![Nevada CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Nevada-CPA-CPE-Requirements.png)

Overall Nevada CPA CPE Requirements

Generally, CPE is the means by which the AICPA endorses its members for continued licensure. Because it helps strengthen a CPA’s existing skill set while also affording them new knowledge and abilities. However, CPE doesn’t come without drawbacks, the largest of which very well might be confusion. Members of the AICPA answer to state Boards of Accountancy. And furthermore, each state has its own regulations and requirements for obtaining CPE credit. So, the Nevada CPA CPE requirements might vary heavily from other states’. As a result, if CPAs don’t know their specific state requirements, the license renewal process can become frustrating.

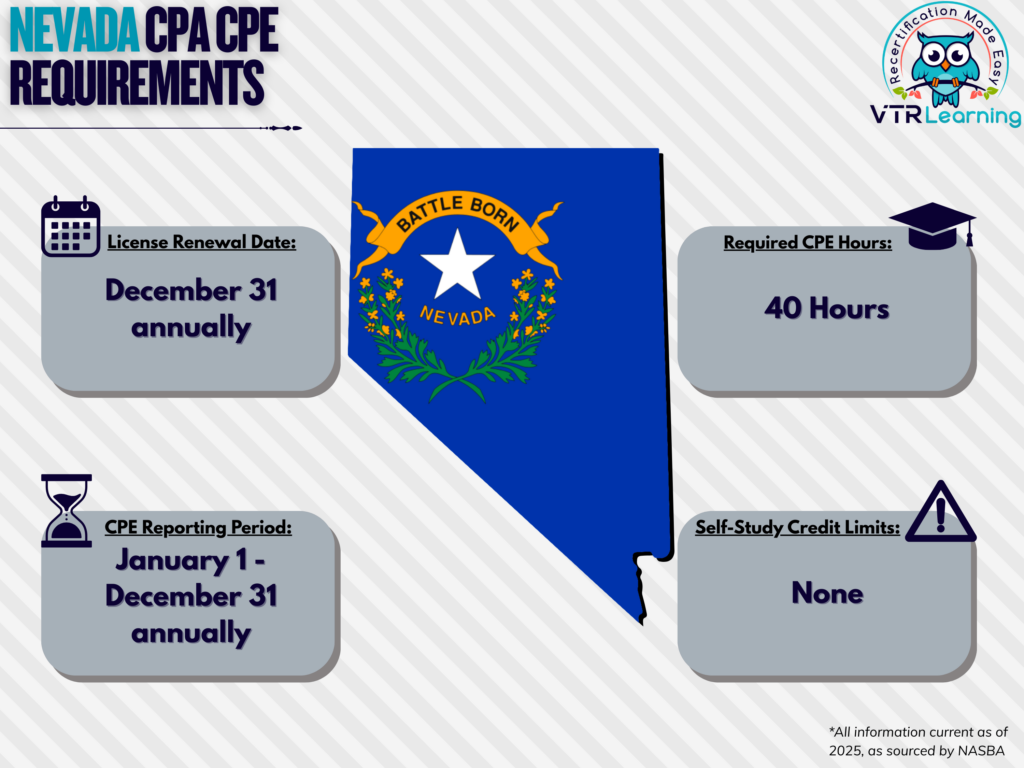

Overall, Nevada-based licensees have to renew their license every year. They also must complete 20 CPE hours each year and 80 hours every recertification period. The below table further showcases the primary recertification limitations and deadlines for certified public accountants in Nevada.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 annually | January 1 – December 31 | 40 hours | None |

Subject Area Requirements

At least 2 hours must be from subject areas dealing with Professional Ethics during each year. CPAs must also complete 8 hours in Accounting and Auditing during the year in which they planned, directed or performed a substantial portion of work or reported on an audit, review, full disclosure compilation or attestation service of a non-governmental agency.

Credit Limitations and Calculation

Instruction or presentations in a formal, educational setting can be counted toward the CPE requirement for license renewal. But credit for preparation may not exceed twice the length of the presentation. Further, repeat instruction during one year is only accepted if the material has been substantially altered or changed. Furthermore, the Board must have approved the revisions.

CPAs enrolled in a college or university course can also obtain CPE credit hours. Generally, this credit equals 15 CPE hours per semester hour or 10 CPE hours per quarter hour. Though non-credit courses accrue CPE at a rate of 1 CPE hour per qualifying classroom hour.

The Board also allows instances of technical review for CPE credit. Though this method is claimed with the understanding that it is time spent reviewing CPE program materials.

Overall, Nevada has no limitations on self-study CPE opportunities.

Credit for continuing education can accrue in increments less than 1 credit at a time for partial credit.

Other Policies and Exemptions

If an applicant for the renewal of a permit to engage in the practice of public accounting is permitted, certified or licensed to engage in the practice of public accounting in another state and resides in that state, the applicant must demonstrate compliance with the continuing education requirements of that state. If the state in which the applicant resides does not have continuing education requirements, the applicant must instead comply with the requirements of Nevada.

Licensed CPAs who are not actively providing their services to third parties are automatically exempt if they are also:

- Retired

- Currently unemployed

- Temporarily removed from the workforce

- Formally “inactive” with AICPA

Waivers for active members whose services are actively employed can be requested because of:

- Health problems

- Active-duty military service

- Extreme natural disasters (further determined by Board)

- Other similar, Board-approved circumstances (also determined by the Board)

Additional Resources for Nevada CPA CPE Requirements

Last Updated:

![West Virginia CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2022/02/West-Virginia-CPA-CPE-Requirements.png)

![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)