![South Carolina CPE Requirements for CPAs [Updated 2025]](/wp-content/uploads/2021/02/South-Carolina-CPE-Requirements.png)

General South Carolina CPE Requirements

Essentially, it could be argued that CPE is something someone in any industry could benefit from. After all, learning and continuing to hone a craft is admirable and worth the effort. Because it helps ensure that an individual is as knowledgeable as possible within their chosen field. This is also why the AICPA requires members to complete a certain amount of CPE for license renewal. However, because qualifications vary from state to state, the South Carolina CPE Requirements differ from other requirements. So, it’s important for licensees to know their specific stipulations.

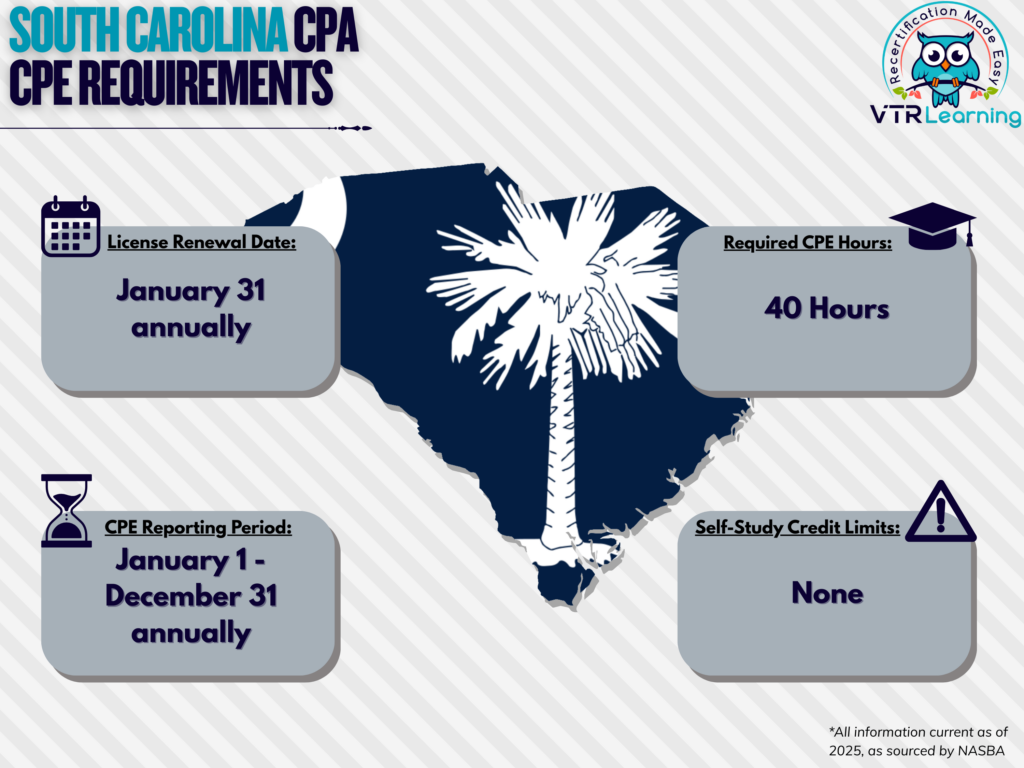

In the state of South Carolina, CPAs must renew their license on a yearly basis. And during that time, they must complete 40 hours of CPE. The table below further outlines several of the primary recertification requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| January 31 annually | January 1 – December 31 annually | 40 hours | N/A |

South Carolina CPE Subject Area Requirements

During each recertification period, South Carolina CPAs must take at least 2 hours of subjects dedicated to professional ethics. However, there are no further subject area requirements.

Credit Limitations and Calculation

CPAs can claim CPE credit if they conduct instances of formal instruction or offer educational presentations. Also, note that credit equals two times the length of the presentation. However, credit is not available for preparation time. And furthermore, the Board only accepts repeated instruction so long as the individual has substantially altered the curriculum. Generally, credit here equals 10 hours per 3 semester hours taught. But repeated instruction will only apply for credit so long as it’s taught over two years after the last instance. For both methods, individuals may not earn more than 10 credits per reporting period.

CPAs active in college or university courses can also claim credit commensurate with the length of the class taken. Overall, licensees can obtain 15 CPEs for a semester-length course or 10 hours per quarter course.

Additional Limitations

CPE credit can be obtained in one-fifth increments once the first full hour of continuing professional education has been completed.

No more than 12 CPE credits can be earned on any given calendar day.

Other Policies and Exemptions

A maximum of 20 credit hours may carry from one reporting period to the subsequent reporting period. Furthermore, credits earned from peer review, published materials, personal development or instruction of university/college courses are exceptions to this policy and cannot be carried.

The Board may accept a compliance report from another jurisdiction if the requirement is substantially equivalent to South Carolina’s state requirements.

CPAs in any of the following categories are automatically exempt from the yearly recertification requirements so long as they refrain from offering their services to any third parties:

- Retirees

- Currently unemployed members

- Members who have temporarily left the workforce

- Officially “inactive” members

Furthermore, it is possible for active members to request waivers for exemption on the following bases:

- Health issues

- Military service

- Natural disasters (further determined by Board discretion)

- Other similar circumstances (also subject to Board determination)

Additional CPE Resources for CPAs

Last Updated:

![Tennessee CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/11/Tennessee-CPA-CPE-Requirements.png)

![How to Get CPE Credits from Home [4 Methods]](/wp-content/uploads/2020/07/How-to-Get-CPE-Credits-from-Home.png)

![CPA Recertification Requirements and Portals [State by State]](/wp-content/uploads/2022/01/Prepare-for-CPA-Recertification.png)