![Connecticut CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2020/10/CT-CPA-CPE-Requirements.png)

Overview of the CT CPA CPE Requirements

Of course, CPE is an important aspect of maintaining a professional license or designation for CPAs. But it is often confusing and frustrating. Making matters worse, different states also vary on their rules for license renewal. So, the CT CPA CPE requirements won’t look the same as those in other locations. Consequently, licensees need to know the state requirements determined by their Board. Because this will ultimately help to avoid frustration.

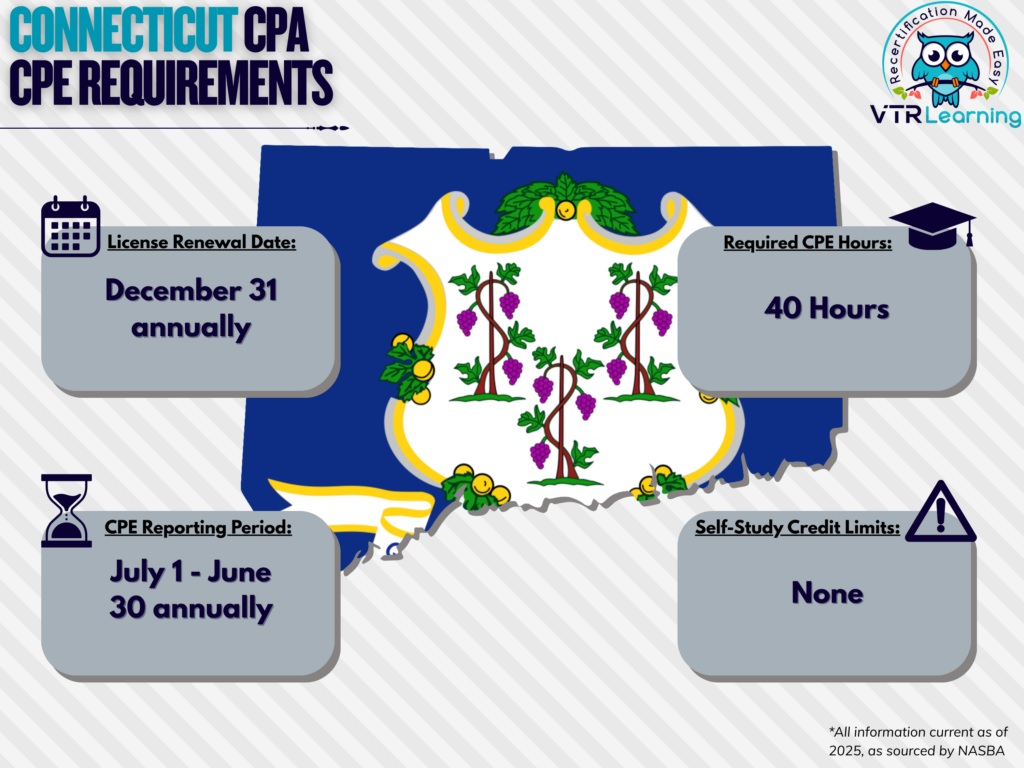

In Connecticut, an individual member must renew their license every year. And during that time, they must complete 40 hours of CPE in order to do so. The table below also shows the primary renewal limitations and deadlines for Connecticut.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 annually | July 1 – June 30 annually | 40 hours | None |

Subject Area Requirements

Each year, Connecticut CPAs must take 4 hours of ethics CPE. Of course, this material should relate to ethical behavior. But it should also cover State and National Code of Conduct, Professional Conduct and State Licensing Regulations.

Licensees must also complete a further 8 hours in the subject areas of attest or compilation services. But only if they sign or authorize another person to sign reports on financial statements on behalf of a firm.

Credit Limitations and Calculation

As per CT CPA CPE requirements, licensees can earn credit by presenting over relevant topics. Of course, this should be in a formal setting. Overall, the maximum credit allowed for instructing CPE programs is 20 hours per renewal period. Though the maximum credit allowed for teaching at an educational institution is 45 hours per reporting period. Repetitious presentations do not qualify unless the presenter has altered the material. Ultimately, credit is equal to presentation and preparation time combined. Though the amount of preparation cannot surpass twice the presentation length.

CPAs in graduate-level university courses can claim 15 CPE credit hours for each hour of a semester course. They can also claim 12 hours for each credit hour of a trimester course and 10 for each hour of a quarter course. Furthermore, for undergraduate courses, CPE accrues in 7.5 hour increments for each hour of a semester course. Also, 6 hours for each hour of a trimester course and 5 hours for each hour of a quarter course.

CPEs may obtain no more than 10 hours per reporting period from a combination of group programs not presented by a qualifying CPE program sponsors. This also includes technical sessions at meetings of recognized national and state accounting organizations and their chapters.

Credit can also be obtained for authoring and publishing educational material. But the maximum credit for articles and books is 10 hour per publication. Further, credit may not exceed 40 hours per renewal period. Credit for authorship is ultimately determined by the Board.

Reviews and Self-Study Limitations

Credit for peer review may not exceed 16 hours in any given renewal period. Licensees can also obtain up to 12 hours for engagement review and 16 hours for system review.

For technical review of qualifying CPE programs, no more than 20 hours per reporting period can be obtained. Credit for repeat reviews only applies if the content has also been altered. Particularly, in such a way that required significant additional study or research.

Group programs and blended learning programs must be a minimum of one hour before partial credit may be earned. Interactive self-study and nano-learning programs must be a minimum of 10 minutes. Non-interactive self-study programs must be a minimum of one-half credit initially. However, credit may be earned in partial increments after the first full hour is earned.

Other State Policies and Exemptions

Connecticut does not preapprove or approve courses. So, individual CPAs are responsible for determining whether the CPE meets the rules set forth in the CT CPE CPA requirements.

20 credit hours exceeding the minimum hours required in a period may be transferred to the next renewal period. But these credits cannot be used to meet Accounting and Auditing requirements.

Connecticut CPE licensees whose principal place of business is outside Connecticut may instead meet the CPE requirements of their principal place of business. If the principal place of business has no CPE requirements, the licensee shall meet the CPE requirements in Connecticut.

In some cases, CPAs are exempt from CPE requirements. However, only so long as they offer no services to any parties. The following categories describe such individuals:

- Retirees

- Unemployed licensees

- Members who have left the workforce (even if they plan to return in the future)

- Members formally listed as “inactive”

CPAs can also request exemption waivers for the following reasons:

- Health complications

- Military service

- Extreme natural disasters (according to Connecticut Board policies)

- Other similar circumstances which might prevent a member from completing their CPE requirements

Additional Resources for CT CPA CPE Requirements

Last Updated:

![CPA Classes Online [490+ Self-Study Credits]](https://assets.vtrlearning.com/wp-uploads/2025/02/CPA-Classes-Online-with-VTR-Learning.png)

![Nevada CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Nevada-CPA-CPE-Requirements.png)

![Kansas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Kansas-CPA-CPE-Requirements.png)