![Iowa CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Iowa-CPA-CPE-Requirements.png)

Iowa CPA CPE Requirements Overview

In any industry where even small mistakes can have a large consequential impact, it is important for professionals to do everything within their power to ensure their tasks are performed correctly. CPE is an essential component of membership with the American Institute of Certified Public Accountants (AICPA) because it helps licensees remain knowledgeable and well-equipped for their specific, accounting-related tasks. However, since location-specific Boards of Accountancy are responsible for setting the license renewal requirements for their own jurisdiction, the stipulations from one place to another can vary greatly. So, the Iowa CPA CPE requirements actually differ from those of other states.

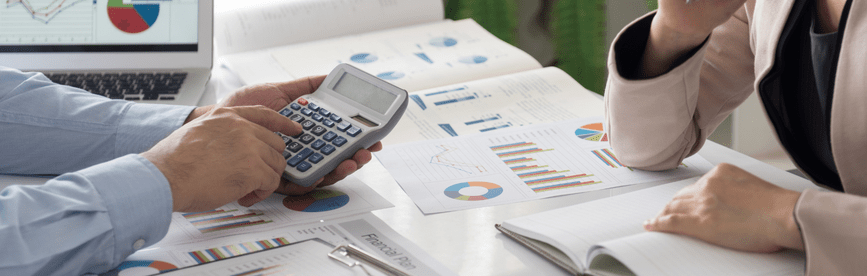

Naturally, it is vital for CPAs to adequately understand their state regulations before jumping into CPE. Members residing in Iowa have to renew their license every three years and also must complete 120 CPE hours per renewal period. The table below also shows the main recertification limitations and deadlines for Iowa CPAs.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 or June 30 annually | January 1 – December 31 OR July 1 – June 30 in the three years preceding renewal date* | 120 hours | Maximum of 50% of total hours required |

Subject Area Requirements

Within the three-year recertification period for CPAs in Iowa, 4 of the required 120 hours must be in Professional Ethics with a further focus on professional conduct. Licensees must also take 8 hours in Accounting and Auditing if they supervise and/or sign compilation reports on financial statements.

Credit Limitations and Calculation

Instruction in a formal setting is one method by which CPAs in Iowa can earn CPE, but only up to 50% of the maximum. Furthermore, instructors can receive 2 hours of preparation credit for each hour of actual instruction. Though courses must be above elementary level or the Board will not approve the credit.

CPAs enrolled in college or university courses can also claim up to 15 CPE hours per semester hour and 10 CPE hours per quarter hour successfully completed.

Licensees can also earn credit for successfully completing the following exams: Certified Management Accountant/CMA, Certified Information Systems Auditor/CISA, Certified Financial Planner/CFP, Enrolled Agent/EA, as well as other similar Board approved examinations. These credits apply only to the calendar year of the examination and cannot exceed 50% of the total renewal requirement. CPAs can earn credit at a rate of five times the length of each examination, which should cover time for adequate preparation.

Dinners, luncheons or breakfast meetings count as an approved method for earning CPE credit. However, they may not surpass 25% of the total required hours or 2 credits per instance. Furthermore, licensees cannot submit firm meetings for credit.

Authorship is an admissible means of obtaining CPE credit so long as the work has been published. This medium only accounts for up to 25% of the total hours required during the renewal period.

For self-study, a maximum of 50% of the required hours are obtainable.

Non-technical subject areas cannot exceed 50% of the hours required.

Credits are obtainable at a rate of one-half credit following the completion of the first full hour.

Other Policies and Exemptions

A CPA holding a currently valid license from their state of residence may choose to meet the Iowa CPE requirements by meeting the mandatory CPE requirements of the resident state.

The following categories describe CPAs who are automatically considered exempt from the continuing professional education requirement:

- Retired individuals who do not offer services to third parties

- Individual members who are currently unemployed, provided their services are not offered to third parties

- Individual licensees who have temporarily and willingly left the workforce, who do not offer services to third parties

- Formally “inactive” licensees who are not offering services to third parties

It is also possible to request a waiver from the Board for the CPE requirements for the following reasons:

- Issues related to health

- Military service

- Natural disasters deemed so extreme as to prevent successful completion of CPE requirements in the time provided

- Any other similar circumstances which could prevent licensees from completing CPE requirements in the provided timeframe

Additional Resources for Iowa CPA CPE Requirements

Last Updated:

![DC CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/02/DC-CPA-CPE-Requirements.png)