![Alabama CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/04/Alabama-CPA-CPE-Requirements.png)

Primary Alabama CPA CPE Requirements

Many business professionals want to prove their credibility and demonstrate the experience they’ve gained. And one common way to do this is by earning a certification or designation through an accrediting organization. Furthermore, most of these groups require a certain amount of CPE during a licensing period to renew membership. CPE comes in many forms, and the requirements differ greatly from one organization to another. But even within some bodies like the AICPA, requirements can differ immensely by state. For example, a state Board of Accountancy regulates Alabama CPA CPE requirements. And overall, licensees must complete 40 CPE hours per year to maintain their licensed status.

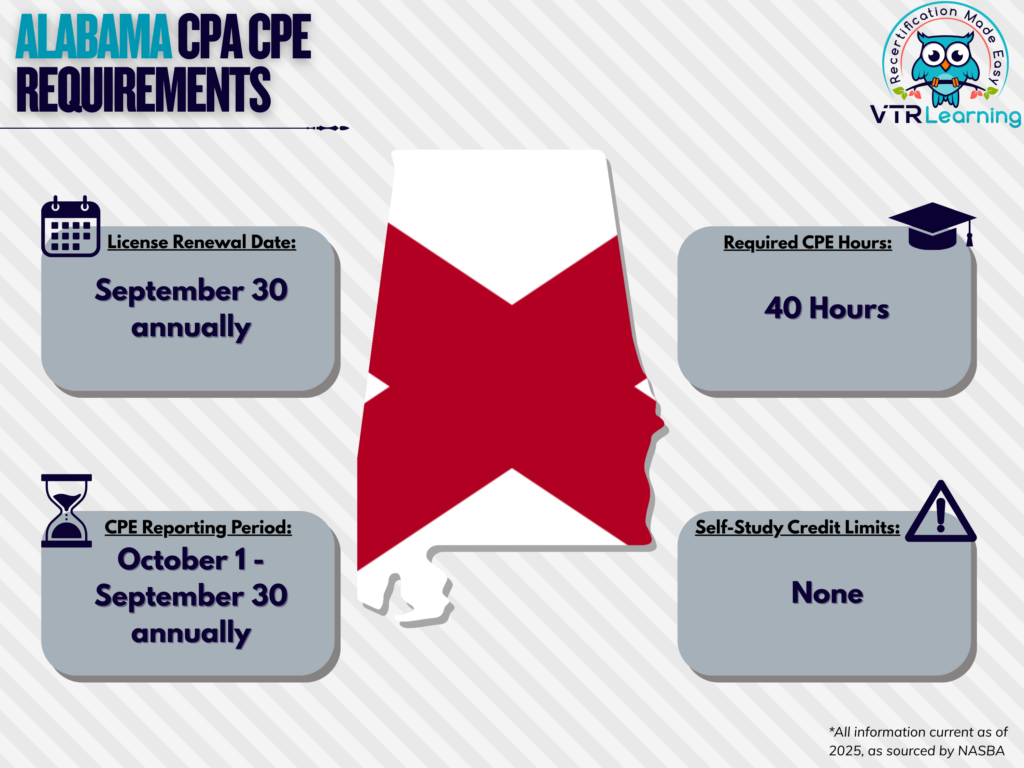

Because the requirements different by location, it is important for CPAs to stay aware of the state requirements. The table below further highlights the primary recertification limitations and deadlines for Alabama.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| September 30 annually | October 1 – September 30 annually | 40 hours | No limit |

Subject Area Requirements

Every recertification period, licensees must complete at least 2 hours of ethics CPE. Furthermore, they must complete at least 8 hours of Accounting and Auditing CPE. However, there are no further regulations on subject areas.

Credit Limitations and Calculation

In the state of Alabama, there exist certain limitations on credit amounts garnered from various forms of CPE. Courses centered around behavioral or personal development topics cannot exceed 12 hours per year. Nano-Learning carries a limit of 25% of the total required hours. Authoring and publishing material is also an acceptable method for obtaining CPE. But has a limit of 50% of the total hours. Furthermore, credit hours for authoring such material is subject to Board determination. However, a recent development is that self-study credit can account for 100% of the recertification amount needed. Initially, credit must be obtained in at least half-hour increments. But after the first full hour, self-study may accrue in one-fifth or one-half measures.

CPAs who present instructional material can claim credit for doing so. Here, credit equals twice the length of presentation, but no credit is offered for preparation of a program. Group programs and blended learning programs must be a minimum of one hour. However, credit may be earned in one-fifth or one-half increments after the first full hour is completed.

CPAs who are active participants in a college or university class can earn 15 CPE credits per semester hour. However, they could also obtain 10 CPE credits for each quarter hour. And alternatively, students in non-credit university courses can claim one CPE hour per hour of class time.

The partial credit policy dictates that half credits are obtainable after earning the first full hour of credit. Nano-learning only accrues in one fifth credit hour increments.

Other Policies and Exemptions

A licensee seeking renewal of an annual permit in the state of Alabama shall be deemed also to have met the CPE requirements of this state by meeting the CPE requirements for renewal of a certification in the state in which the licensee’s principal place of business is located. However, if a licensee’s principal place of business has no CPE requirements for renewal of a certificate, the licensee must comply with all the CPE requirements for renewal of an annual permit in Alabama.

Licensed CPAs in the categories listed below do not have to meet any CPE stipulations as dictated by the AICPA.

- Retired members who offer no services to third parties

- Unemployed members who offer no services to third parties

- Members who have temporarily and willfully left the workforce, who offer no services to third parties

- Anyone who has formally and willingly listed their status as “inactive”, not offering services to third parties

Exemption waivers are also available for CPAs on the following bases:

- Health complications

- Active-duty military service

- Extreme natural disasters (in accordance with Alabama policies)

- Other similar circumstances which might prevent a member from completing their CPE requirements

Additional Resources for Alabama CPA CPE Requirements

Last Updated:

![How to Earn CPEs [5 Quick Tips]](/wp-content/uploads/2022/06/5-Quick-Tips-for-Obtaining-CPEs.png)