![Arkansas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/12/Arkansas-CPA-CPE-Requirements.png)

General Arkansas CPA CPE Requirements

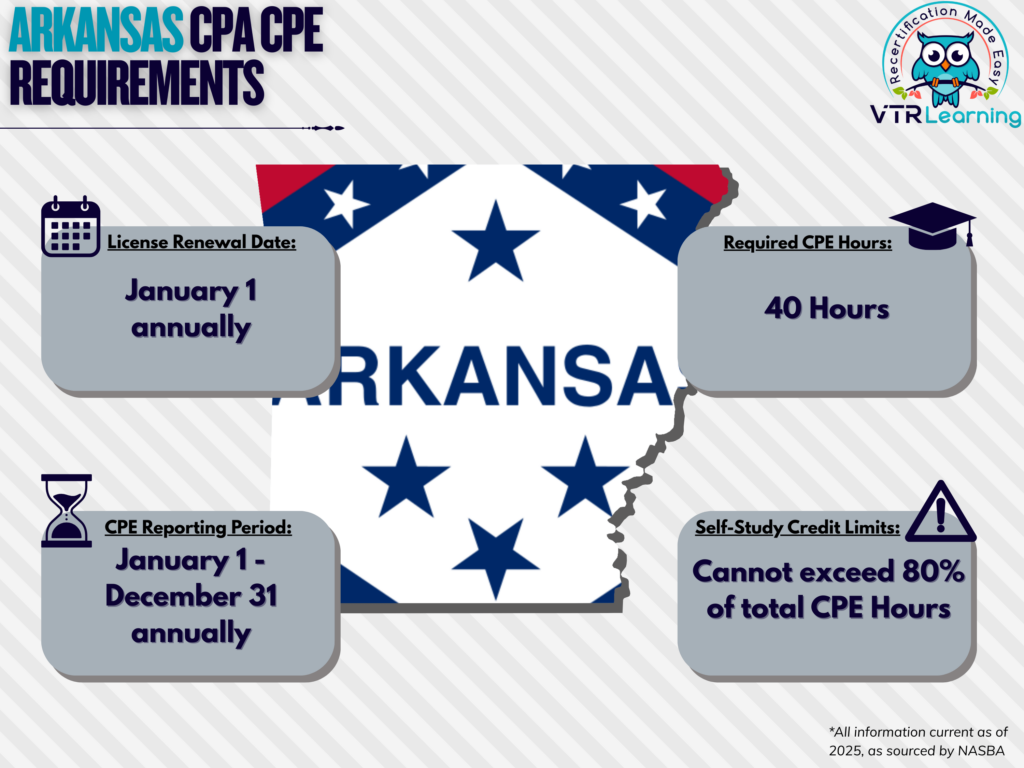

CPE is an intrinsic requirement for many business professionals who hold prestigious titles or designations bestowed by an accrediting organization. Although, the requirements vary greatly between each accrediting body. Even within organizations themselves, there often exist discrepancies between various locations. When it comes to the AICPA, a state Board of Accountancy dictates each location’s renewal requirements. And as such, the stipulations vary widely. The Arkansas CPA CPE Requirements dictate licensees, must renew their license every year.

But there are still further state requirements. For example, each individual must obtain 40 hours of CPE during each recertification period. The table below also highlights the primary Arkansas CPA CPE requirements.

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| January 1, annually | January 1 – December 31, annually | 40 hours | Maximum of 80% of total required hours |

Subject Area Requirements

During the three years immediately preceding license expiration, CPAs must also take 4 hours in professional conduct and ethics. Furthermore, one hour of ethics must be on Arkansas State Board of Public Accountancy specific laws and rules. However, this requirement may also be satisfied by completing a free, web-based course via the Board’s website. Or instead by attending group training taught by a Board member, Board staff member, or a designee of the Board. Overall, whichever path chosen, the credit counts toward the 4-hour ethics requirement.

Additionally, licensees who received their initial license during the current calendar year are exempt from the ethics requirement. So, they have until their first full calendar year of licensure before this rule applies.

Licensees in Arkansas must also complete 40% of their CPE in the areas of Accounting/Attest, Accounting Ethics or Tax. Furthermore, if they perform attest or compilation services, they must obtain 20% of their hours from courses dealing with Accounting/Auditing.

Programs in the following subject areas are not acceptable CPE: spirituality, personal health and/or fitness, sports and recreations, or foreign language and cultures and other subjects which fail to contribute directly to the professional competency of the licensee.

Credit Limitations and Calculation

In Arkansas, CPAs can obtain CPE credit for instructing or presenting accounting or auditing-related material in a formal setting. But if those courses are part of an accredited college or university program, they must be upper-level. And furthermore, may only be used for CPE one time in a three-year period. Overall, a lecturer or discussion leader shall be granted credit for preparation and presentation of a program. Though credit cannot exceed twice the number of CPE hours available to participants. For any program, repeat instruction within the same calendar year will not be valid for obtaining further credits.

CPAs can also earn credit if they enroll in accredited college or university courses. Here, credit calculates as 15 CPE credits per semester hour and 10 CPE credits for quarter hours completed. Alternatively, licensees can earn one credit hour for each class hour of a university non-credit course. However, credit will not be granted for academic courses used to qualify for the CPA exam or acquire the certification.

Credits from independent study, self-study and authorship may not exceed 80% of the required CPE hours during any recertification period. Furthermore, the Board must approve independent study in advance. Published articles, books or CPE programs may also be eligible for credit. But overall, the material must contribute to the licensee’s professional competency. And furthermore, it must also have been accepted for publication in writing prior to the renewal date.

Nano learning must not surpass 4 credits per yearly recertification period.

Any provider offering 16 or more credits mus register with NASBA’s National Registry. However, providers offering fewer than 16 credits may register instead with NASBA’s Roster program.

CPAs may obtain credits in half-hour increments after completing the first full hour.

Other Policies and Exemptions

Overall, sponsors must be preapproved by the Arkansas Board or be:

- A national or state CPA association

- An accredited college or university

- An accounting or industrial firm that performs in-house education

- A recognized government entity

Some licensed AICPA members have exemption from CPE, so long as they provide no services to third parties:

- Retirees

- Individuals who are currently unemployed

- Licensees who have temporarily left the workforce and intend to return

- Members who have formally listed their status as “inactive”

A full or partial exemption from continuing professional education requirements may be allowed for the following licensees:

- An active-duty military service member outside of the State of Arkansas

- A returning military veteran within one year of his or her discharge from active duty

- The spouse of a person under either point above

In order to receive full or partial exemption, a qualifying individual must submit a written request to the Board. There are also situational reasons for which members might apply for exemption:

- Health complications

- Extreme natural disasters (further determined by Arkansas Board policies)

- Other similar circumstances which might prevent a member from completing their CPE requirements (also per Board discretion)

Additional Resources for Arkansas CPA CPE Requirements

Last Updated:

![8 Finance Courses to Help Boost Your Skills [And Earn CPE]](/wp-content/uploads/2021/10/Learning-with-Online-Finance-Courses.png)

![NC CPA Requirements for License Renewal [Updated 2025]](/wp-content/uploads/2021/05/CPE-in-North-Carolina.png)

![Maine CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Maine-CPA-CPE-Requirements.png)