![Mississippi CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/12/Mississippi-CPA-CPE-Requirements.png)

Overview of Mississippi CPA CPE Requirements

CPE is a requirement for members of the AICPA as a part of the license recertification process. Primarily, because it helps CPAs learn new skills essential to the industry while sharpening existing abilities. However, the difficulty with CPE for CPAs is that not all have to meet the same standards and stipulations. Ultimately, individual State Boards of Accountancy are responsible for this, since each sets its own rules. For example, the Mississippi CPA CPE requirements vary from those of other states. So, it is important for all CPAs to understand their state requirements to avoid confusion during the license renewal process.

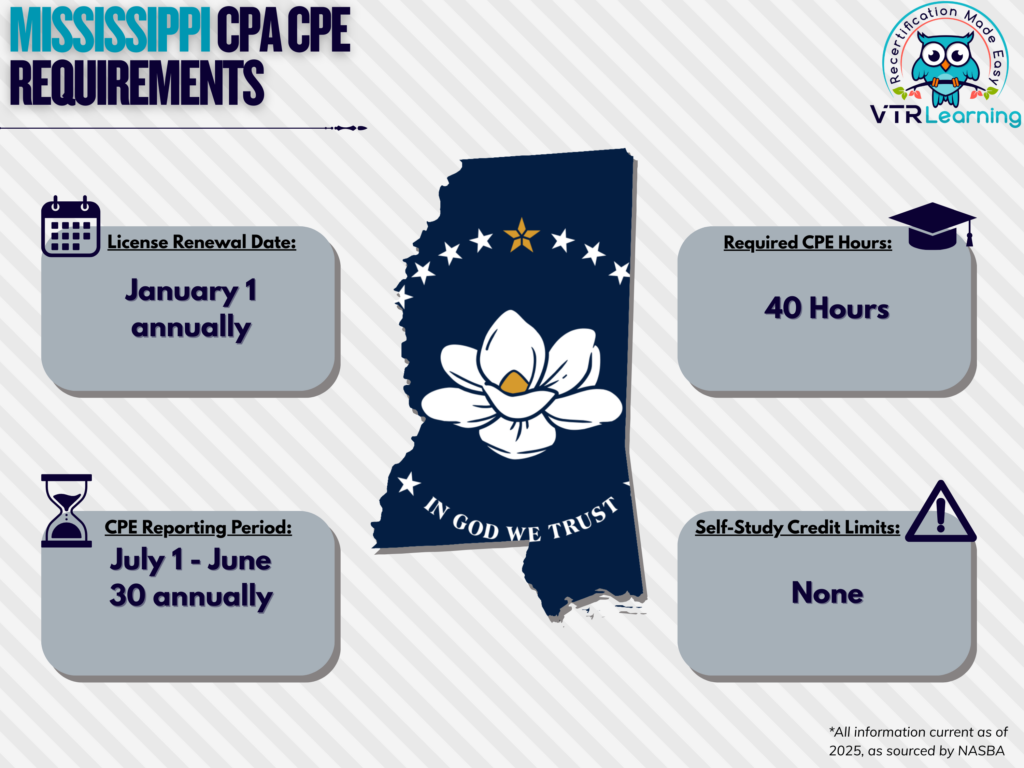

Overall, Mississippi CPAs have to renew their license every year, and they must complete 40 CPE hours per recertification period. The table below also details the primary limitations and requirements for CPE in Mississippi.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| January 1 annually | July 1 – June 30 annually | 40 hours | None |

Subject Area Requirements

During each recertification period, 4 of the 40 hours must involve Ethics, Professional Conduct and Public Accountancy Law and Regulations. Furthermore, this must include at least 1 ethics CPE hour exclusively in Mississippi Public Accountancy Law and Regulations. There are no further subject area requirements.

Credit Limitations and Calculation

In Mississippi, CPAs can obtain CPE through formal instruction of educational material. However, Credit equals preparation time and cannot exceed twice the actual class presentation time. Furthermore, repetitious presentations of the same material will not accrue credit.

CPAs can also obtain up to 15 CPE hours per semester for successful completion of a college or university course. And for a quarter hour course, up to 10 CPE hours. Non-credit university courses are also worth 1 CPE hour for each hour of class attendance and participation.

As per Board policy, 50 minutes of continuous participation in a program will constitute 1 CPE credit hour. The shortest recognized program must consist of at least 10 minutes of continuous participation in order to receive credit.

CPAs can claim credit for authoring and subsequently publishing instructional or educational material. Authorship is based on submission of the published document and a request for the number of credits to the Board.

Independent study is not a Board-recognized method of continuing professional education in Mississippi. Self-study credit is allowed, but courses must be approved by the NASBA QAS program. Personal development courses are also recognized, although no more than 20 hours may be claimed in any compliance year.

Other Policies and Exemptions

If CPAs obtain more than 40 credits during one period, the excess hours may carry over to the next. However, this allowance only applies for the immediately following one-year compliance period, and carried credits cannot exceed 20 CPE. Furthermore, no personal development hours in excess of 20 within a compliance year may carry forward to future years.

The Board may exempt a non-resident licensee from CPE requirements if their primary employment is not in Mississippi. But only if in a state where CPE requirements are substantially equivalent to Mississippi’s requirements, as determined by the Board. Furthermore, the individual must be a licensee in the state of primary employment and report CPE credit hours as required. This also includes a sworn statement to the Board that the CPE requirements for that jurisdiction have been met. Furthermore, the licensee must comply with the Mississippi ethics CPE requirement. This requirement applies unless their state of primary employment has an ethics CPE requirement and they comply with that requirement.

CPAs who offer no services to third parties are automatically exempt from CPE requirements for license renewal. But only if they are part of the following categories:

- Retired individuals

- Any licensee currently unemployed

- Members who have willfully and temporarily left the workforce

- Individuals who are formally listed as “inactive”

It is possible for active CPAs to request waivers for exemption for the following reasons:

- Issues with health

- Military service (active duty)

- Natural disasters (as approved by the Board)

- Similar circumstances which warrant exemption (approved by the Board)

Additional Resources for Mississippi CPA CPE Requirements

Last Updated:

![CPA Classes Online [490+ Self-Study Credits]](https://assets.vtrlearning.com/wp-uploads/2025/02/CPA-Classes-Online-with-VTR-Learning.png)