![Illinois CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Illinois-CPA-CPE-Requirements.png)

Basic Illinois CPA CPE Requirements

Many business professionals are required to maintain a license through CPE hours. And generally, they must complete a certain amount during the renewal period. However, a prime difficulty with this is the fact that different locations have their own requirements. When it comes to CPE, each state is subject to a Board of Accountancy which sets its own policies. So, the Illinois CPA CPE requirements might be different than other states. Unfortunately, some CPAs don’t pay attention to their state requirements, and license renewal becomes a difficult process. So, it is important for them to know the stipulations they must follow.

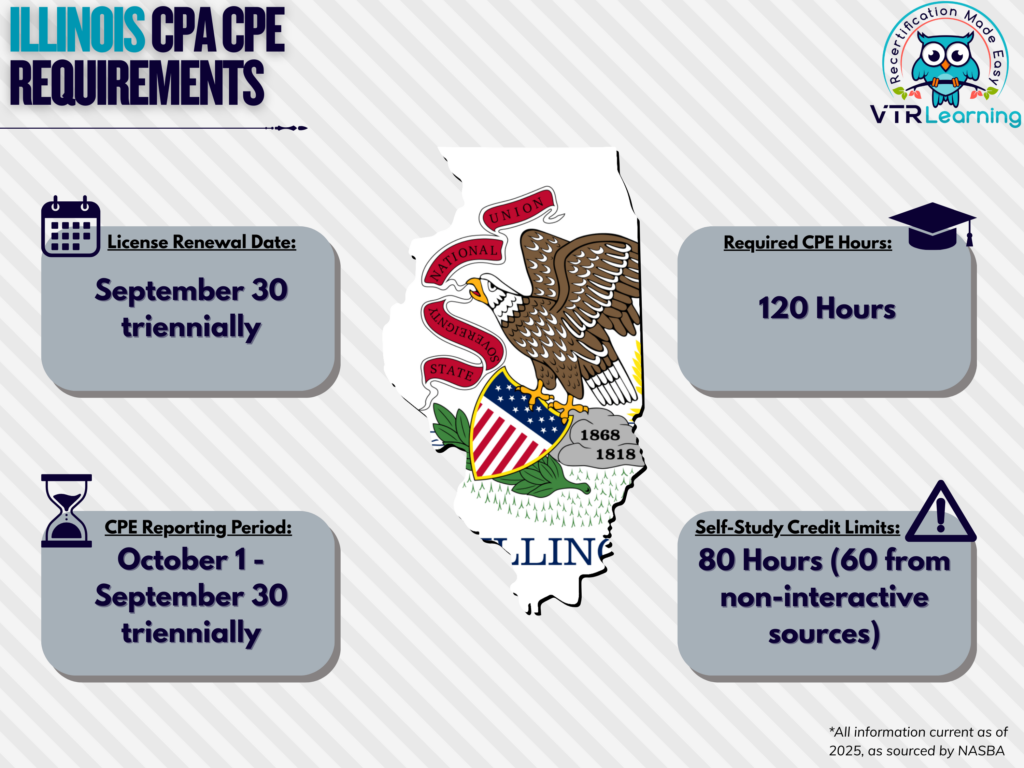

CPAs in Illinois need to renew their license every three years, so in that time, they must complete 120 hours of CPE. The table below shows a few of the main limitations for license renewal.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| September 30 every three years | October 1 – September 30 every three years | 120 hours | Limited to 80 hours, or 60 for non-interactive methods |

Subject Area Requirements

At some point within each recertification cycle, licensees must take at least 4 hours of professional ethics and 1 hour of sexual harassment prevention training. However, there are no other subject area requirements for Illinois CPAs.

Credit Limitations and Calculation

It is possible for Illinois CPAs to obtain 60 CPE credits for instruction or presentation. Here, credit equals presentation time and preparation together, where prep is less than twice the presentation length. But prep time for repeat instruction will only be given if the subject material has been altered or changed.

College or university courses are also an approved form of CPE. They are worth up to 15 CPE credits per semester hour or 10 CPE hours per quarter hour.

Licensees can also receive up to 30 CPE hours for authoring and publishing material. And the published material must instruct on topics related to accounting.

CPAs can take personal development courses for credit, but only up to 24 hours, as mandated by the Board.

CPAs can earn as much as 80 hours of self-study credits each renewal period. However, if the format is non-interactive, the limit is 60 hours. Furthermore, CPAs can only earn half an hour of non-interactive credit for each full hour gained.

Limited credit for non-verifiable CPE is 60 hours per renewal period and includes the following:

- Programs with no approved sponsor

- Committee and technical meetings (10 hours)

- Reading of published material (10 hours)

- Consultations with experts or research in a new area (10 hours)

Credit can be earned in half-hour increments after the first full hour of credit has been gained.

Other Policies and Exemptions

Licensees with an address on record outside of Illinois are considered compliant with the state’s CPE requirements. But only if the licensee has complied with the CPE requirements of the state in which their address is on record. And that location must require at least 120 hours of CPE over a three-year period.

Some CPAs are automatically exempt and do not have to meet CPE requirements. In order to qualify, they must offer no services to any parties. These include:

- Retired licensees

- Unemployed members

- Licensees who have temporarily opted to leave the workforce

- Any individuals who are formally “inactive” with the AICPA

Waivers are available by request for CPAs who have a legitimate need for CPE requirement exemption. The following categories describe several potential reasons.

- Health issues and complications

- Active duty military service

- Extreme natural disasters (further decided by the Illinois Board)

- Extenuating circumstances which prevent members from completing CPE (also up to Board determination)

Additional Resources for Illinois CPA CPE

Last Updated:

![Oregon CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/Oregon-CPA-CPE-Requirements.png)