![Colorado CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/05/Colorado-CPA-CPE-Requirements.png)

CO CPA CPE Requirements

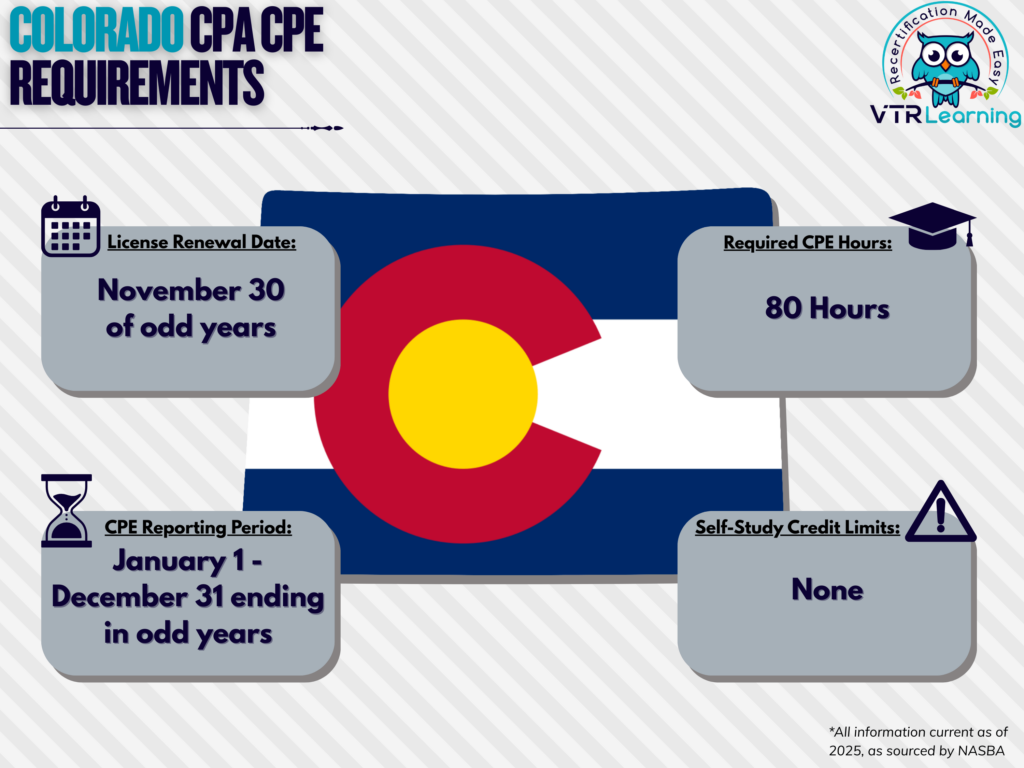

Many business pros are members of organizations that certify them for certain skills or positions. Because sometimes, specific jobs require these specialized abilities. But more so, membership demonstrates hard work and prestige. Generally, individuals must show their willingness to keep up with industry topics and advancements. And the main way of doing this is through CPE courses or learning activities. However, the stipulations vary from one location to another. So, individuals need to stay aware of their state requirements. The Colorado CPA CPE requirements include renewing a license every two years. More specifically, within that time, individuals must complete 80 hours of CPE.

Ultimately, the state Board of Accountancy is responsible for setting the Colorado CPA CPE requirements. However, it also decides the forms of CPE which are acceptable for maintaining a designation. And because Colorado’s requirements differ from other states and locations, CPAs must know the rules and limitations for recertification. So, the table below highlights the primary recertification limitations and deadlines for Colorado.

Share this Image On Your Site

Colorado CPA CE Requirements and Recertification Deadlines

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| November 30 of odd-numbered years | January 1 – December 31 biennially, ending on odd years | 80 hours | None |

Subject Area Requirements

During each two-year recertification phase, four of the 80 hours must be in Professional Ethics. Providers offering ethics courses must register with the Board and have their content approved by the Board. According to the Colorado CPA CPE ethics requirements, no more than two hours may be in Colorado Rules & Regulations. And eligible courses must cover current Colorado Revised Statutes and Board rules. They must also comply with Content Outline provided in section 7.8 (E) of the Accountancy Rules and Regulations.

Credit Limitations and Calculation

The state of Colorado does not pre-approve courses or providers. But, if the CPA and provider comply with organization standards, the Board will consider the Colorado CPA CPE requirements met. Of course, sponsors listed on NASBA’s National Registry of CPE Sponsors are accepted by the Board.

There are limitations for personal development courses and published and instructed materials. For example, licensees can only earn 20% of the total hours through personal development methods. Similarly, the limit for published and instructed materials combined is 50% of the hours.

Exemptions

Some Colorado CPAs are exempt from the general CPE requirements. However, they must not offer services to any third party:

- Retirees

- Licensees who are unemployed

- Members who have temporarily left the workforce

- Any member who is “inactive”

Furthermore, CPAs who do not fall into any of the above categories can request waivers for the following reasons:

- Health concerns

- Military duty

- Natural disasters

- Other like circumstances which might also prevent CPE

Additional CPE Resources for CPAs

Last Updated:

![Check Out These CPA CPE Courses [11 Unique Options]](/wp-content/uploads/2021/03/VTR-Learnings-New-Online-CPA-CPE-Courses.png)

![Illinois CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Illinois-CPA-CPE-Requirements.png)