![Idaho CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/03/Idaho-CPA-CPE-Requirements.png)

Overall Idaho CPA CPE Requirements

Any business professional with a prestigious title or designation from and accrediting organizations is likely also familiar with CPE. Because it is an intrinsic part of maintaining that status. However, it is easy for the license renewal process to become confusing and frustrating. Especially since requirements can vary by location with some organizations. A perfect example is the AICPA, which relies on state Boards of Accountancy to set jurisdiction-wide requirements. So, the Idaho CPA CPE requirements will actually be somewhat different from those in other places. And in order to avoid frustration, CPAs must keep up-to-date on their individual state requirements for license renewal.

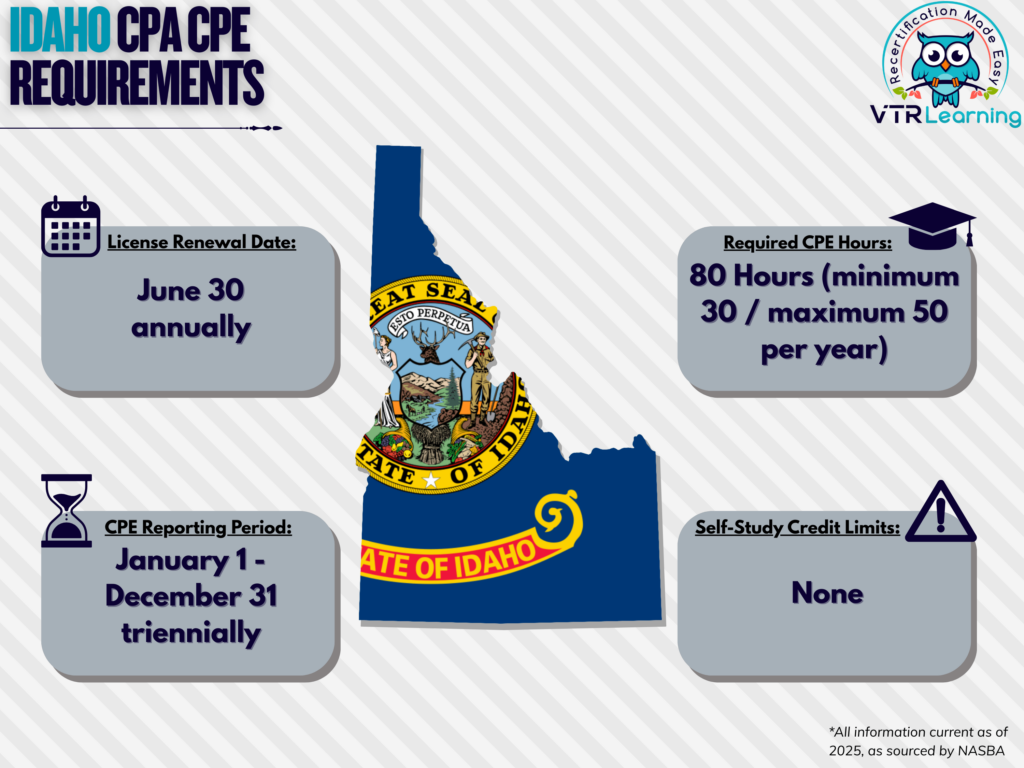

Overall, Idaho CPAs have to renew their license every two years. And they must also complete a minimum of 30 per year. Furthermore, there is a maximum limit of 50 per year, for a total of 80 hours each recertification period. The table below further highlights the Idaho CPA CPE requirements.

Share this Image On Your Site

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| June 30 annually ($120 fee) | January 1 – December 31 biennially-rolling | 80 hours | None |

Subject Area Requirements

During each two-year recertification cycle, CPAs must complete a rolling total of 4 Ethics CPE credits. As part of this rule, new licensees must complete a two-hour, state-specific CPE course covering Idaho Accountancy Act and Rules. Furthermore, new members must complete this requirement during the first licensed calendar year. Additionally, all licensees looking to reinstate or re-enter must complete a two-hour, state-specific CPA course covering the same material.

Credit Limitations and Calculation

In Idaho, instructors, speakers and discussion leaders can obtain CPE credit for instances of formal presentation or instruction. Licensees who present a learning activity for the first time, may receive CPE credit for actual preparation time. This allowance extends up to twice the CPEs which participants could claim, in addition to the actual presentation time. However, the activities must maintain or improve their competence.

Overall, instruction is subject to regulations and maximums established by the Board of Accountancy. For example, if participants could receive 8 CPE credits, instructors may receive up to 24 CPE credits. Ultimately, 16 for preparation and 8 for presentation time. Repeat presentations only carry further CPE credit if demonstrated to the Board that the learning material changed substantially. In particular, to a degree which required significant additional study and/or research.

According to state policies, CPAs can obtain up to 15 CPEs per semester hour for a college or university course. Alternatively, 10 CPE credits for every quarter hour course taken and completed. Of course, subject material should relate to the accounting profession for this method to hold.

CPAs who are instructors at an accredited college or university can also obtain CPE credit for preparation and instruction. However, this method cannot exceed twice the CPE credit available for CPAs or LPAs taking the course. And furthermore, instructors can only claim credit the first time the course is taught.

It is possible to obtain CPE credit for writing and publishing instructional material. The Board may approve credit for articles, books or CPE programs, and will include credit for research and writing time. An independent party must also formally review the material. And furthermore, licensees must submit all supporting documentation to the Board with the CPE report for review.

Self-Study and Other Methods

For committee or organizational staff meetings, only portions of the meetings designed and designated as learning programs qualify for CPE. These activities must also comply with the 2016 AICPA/NASBA Statement on Standards for Continuing Professional Education.

Licensees may not take non-interactive self-study courses without review or assessment questions to evaluate understanding at the end of the course. As such, they will not qualify for CPE credit. However, other self-study courses which comply with these standards are applicable. Initially creditable courses must offer at least one-half credit. But after the first full credit has been earned, subsequent credits may be accrue in one-fifth or one-half increments.

CPE credit for each review equals the actual review time, up to the number of CPE credits for the program. However, repeat technical reviews are only worth CPE credit content was substantially altered and required further research or study.

For group, independent study or blended learning opportunities, licensees must obtain a minimum of one full credit initially. But after the first credit has been earned, credits may be obtained in one-fifth or one-half increments.

For Nano-Learning methods, credits must be awarded only as one-fifth increments for each individual, 10-minute training period. A 20-minute program would have to be submitted as two separate, standalone Nano-Learning courses.

Other Policies and Exemptions

Some CPAs have no CPE requirements for license renewal. However, only as long as they offer no services to third parties. These licensees include:

- Retirees

- Members who are currently unemployed

- Members who have willingly and temporarily left the workforce

- Formally “inactive” members

Waivers can be requested for exemption upon the following bases:

- Health issues or complications

- Military service or related duties

- Natural disasters of a sort which interfere with the ability to complete continuing professional education

- Any other circumstances which interfere with a member’s ability to complete CPE requirements in a timely manner

Additional Resources for Idaho CPA CPE Requirements

Last Updated:

![Louisiana CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Louisiana-CPA-CPE-Requirements.png)