![Nebraska CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/04/Nebraska-CPA-CPE-Requirements.png)

Overview of Nebraska CPA CPE Requirements

Licensed members of the AICPA report to their state’s Board of Accountancy, which helps ensure professional compliance. However, this setup has the potential to create difficulties for the license recertification process. Particularly for CPE, one of the main requirements for license renewal. Since each Board sets its own stipulations for CPE requirements, CPAs in different states have varying requirements. And if individuals don’t know their state regulations, the license renewal process could become quite confusing. So, individual CPAs in Nebraska should know the Nebraska CPA CPE requirements.

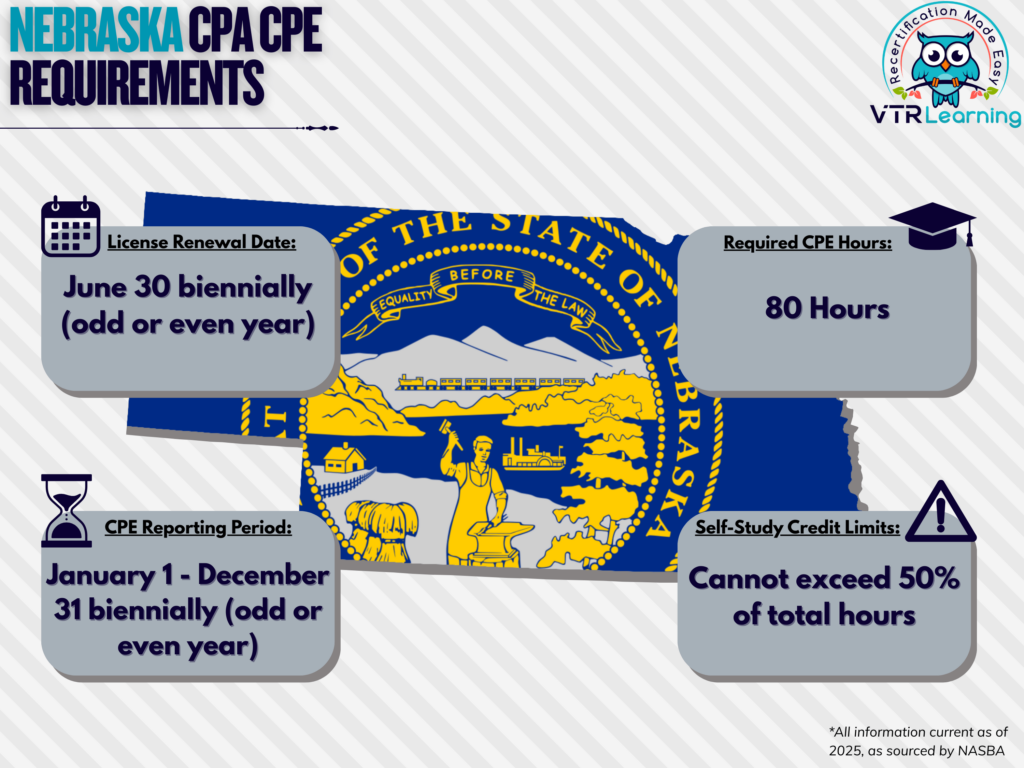

Overall, Nebraska CPAs have to recertify their license every two years. Furthermore, they must complete 80 CPE hours each recertification period. The table below further highlights some of the primary recertification details for residents of Nebraska.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 biennially (odd or even year based on birth year) | January 1 – December 31 biennially (odd or even year based on birth year) | 80 hours | Limited to 50% of the maximum credits required |

Subject Area Requirements

Licensees must take at least 4 hours of CPE dealing with Professional Ethics during each recertification cycle. However, there are no further subject area requirements.

Credit Limitations and Calculation

CPAs can earn 50% of their credits through formal instruction of educational material, where credit equals presentation plus preparation. Though preparation cannot exceed two times presentation length. And furthermore, the Board will not approve repeat instruction of the same material within the renewal period. Additionally, licensees can acquire a maximum of 10 credits for updating material for previously presented courses.

Active college course enrollment also cannot surpass 50% of the cycle requirement. Overall, a semester hour equals 15 CPE credit hours and a quarter hour equals 8 CPE credit hours. Though non-credit university courses are worth 1 credit per qualifying classroom hour.

Credit for technical meetings must not exceed 16 hours per recertification period. Also, firm meetings cannot grant credit unless the program consists of at least 50 minutes of instruction. Furthermore, a qualified instructor must conduct them and include an outline of the program. This outline should include a detailed timeline proposed in advance and preserved.

Peer review programs also may not surpass 50% of the total hours required. Furthermore, they must be sponsored by a state board of national or state professional society.

Personal development communications may not exceed 16 hours per recertification period.

Authorship of instructional or educational material is acceptable, so long as the work has been published. But this method cannot surpass 16 hours per recertification period.

Self-Study and Other Methods

Self-study credits likewise cannot exceed 50% of the total hours required.

Credit amounts for nano-learning programs must meet Nebraska’s current rounding rules in credit calculation. Nano-learning programs accrue in 50-minute increments, and 50-minute increments must be earned from the same sponsor. These credits must not exceed 40 hours during any licensing period.

Credit amounts awarded for blended learning programs must meet Nebraska’s current rounding rules in credit calculation.

Credit will be accepted in half-hour increments after the first full hour of continuing education has been earned.

Other Policies and Exemptions

Some CPAs are automatically exempt and do not have to complete license renewal requirements for the following reasons:

- Retirement, so long as they offer no services to third parties

- Current unemployment, so long as they offer no services to third parties

- Temporary exit of the workforce, so long as they offer no services to third parties

- Formal listing with the AICPA as “inactive”, so long as they offer no services to third parties

CPE waivers may be requested for members for any of the following reasons:

- Health issues

- Military service or active duty

- Natural disaster

- Similar circumstances which warrant exemption

Additional Resources for Nebraska CPA CPE Requirements

Last Updated:

![Arkansas CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/12/Arkansas-CPA-CPE-Requirements.png)

![Montana CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Montana-CPA-CPE-Requirements.png)

![Connecticut CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2020/10/CT-CPA-CPE-Requirements.png)