![Kansas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Kansas-CPA-CPE-Requirements.png)

Overall Kansas CPA CPE Requirements

An essential part of maintaining a license as a CPA is complying with the AICPA’s requirements for CPE. Especially since doing so is one of the primary ways to ensure members consistently sharpen skills and hone their understanding. However, individual Boards of Accountancy are responsible for determining the specific requirements for each state. So, the limitations and stipulations look different from one location to another, and the Kansas CPA CPE requirements aren’t necessarily like those of other states. Consequently, CPAs should know the state requirements for their location to keep frustration and confusion out of the recertification process.

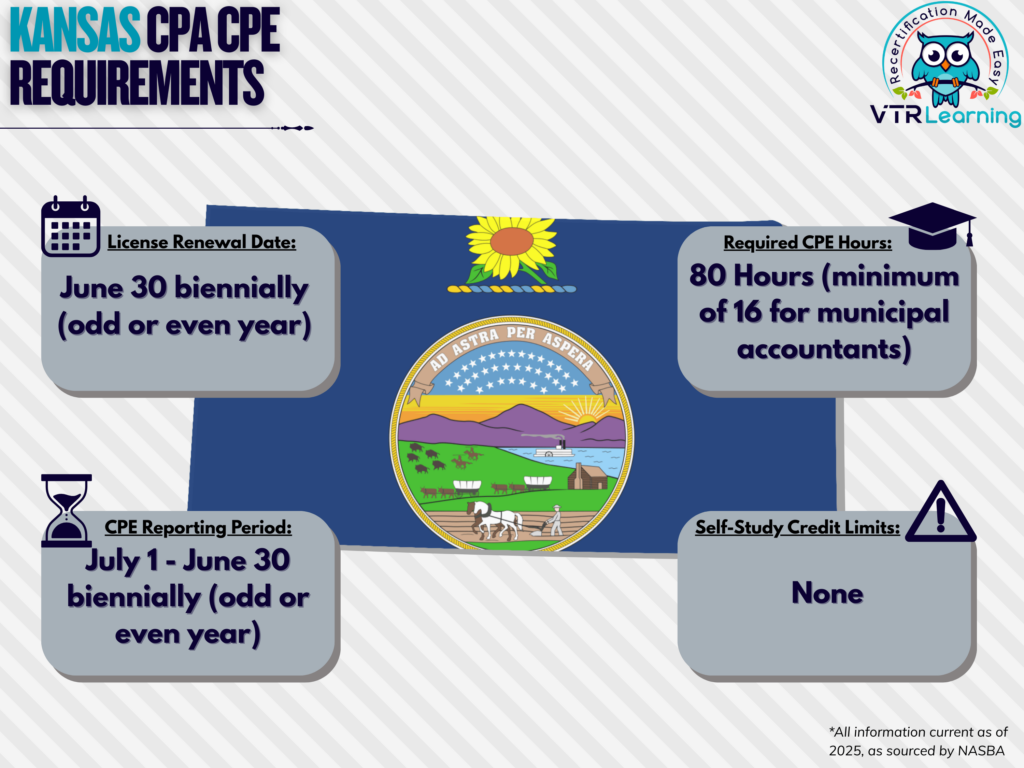

Overall, Kansas CPAs must renew their license every two years, and they have to complete 80 CPE hours per recertification period. Furthermore, licensees who are municipal public accountants must complete a minimum of 16 per year. The table below further explains several of the primary recertification requirements for CPAs in Kansas.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 biennially, based on certificate number (even number = even years; odd number = odd years) | July 1 – June 30 biennially, based on certificate number (even number = even years; odd number = odd years) | 80 hours | None |

Subject Area Requirements

CPAs must take no less than 2 hours in Professional Ethics each recertification, both related to public accountancy. If the individual is a licensed municipal accountant, they must also complete 8 hours in municipal accounting and auditing subjects.

Credit Limitations and Calculation

In Kansas, CPAs can offer formal instruction or presentation and earn up to 50% of the total required credit hours. Here, credit equals presentation time and preparation combined, where preparation is limited to twice presentation. Furthermore, the Board will only endorse repeat instruction if the subject material has substantially changed.

CPAs who are actively enrolled in college or university courses can claim CPE credit hours at the following rates:

- 15 CPE hours per semester hour

- 10 CPE hours per quarter hour

- 1 CPE hour per qualifying classroom hour of Non-credit university courses

Licensees can take personal development for CPE credit. But this method cannot exceed 30% of the maximum required credit amount per recertification period.

Self-study and group internet-based programs must be from sponsors approved by NASBA’s National Registry, the AICPA or a state society.

Credit may be obtained in one-half hour increments after the first full hour has been earned.

Other Policies and Exemptions

In Kansas, CPAs can also carry over 20 hours in excess of the 80 hour requirement into the next period. However, carryover hours cannot be used to satisfy the professional ethics requirement.

The Board may exempt from the CPE requirements any individual who holds a permit from another state if the permit holder has a principal place of business located outside the state of Kansas. However, the permit holder must verify to the Board’s satisfaction that they have met the CPE requirements in the state of principal business. And furthermore, the Board must consider the CPE requirement of the state in which the principal place of business is located to be substantially equivalent to those of Kansas.

CPAs automatically become exempt from CPE requirements if they cease offering their services to any third parties and are also:

- Retired

- Currently unemployed

- Temporarily removed from the workforce

- Formally listed as “inactive” with the AICPA

CPAs needing exemption, who don’t fall into the categories above, can apply for a waiver on the following bases:

- Health complications

- Military service

- Extreme natural disaster (further determined by the Board)

- Other similar circumstances which warrant exemption (also up to the Board)

Additional Resources for Kansas CPA CPE Requirements

Last Updated:

![Illinois CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Illinois-CPA-CPE-Requirements.png)

![Iowa CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Iowa-CPA-CPE-Requirements.png)

![Virginia CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/05/Virginia-CPA-CPE-Requirements.png)