Calculating the Cost for CPA CPE License Renewal

When it comes to continuing education, the automatic response seems to be a sense of distaste that wavers between two unwanted costs: time and money. But for members of organizations like the American Institute of Certified Public Accountants, continuing education is a nonnegotiable. At least, so long as the licensee wants to keep practicing their craft. In order to maintain their designation, CPAs generally have to take 120 hours of continuing education per three-year period. Unfortunately, that doesn’t come cheap. However, calculating the exact cost for any particular licensee is difficult, because there are a combination of factors which can alter the overall price. For example, organization, location, preferred continuing education method, state limitations and more. So, in many cases, asking, “How much does CPA CPE cost,” amounts to a jigsaw puzzle of strangely-shaped pieces that somehow have to fit together.

However, if you separate the pieces into their own, specific piles, the overall picture becomes clearer. And it’s easier to recognize which pieces need to fit where to take the best path forward.

In order to begin separating the pieces, you must first determine some concept of the categories. When looking at the recertification process, there appear to be at least three main areas of cost:

- Cost of Continuing Education (Preferred Method)

- CPA Membership Renewal Costs

- CPA State Registration Fees

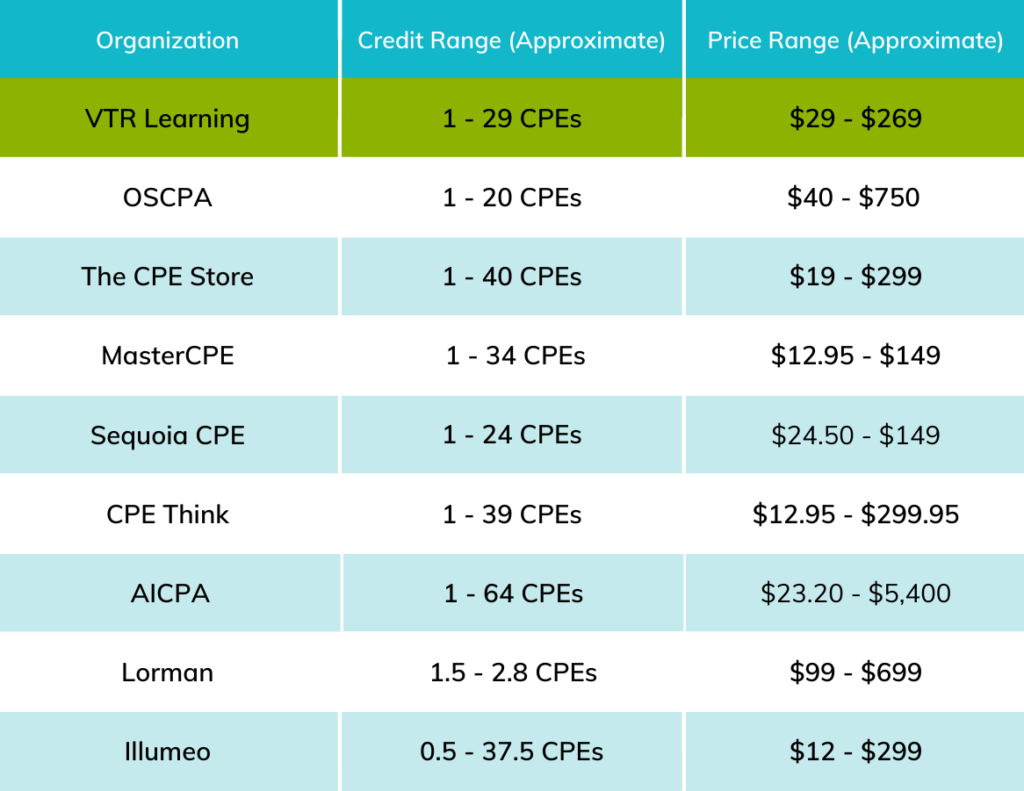

Compare the Costs of Different CPA CPE Online Course Providers

The cost of CPA CPE is exactly what it sounds like: the amount an individual must pay for learning activities that afford credits for completion. Broadly speaking, this category is likely to be the most expensive for the entire recertification process. Webinars and conferences can easily cost hundreds if not thousands of dollars. And though individual online, self-study courses generally come somewhat cheaper, it can still be costly to purchase multiple courses.

As seen by the table below, there are many providers of online CPE self-study courses. Understandably, the prices and methods differ. Some, like VTR Learning, offer pay-as-you-go courses, where a CPA can pay for a course and take it anytime. Here, someone can purchase courses separately and intentionally. However, other providers, like Sequoia CPE, offer virtual subscriptions. Here, an annual payment unlocks the full library of courses for a set period.

