![How to Get CPE Credits from Home [4 Methods]](/wp-content/uploads/2020/07/How-to-Get-CPE-Credits-from-Home.png)

How to Get CPE Credits for CPA License Renewal from the Comfort of Your Couch

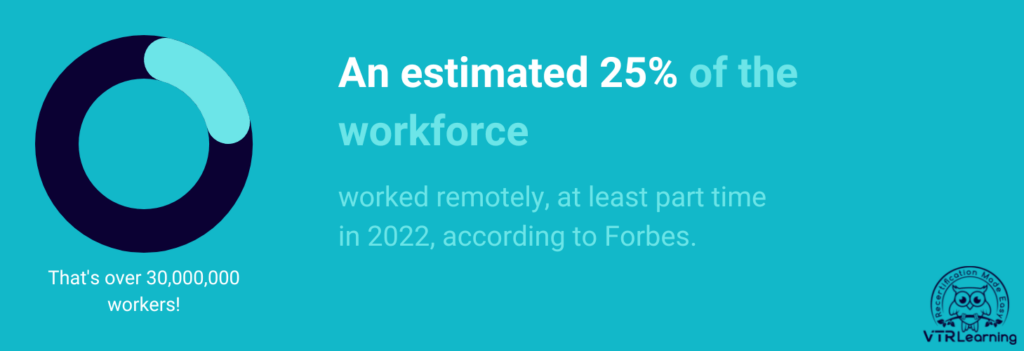

Even before the onset of the COVID-19 pandemic, there was a large shift toward virtual, learning opportunities. According to the Brookings Institute, over seventy-five percent of schools in the U.S. used online education methods during the 2018-2019 school year. Undoubtedly, COVID has sped up the adoption process for fully virtual programs. However, it has not been the sole cause. And furthermore, this shift doesn’t apply to the primary education sphere alone. In fact, the growing popularity of remote work clearly demonstrates this idea. The American Psychological Association estimated that in 2019, more than 26 million Americans worked from home at least part of the time. That’s more than sixteen percent of the workforce. So, it makes sense that business professionals might want to know how to get CPE credits from home as well.

Membership with organizations like the AICPA carries a large CPE requirement, generally over three years. And of course, CPAs can obtain these hours by attending conferences and other live events. However, online self-study CPE options might work better for busy professionals.

How to Get CPE Credits Remotely

The Benefits of CPA CPE Online Courses

VTR Learning is one provider of online CPE courses registered on NASBA’s National Registry of CPA Sponsors. This status guarantees every VTR Learning course offered for CPAs is acceptable for obtaining self-study CPE credit. Moreover, all from the comfort of home, and at a pace that works around any busy schedule.

The array of courses includes both technical and nontechnical subjects, such as Accounting, Human Resources Management and Leadership. And they also offer a wide range of credit amounts — from 1 to 28.5 CPEs apiece. But unlike other online provider options, VTR Learning sells courses individually, on a pay-as-you-go basis. Void of a subscription fee, the wide range of CPE counts ensures CPAs never pay for more than needed.

Earning CPE credits online with VTR Learning is a simple matter. CPAs can browse the list of courses in the shop. And once they’ve found one that meets their needs, add it to the cart, check out and start learning. Once they finish the course, they receive a certificate of completion. This includes the activity ID necessary to receive the CPE credit due.

Live Stream Industry Events & Conferences

Self-study courses might make up a large portion of online opportunities for earning CPA CPE. However, they’re not the sole option. Many conferences and events normally geared toward live attendance have added alternative options for live virtual viewing. And this feature also has the potential to reduce the cost of attendance. For example, it eliminates several significant fees including transportation, rooming, and food. However, it is not limited to these three, as there are other costs for live attendance events.

These types of online options are not new to the industry, though. AICPA has been offering virtual conference opportunities for over a decade. And now, it offers a large selection of online events each year. But the current pandemic is still affecting the safety of hosting live events. So, virtual options are more of a need than a want right now.

AICPA conferences take place all throughout the year, and vary significantly in terms of cost and CPE credit amounts. For example, the Private Foundation Summit costs $405 and grants 8 to 14 CPEs, even with online options. However, the HFMA Annual Conference is worth 14 CPEs for $1,699. So, depending on the event details, even online options can be extremely expensive for the amount of credit obtained.

Notably, the AICPA is not the sole provider of online conferences and events. In fact, many state organizations and local chapters also host learning activities.

When calculating and submitting credits from conferences and other virtual events, the process is similar to self-study options. CPAs must provide documentation to their state Board in order for it to qualify for CPE credit.

Webinars

Webinars work much the same way as virtual conferences do. However, the length, cost and credit amount generally seem to be less. For example, conferences often last multiple days and include several lectures. But webinars often cover a single topic and take place within a matter of hours. The AICPA site offers a list of available webinars, many of which fall between 2 and 8 CPE credits.

Once again, credit calculation is handled by the individual CPA’s state Board. So, the webinar must be reported alongside all other CPE hours when that licensee applies for renewal.

How to Get CPE Credits While Contributing to the Profession

Self-study online courses, conferences and webinars are potentially the easiest methods for obtaining CPE credit. But remote opportunities go far beyond these options. Most Boards usually allow credit for instruction, authorship and university programs. Much in the same vein as the previous CPE methods, these alternatives are fully possible in remote settings.

Instruction is formal presentation over educational information and material. Here, CPAs gain credit not only for the actual instruction time but also for the time spent in preparation. This relies on the assumption preparation has helped contribute to the CPA’s competency. And further, that it has also enhanced the quality of their technical knowledge.

Authorship is a great option for CPAs practicing strict social distancing guidelines. Because it is often a solitary task best undertaken in the quiet atmosphere of a home. That is, it’s sometimes difficult to write educational or instructional material when consistently interrupted in an office workspace. One caveat to this method of CPE is that the licensee must have published the work to count toward renewal.

Many colleges and universities around the United States still offer remote options for students. And in many states, Boards will allow CPE credit for active participation in above-basic courses dealing with Accounting, Auditing, Taxation and so on. This type of participation, if remote, is another helpful option for obtaining continuing education credit online.

Modern technology has made it possible to conduct audits and firm reviews electronically. So, auditors might never have to set foot in the physical space of a company or organization. Furthermore, many states allow audits to count toward CPE goals. Because of this possibility, instances of audit, peer review, and system review classify as remote CPE opportunities.

Find Your State CPE Requirements

If you’re unsure what methods your state Board considers acceptable for CPE, make sure you find your area’s specific rules. In fact, you could probably benefit from our ultimate guide to CPA recertification. And if you’re still feeling uneasy after that, don’t worry – we have five quick tips for earning CPE.

Last Updated:

![How to Become a CPA [State Exam Requirements]](https://assets.vtrlearning.com/wp-uploads/2024/09/Understanding-How-to-Become-a-CPA.png)

![Oklahoma CPA CPE Requirements to Recertify [Updated 2025]](/wp-content/uploads/2021/06/Oklahoma-CPA-CPE-Requirements.png)