![Wyoming CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Wyoming-CPA-CPE-Requirements.png)

Overview of Wyoming CPA CPE Requirements

CPE is an inescapable part of life for members of prestigious organizations like the AICPA. But that doesn’t mean it’s an easy process. Of course, issues like time and money play a central role in the difficulty of CPE, but it’s safe to say that confusion can also creep in if licensed CPAs aren’t careful to understand the stipulations required of them. Since a Board of Accountancy governs each individual state, the actual rules and regulations for CPE change based on location. For example, the Wyoming CPA CPE Requirements differ from those in other places. So, CPAs need to be careful in understanding their state’s requirements, lest they fail to fully comply with the Board’s CPE standards.

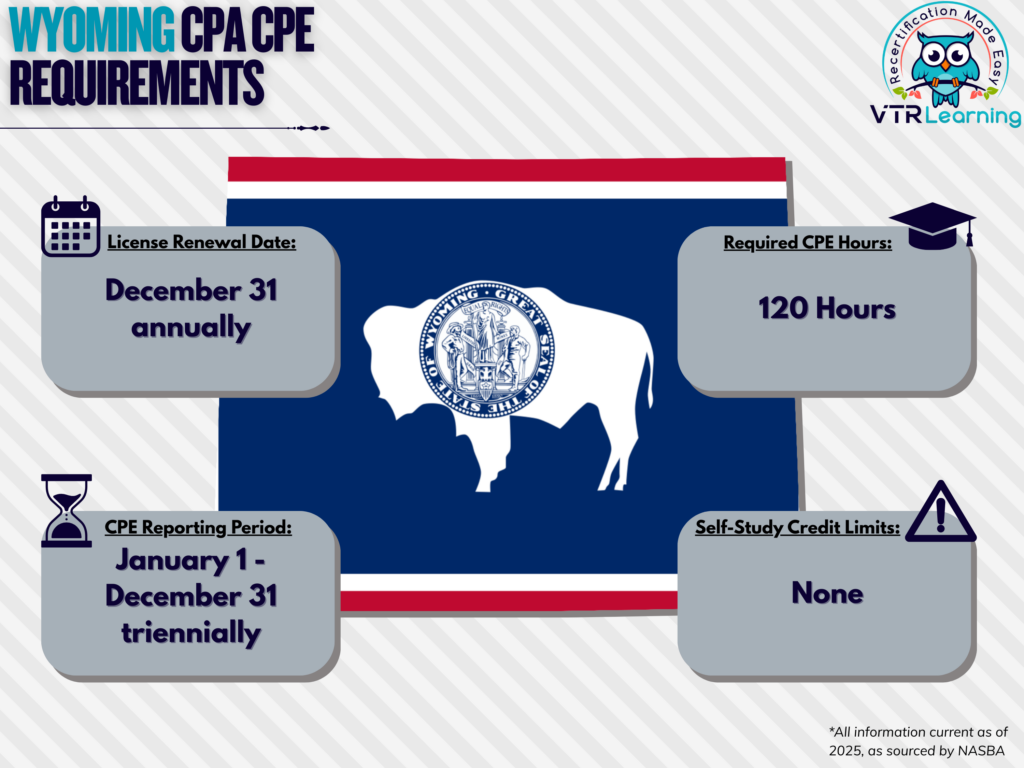

Overall, certified public accountants in Wyoming must renew their license every three years. And during that time, they must also complete 120 hours of CPE. The table below further highlights some of the primary requirements for CPAs in Wyoming.

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 annually | January 1 – December 31 over a rolling, three-year period | 120 hours | None |

Subject Area Requirements

Within each three-year recertification period, 4 of the required 120 CPE hours must also be from a Board-approved course on Professional Ethics. New licensees also must take a Board-approved course on the provisions of the Wyoming CPA Act and Wyoming Rules and Regulations. Furthermore, this has to happen within six months of the date of the initial permit.

CPAs must also take 80 hours per recertification period in Code A subjects.

Credit Limitations and Calculation

In Wyoming, CPAs who instruct in a formal setting can obtain up to 50% of their total required credit hours. However, this credit only extends to three times the presentation length. No further credit will be offered for repeated instances of instruction of the same material.

Licensees who are enrolled and participating in college or university courses can also claim CPE credit hours, up to 15 CPE hours per semester hour of 10 CPE hours per quarter hour. However, courses taken to fulfill the initial requirements for reception of a baccalaureate degree are not countable toward meeting CPE requirements.

It is possible to earn CPE credit by authoring and subsequently publishing instructional or educational material relating to the Accounting profession, with the understanding that the maximum credit available for books and/or articles is 25% of the total requirement. Furthermore, a provided copy of the publication must be made available to the Board for review.

Independent study is also a Board-accepted method under a qualified sponsor/provider who has met the applicable program standards. But this method is limited to 12 hours of CPE credit in any renewal period.

Overall, there are no requirements or limitations for self-study credit opportunities.

Credit can accrue in half-hour increments after completing the first full hour of CPE.

Other Policies and Exemptions

A non-resident licensee seeking renewal of a license in Wyoming shall meet the CPE requirement of this rule by instead meeting the CPE requirements for renewal of a license of the state in which the individual’s principal office is located. However, the principal place of business state must have a 4-hour ethics requirement. The ethics course in the state of principal place of business must also cover state-specific statues and rules. If the state of the principal place of business has no CPE requirement for renewal of a license or lacks the necessary ethics requirement, the non-resident licensee must instead comply with all CPE requirements for renewal of a license in Wyoming.

CPAs in any of the following categories are automatically excepted from AICPA license renewal requirements. However, only if they refrain from offering their services to third parties:

- Retirees

- Unemployed members

- Licensees who have temporarily left the workforce

- Formally “inactive” members

It is also possible for active members of the AICPA to request waivers for the following reasons:

- Health complications

- Matters relating to military service

- Extreme natural disaster (further determined by the Board)

- Other similar circumstances preventing a licensee from accomplishing their CPE goals (also subject to Board discretion)

Additional Resources for Wyoming CPA CPE Requirements

Last Updated:

![Georgia CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2021/03/Georgia-CPE-Requirements.png)

![New York CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/04/New-York-CPA-CPE-Requirements.png)