One difference between the two types of providers is the proliferation of courses that are worth large amounts of CPE. VTR Learning, for example, has multiple courses worth large amounts of credit. And though the courses must be purchased individually, a single one can cover much of the necessary CPE hours per recertification period. Subscription-type providers often offer a multitude of smaller courses, which are worth one to four credits. That means CPAs may have to take approximately eight to sixteen courses to cover what one larger course could. The table below highlights several prominent providers of online CPE courses, including the credit and price ranges per organization.

Cost for CPA Membership Fees

The CPA membership renewal cost is the price a CPA pays to the AICPA to continue membership. Here, as with the overall cost of recertification, there is no set number, because the cost fluctuates with several factors, primarily industry, role and work status. For example, a sole practitioner in public accounting would pay $475 for membership renewal. Alternatively, an internal auditor in business or industry would pay $285. However, note the aforementioned prices apply to the year 2020, and could change with time. This table is an extremely helpful resource for determining the annual cost of membership for individual CPAs. Because it is hosted by AICPA, it should give accurate information regarding the price for any given year.

CPA License Renewal Fees

The last of the three main cost categories represents the actual cost of renewal, to be submitted to an individual CPA’s state Board of Accountancy alongside the appropriate forms for license recertification. Since each state is regulated by a Board, the fees for license renewal vary with location, so it is important for those seeking recertification to check with their state’s Board website to determine the exact cost.

Cheap CPE Online Courses

Having looked at the cost categories for license renewal, it’s possible to begin trying to put the pieces of the puzzle together. When it comes to AICPA annual membership fees, the price for individual renewal never exceeds $500. And for application and license fees with a state Board, the cost seems to fall between $100 and $300, depending on location. However, as mentioned earlier, the cost for CPA CPE credit can be astronomical in comparison with the other two categories.

Looking at AICPA’s course catalog specifically, there are self-study options worth only one credit, costing between $59 and $109. Even using the low number and calculating to half of what an individual CPA needs per recertification period due to state-specific self-study limitations, it’s possible to spend up to $3,600. To be fair though, it’s extremely unlikely for an individual to take all of their self-study CPE from one-credit-hour courses, and the price is far cheaper for single courses with larger credit worth. For example, AICPA offers another course worth 55.5 CPE credits that costs only $385, so there are available options for obtaining cheap CPE credits for CPAs.

VTR Learning’s highest credit-level course is worth 29 CPEs, and the cost is $234. Comparatively, AICPA offers a 28 CPE hour course for $305, making VTR Learning the cheaper option in terms of price per credit. The difference is even more apparent when looking at courses with fewer credits.

Unlike other providers, VTR Learning has no subscription or membership fee. Each course can be purchased individually, so CPAs get exactly what they want without having to overspend for credits they might not need. You can see a full list of VTR Learning’s cheap CPE credits for CPAs in the shop.

VTR Learning Offers Free CPA CPE Online Courses

Perhaps the most unique aspect of VTR Learning’s style of CPE is that each course is narrative-driven (with the exception of our partner courses). Rather than a series of slides or a recorded webinar, they cast the learner as an intern at a fictional company called Central Products, where they interact with characters and events based on real-life people and situations. Though the learning content largely consists of videos, it also includes readings and quizzes throughout to ensure the learner comprehends the concepts.

Furthermore, it’s worth noting that VTR Learning offers free courses, each worth a small amount of CPE credit, so anyone interested in trying out a different style of continuing education can do so without the financial obligation required by other providers.

For confirmation of VTR Learning’s status as an approved provider of CPE credit, view NASBA’s National Registry of CPE Sponsors.

Find Your CPA CPE State Requirements

None of the pieces of the continuing education puzzle can accurately fit together without understanding the overall license renewal process . For example, some states have a full, three-year recertification, while others have biennial or even annual periods for license renewal. Often, the exact number of required credits depends upon the number of years in between each instance of recertification. Furthermore, there are quotas and limitations on the methods and CPE hours CPAs can take in particular subjects. And if licensees don’t carefully follow the rules, the recertification process can quickly turn disastrous. So, before deciding on any path for completing recertification requirements, CPAs must be aware of what those requirements are.

For more detailed information, see our blog on state-specific requirements for CPA CPE license renewal, including:

- License Renewal Date

- CPE Reporting Period

- Total Number of CPE Hours Required

- Limitations on Self-Study Credits

So, if there is any uncertainty regarding the best path forward when it comes to earning cheap CPE credits for CPAs, understanding your state’s requirements is the best place to begin.

Last Updated:

![Arizona CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/02/Arizona-CPA-CPE-Requirements.png)

![Wisconsin CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Wisconsin-CPA-CPE-Requirements.png)