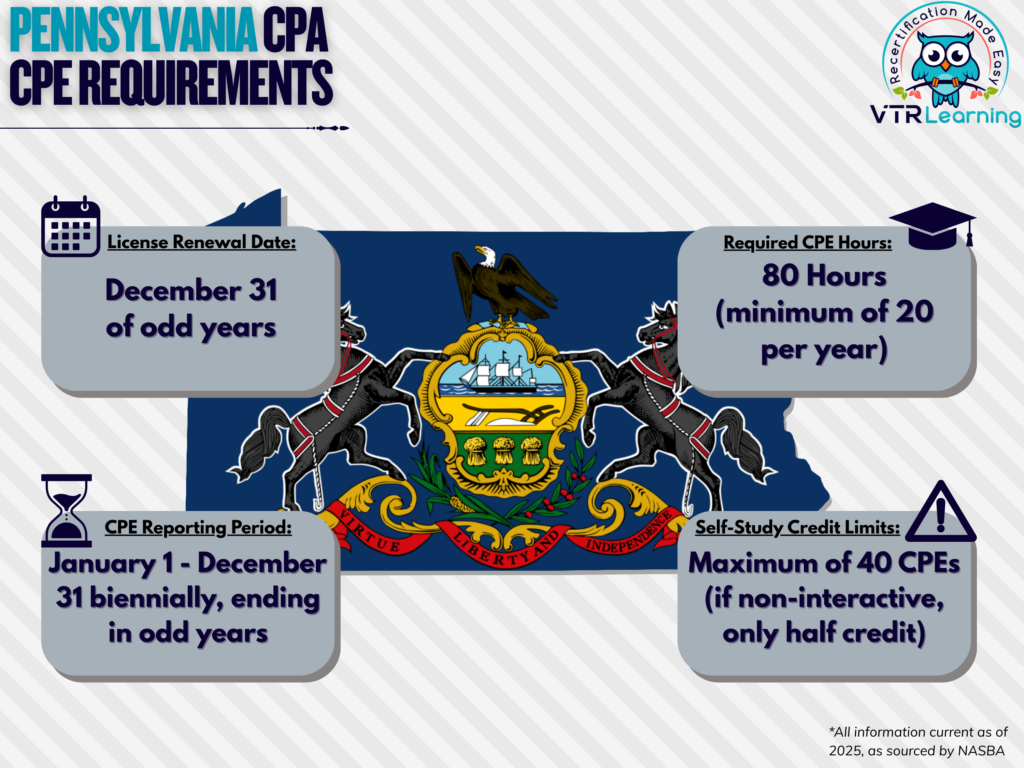

Essentially, members living in Pennsylvania must renew their license every two years. And they need to complete at least 20 hours of CPE each year. However, for the overall requirement, they must complete 80 hours of CPE. The chart below offers further details on the requirements for licensees in Pennsylvania.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 on odd-numbered years | January 1 – December 31 biennially, ending on odd-numbered years | 80 hours | Maximum of 40 hours (half credit if delivery method is non-interactive) |

Subject Area Requirements

Licensees in Pennsylvania must complete at least 4 hours of CPE related to Professional Ethics during each recertification cycle. These hours also count toward the total 80-hour requirement. Furthermore, individuals must take 24 hours of CPE courses specifically related to Accounting and Auditing subjects during the same time period.

Credit Limitations and Calculation

CPAs who offer formal instruction opportunities or present on relevant information can obtain up to 40 hours (50%) of the total required hours during each recertification period through these methods. However, no repetitive presentations will be granted credit unless the subject material has been altered substantially. Furthermore, entry-level accounting courses cannot count as instruction credit. When calculating, credit for this method is equal to 3 CPE hours per 50 minutes of presentation time. CPAs should also recognize that preparation time cannot exceed 2 credit hours.

CPA members who are currently taking college or university courses from an accredited institution can receive CPE credit hours:

- 15 CPE hours per semester hour

- 10 CPE hours per quarter hour

- 1 CPE hour per 50-minutes of classroom time in a non-credit university course

Credit is also available for authors who have published relevant information in educational or instructional mediums. However, this type of credit cannot exceed 20 hours per instance on a self-declaration basis. And the maximum amount allowed for all publications combined is 40 (50% of the maximum). Self-study, if used as a recertification method, is combined with publication credit and also has a limit of 40 credit hours. If the delivery method for self-study credit is non-interactive, only half the full credit amount can be reported.

It is acceptable for licensees to earn credit in half-hour increments once the first full hour has been obtained.

Other Policies and Exemptions

Licensees in the following categories do not have to complete CPE requirements. They are automatically exempt from the process, as long as they refrain from offering their services.

- Retirees

- Currently unemployed

- Temporarily and intentionally apart from the workforce

- Formally listed as “inactive” with AICPA

For members who do not fall into the above categories and who need exemption to the rule, the following categories describe legitimate reasons for requesting waivers from the Board:

- Health issues

- Military responsibilities

- Natural disaster

- Other similar circumstances

Additional Resources for PA CPE Requirements

Last Updated:

![Texas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Texas-CPA-CPE-Requirements.png)