![Tennessee CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Tennessee-CPA-CPE-Requirements.png)

CPE Requirements for CPAs in Tennessee

Ultimately, state Boards of Accountancy are responsible for enforcing AICPA license renewal CPE requirements. And all for the purpose of ensuring licensees provide quality services within the accounting industry. However, different Boards are responsible for setting and enforcing individual state requirements. And consequently, stipulations vary from one location to another. So, Tennessee CPA CPE requirements differ from the rules in other states. Consequently, it is vital for CPAs to understand the rules for CPE within their jurisdiction.

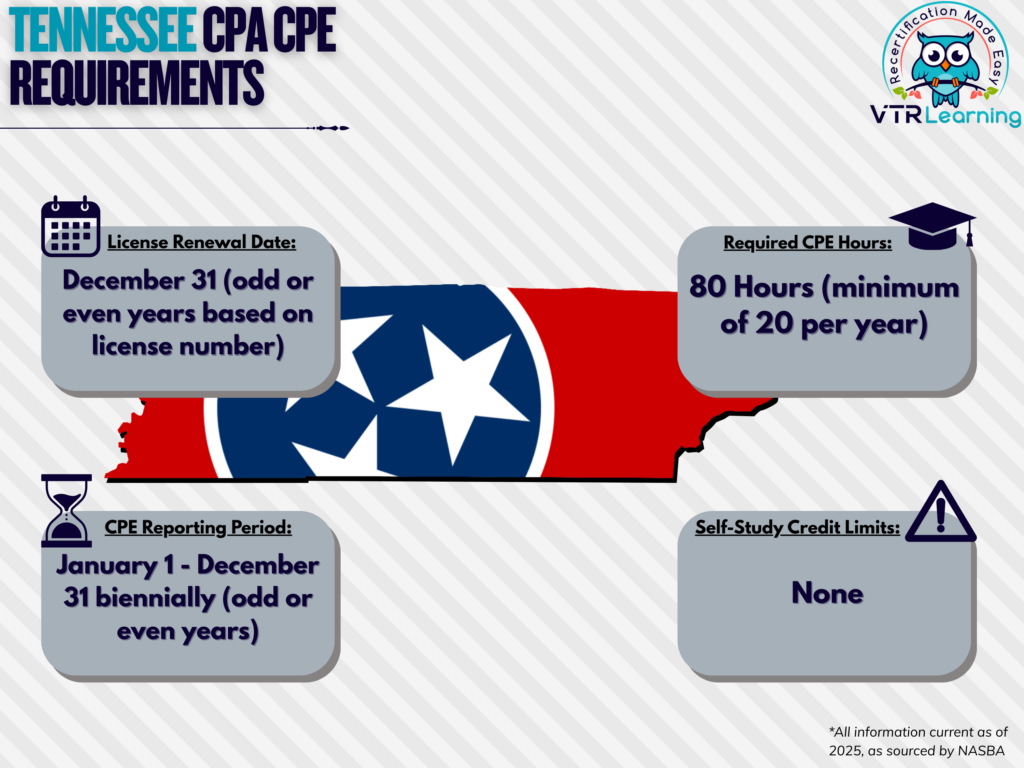

Tennessee CPAs must renew their license every two years and also complete 20 hours of CPE each year. However, they must have completed a total of 80 hours by the end of the recertification period. The table below further explains several important components of Tennessee’s requirements for licensure.

Share this Image On Your Site

Tennessee CPA CPE Requirements and Recertification Deadlines

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 (odd or even year depending on license number) | January 1 – December 31 biennially, ending on odd or even years depending on license number | 80 hours | None |

Subject Area Requirements

CPAs in Tennessee must complete at least two hours of a Board-approved, state-specific ethics course each recertification cycle. Furthermore, this course should familiarize the licensee with accountancy law and rules as well as professional ethics. At least 40 hours must be in technical subjects. Of course, these include accounting, governmental accounting, auditing, governmental auditing, business law, economics, finance, information technology, management services, regulatory ethics, specialized knowledge, statistics or taxes. Some licensees also engage in attest functions, including compilation. And if so, they must take at least 20 hours in accounting and/or auditing subjects. If a licensee provides expert witness testimony, they also have to complete 20 hours in their area of expertise.

Credit Limitations and Calculation

It is possible for CPAs in Tennessee to obtain credit for instances of formal instruction or presentation. If so, the credit cannot exceed 50% of the total required amount. Furthermore, educational instructors may receive up to 3 hours of credit for each hour of class time.

CPAs in college or university courses can also claim CPE credit hours. Here, credit equals 15 CPE hours per semester hour or 10 CPE hours per quarter hour. Non-credit university courses are also applicable under this rule. However, they only offer CPE at a rate of 1 hour for each qualifying hour of classroom time.

Alternatively, licensees can also complete professional exams to partially fulfill their CPE requirements. Here, credit awarded equals 5 times the length of the exam. But licensees can only earn 50% of the maximum required hours through this method. This rule applies for CMA, CISA, and other similar Board-approved exams.

Individuals can earn credit for reading professional journals and then passing exams on the material. However, they can only obtain 20% of the maximum required hours per renewal period this way.

CPE credit is available for authoring instructional or educational material, though that work must also be published. A copy of the article must also be provided to the Board if CPE records are audited at any point. CPAs can earn up to 50% of the total required hours through authorship.

Group and blended study opportunities award CPE credit in 10-minute increments. But only once the first full hour has been completed. Self-study credit can also be earned in 10-minute increments once the first half-hour has been completed.

Other Policies and Exemptions

CPE providers offering 16 or more credits must be registered with NASBA’s National Registry. But those offering fewer than that amount may register instead with NASBA’s Roster Program.

A non-resident licensee can also meet the Tennessee CPA CPE requirements by completing those of the state where their office is located. However, CPAs must demonstrate compliance by signing a binding statement on the renewal application. This statement certifies that the principal jurisdiction’s CPE requirements for renewal are completed. If the state where the office is located has no CPE requirements, the licensee must comply with Tennessee rules. If the licensee’s principal jurisdiction has no ethics requirement, the ethics requirement for Tennessee must also be met.

CPAs in any of the following categories are exempt from license renewal requirements:

- Retired members who offer no services to third parties

- Any person who is currently unemployed and not offering their services

- A licensee who has temporarily left the workforce and is not offering their services

- Someone who has formally listed their status as “inactive” and is not offering their services

Furthermore, waivers can be obtained from the Board for the following reasons:

- Health complications

- Active-duty military service

- Extreme natural disaster of a sort preventing continuing professional education opportunities

- Other similar circumstances preventing CPE completion

Additional CPE Resources for CPAs

Last Updated:

![Understanding and Earning CPE Credit [A Short Guide]](/wp-content/uploads/2022/05/Understanding-and-Earning-CPE-Credit.png)

![West Virginia CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2022/02/West-Virginia-CPA-CPE-Requirements.png)