![Rhode Island CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/06/Rhode-Island-CPA-CPE-Requirements.png)

Overview of Rhode Island CPA CPE Requirements

In the world of accounting, CPE is a fact of life. Particularly for CPAs, who have to complete hours every few years to keep up their organizational membership status. Overall, continuing education helps licensees stay up-to-date with organizational trends and important developments. But without this knowledge, it would be nearly impossible to offer the best services to clients and employers. However, individual state Boards of Accountancy oversee the regulations for different locations. So, the Rhode Island CPA CPE requirements differ from the rules in other places. Consequently, it’s paramount that CPAs recognize and understand the state requirements for their particular location.

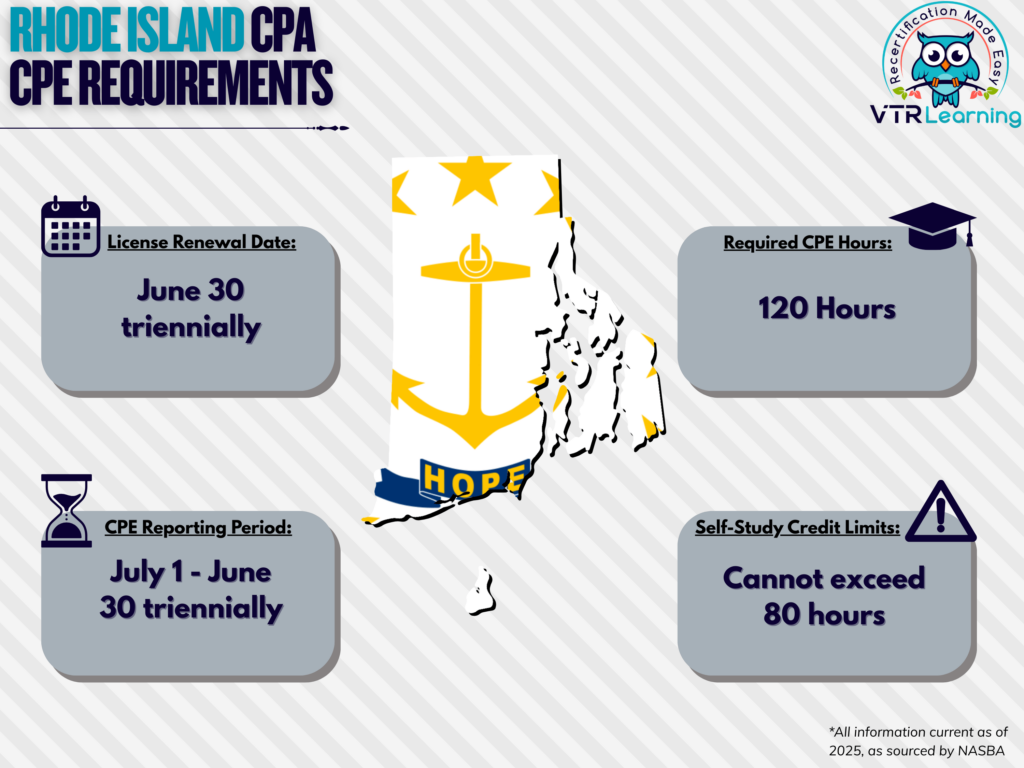

Overall, in Rhode Island, CPAs must complete 120 CPE hours every three years in order to renew their license. The table below provides further information about the requirements in Rhode Island.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 triennially | July 1 – June 30, triennially | 120 hours | 80 hours maximum each recertification period |

Subject Area Requirements

Licensees in Rhode Island must also take at least 6 hours of Professional Ethics during each three-year recertification cycle. Of course, these hours count toward the full 120-hour requirement. And furthermore, this can include programs devoted to the AICPA Code of Professional Conduct and opinions issued thereunder. Alternatively, programs relating to legal, professional or ethical codes of authoritative organizations also apply. So, there are multiple means of fulfilling the Rhode Island CPE ethics requirement.

Credit Limitations and Calculation

Instructing educational presentations is one possible way for CPAs in Rhode Island to partially complete their CPE requirements. Overall, with this method, it is acceptable to earn up to 60 hours per period. Licensees can determine credit amounts by adding the presentation time and preparation time together. However, prep time should not extend beyond twice the length of the presentation itself.

Other methods for earning CPE credit include personal development and marketing opportunities, limited to 24 hours per cycle. Encompassed in this are the following subject areas:

- Business Management and Organization

- Communications

- Communications and Marketing

- Marketing

- Personnel/HR

- Personal Development

It is further possible to earn CPE credit for authoring and publishing relevant material. Like instruction, this method is limited to no more than 60 hours per period.

Self-study credit must be approved by the NASBA Quality Assurance Service or be interactive in nature.

Partial credits are acceptable to the Board in 0.2, 0.5 or 1 hour amounts.

Other Policies and Exemptions

A non-resident licensee can also meet the Rhode Island CPA CPE requirements by meeting those of the state where their principal place of business is located. Furthermore, they must sign a statement to that effect on the renewal application for Rhode Island. However, if the principal place of business state has no CPE requirements, the licensee must comply with all CPE requirements for renewal of a certificate in Rhode Island.

CPAs in any of the categories below automatically have exemption from the typical recertification requirements. However, they must refrain from offering any services to third parties:

- Retired individuals

- Members who are currently unemployed

- Licensees who have temporarily and willfully left the workforce

- CPAs who have formally changed their organizational status to “inactive”

Alternatively, for active members who wish to apply for exemption status, waivers are provided by the Board for reasons including:

- Health issues

- Military service or duty

- Extreme natural disaster

- Similar circumstances

Additional Resources for Rhode Island CPA CPE Requirements

Last Updated:

![Cultivate Your Garden [One Act at a Time]](/wp-content/uploads/2019/01/Cultivating-Your-Garden-In-Life.png)