![Indiana CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Indiana-CPA-CPE-Requirements.png)

Indiana CPA CPE Requirements for Recertification

Licensed members of the AICPA should be familiar with the topic of CPE. Particularly as it is a requirement for license renewal with the organization. CPE ultimately helps ensure CPAs keep their abilities on-par with the high demands of the industry. But it also serves to update them on any important changes. However, Boards of Accountancy regulate each state and territory. Consequently, there is often variance in the CPE requirements from one location to another. In effect, Indiana CPA CPE requirements aren’t the same as those of other states. So, if licensees aren’t careful to know the state requirements, it can frustrate the license renewal process.

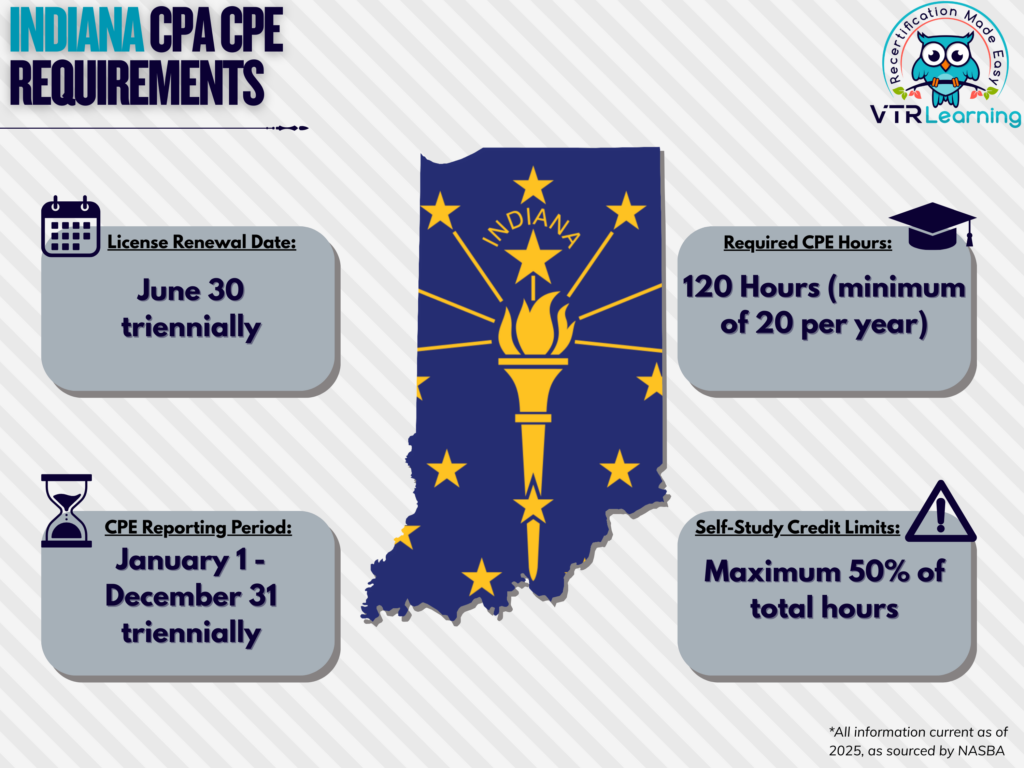

AICPA members in Indiana must renew their license every three years. Each year, they have to complete a minimum of 20 hours of CPE hours. And a full 120 hours are also necessary over the course of the renewal period. The chart below further details the limitations and deadlines for Indiana licensees.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 triennially | January 1 – December 31 triennially | 120 hours | Maximum of 50% of total required hours |

Subject Area Requirements

Each recertification period carries a requirement for CPAs to complete at least 4 hours of professional ethics training. Individuals can fulfill this requirement by completing a competency-based ethics course. However, another option is gaining experience that augments the applicant’s knowledge and skill in providing accounting services. Specifically, experienced should be gained through the application of the code of professional conduct. This must also be through a non-compensated role with a professional or trade organization verified by the organization.

Furthermore, 10% of the total hours required per recertification period must be in the subject areas of Accounting and/or Auditing.

Credit Limitations and Calculation

CPAs can obtain up to 50% of the required recertification credit through formal instruction or presentation. This material must cover accounting and/or auditing-related topics. However, college instruction is not acceptable if the licensee is an instructor who teaches courses on a daily basis. For this method, credit is equal to presentation plus preparation. But preparation credit may not exceed twice the length of presentation. Furthermore, repeat instruction of the same course is not accepted within the same renewal period.

It is also possible for CPAs to earn up to 15 CPE hours per semester hour through a university course. Alternative, if taking a quarter courses, 10 CPE hours. However, the licensee must obtain a grade of “C” or above for the Board to accept the credit.

Meetings in the certain categories will not count for CPE credit as dictated by the Indiana Board. These include meetings conducted during eating periods, business meetings for the election of directors or officers, treasurer’s reports or committee reports, committee work with local, state and national professional organizations, and also firm staff meetings oriented toward administrative and housekeeping matters.

The Indiana Board accepts Self-study credits. But they may only account for 50% of the total hours requirement for the recertification period.

CPE credits can be obtained in half-hour increments after the first full hour has been obtained.

Other Policies and Exemptions

CPAs described by the following categories are automatically exempt from the CPE requirements. However, to be included, they cannot offer their services to any parties.

- Retired members

- Any unemployed licensee who plans to rejoin the workforce

- Those who have temporarily left the workforce

- Individuals opting for formally “inactive” status

It is also possible for CPAs to request waivers for exemption upon the following bases:

- Health complications

- Military service

- Natural disasters

- Severe circumstances which prevent timely accrual of CPE credit (subject to review and approval by the Board)

Additional Resources for Indiana CPA CPE Requirements

Last Updated:

![Massachusetts CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Massachusetts-CPA-CPE-Requirements.png)

![DC CPA Requirements for CPE [Updated 2025]](/wp-content/uploads/2021/02/DC-CPA-CPE-Requirements.png)

![Oklahoma CPA CPE Requirements to Recertify [Updated 2025]](/wp-content/uploads/2021/06/Oklahoma-CPA-CPE-Requirements.png)