![West Virginia CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2022/02/West-Virginia-CPA-CPE-Requirements.png)

Overview of West Virginia CPA CPE Requirements

Generally, CPE isn’t something business professionals necessarily look forward to. Because it can take quite a bit of time, money and energy to complete. However, it’s a necessary part of membership with organizations like the AICPA. After all, continued learning provides the foundation for professionalism and expertise. But especially for CPAs, what complicates the matter further is that different Boards oversee each state. Consequently, the West Virginia CPA CPE requirements differ from those in other locations. So, it’s important for licensees to know the individual state requirements.

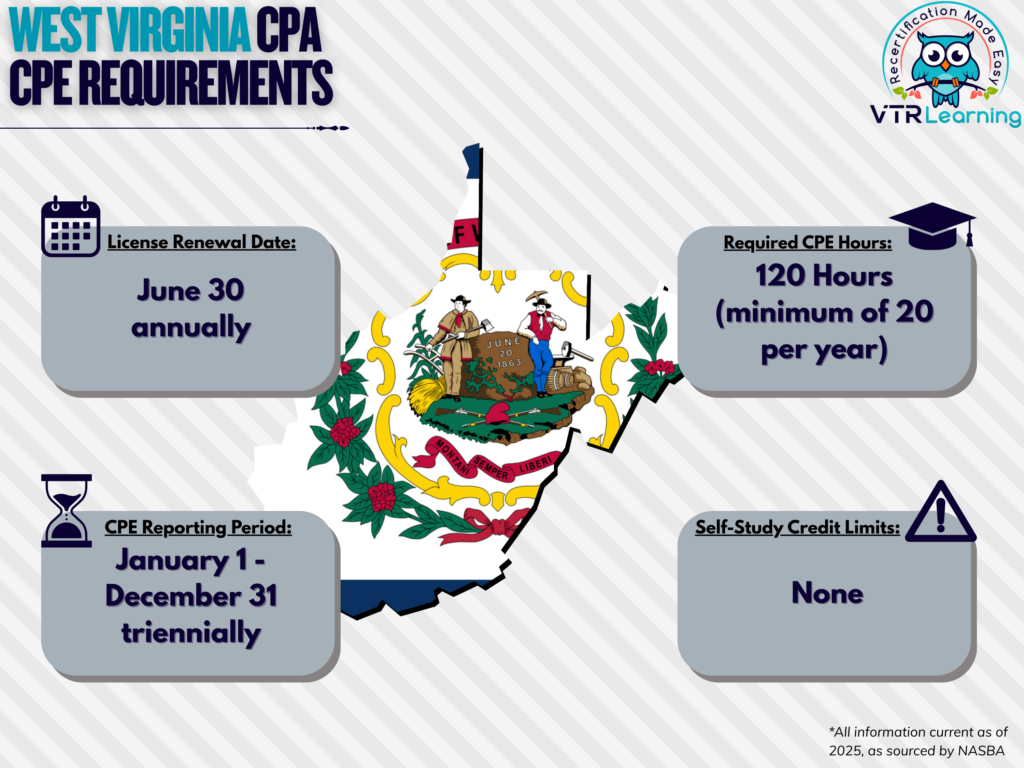

Overall, CPAs in West Virginia must renew their licenses every three years. And furthermore, during that time they must complete at least 120 CPE hours, with no less than 20 per year. The table below provides more information on the general West Virginia CPA CPE requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 annually | January 1 – December 31 over a three-year, rolling period | 120 hours | None |

Subject Area Requirements

Every recertification period, CPAs in West Virginia must complete at least 4 hours of ethics related CPE. The Board must also have approved the chosen course or activity. However, the CPE hours do count toward the 120 minimum for recertification.

Credit Limitations and Calculation

In West Virginia, CPAs can provide formal instruction or presentations to earn up to 60 CPE credits per renewal period. Although, repetitious presentations of the same material will earn no further credit unless significantly altered. For the first instance of instruction, teachers receive two additional CPE study hours for each hour taught. For instance, a total of three hours for each actual hour taught in a presentation. However, licensees receive half credit for each hour spent teaching tax courses to VITA volunteers. And furthermore, credit is not available for attending or teaching courses related to principles of accounting.

CPAs can also obtain credit for active enrollment in college or university courses. Here, each semester hour equals 15 CPE credits, and each quarter hour equates to 10 CPEs.

Authorship and publishing of instructional or education material also represents a viable method of CPE in West Virginia. However, the credit must not exceed 60 per instance of publishing.

The Board will accept blended learning credit so long as the amount falls within the current rounding rules. However, it will not award credit for any course or program less than 1 CPE hour (50 minutes) in length.

There are no stated limits on self-study credit opportunities.

Other Policies and Exemptions

Any providers who offer more than 16 CPE hours must register with NASBA’s National Registry of Sponsors. However, those offer fewer than 16 CPEs may instead register with the Roster Program.

Non-resident licensees may meet the West Virginia CPA CPE requirements by demonstrating compliance with those of their home state. However, if that state has no CPE requirements, the licensee must meet the West Virginia Board’s rules. Furthermore, the state of residence must have CEP standards considered equivalent to those of West Virginia.

Some CPAs are automatically exempt from the CPE requirements in West Virginia. However, they must not offer any services to outside parties. These include:

- Retired licensees

- Any member currently unemployed

- Those who have temporarily left the workforce

- Anyone formally “inactive” with AICPA

Furthermore, waivers are available upon request for active CPAs who require exemption. Potential reasons include but are not limited to:

- Health complications

- Military service or active duty

- Natural disaster (subject to Board discretion)

- Other similar circumstances (also determined by Board)

Additional Resources for West Virginia CPA CPE Requirements

Last Updated:

![Wisconsin CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Wisconsin-CPA-CPE-Requirements.png)

![Massachusetts CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Massachusetts-CPA-CPE-Requirements.png)